What is the Danger of Taking a Variable Rate Loan?

Contents

Variable rate loans are often advertised as a low-cost way to borrow money, but there is a danger in taking one out. This type of loan typically has a lower interest rate than a fixed rate loan, but the rate can change over time. This means that your monthly payments could go up or down, and you could end up owing more money than you originally borrowed.

Checkout this video:

Introducing the Variable Rate Loan

A variable rate loan is a loan where the interest rate can change over time. This means that your monthly payments could go up or down, depending on the market.

While a variable rate loan may start off with a lower interest rate than a fixed rate loan, it comes with the risk that your payments could increase in the future. This makes it important to understand how these loans work before you agree to one.

The Dangers of a Variable Rate Loan

Variable rate loans can be very dangerous if you are not careful. The interest rate on these types of loans can change at any time, which can make your monthly payments go up or down. This can be a problem if you can’t afford the higher payments, or if you can’t make the lower payments. You need to be very careful when taking out a variable rate loan.

The interest rate may increase

The danger of taking out a variable rate loan is that the interest rate may increase. This could cause your monthly payments to increase, and you may end up having to pay more interest over the life of the loan. If you’re not careful, you could end up in a situation where you can’t afford your loan payments.

Another danger of taking out a variable rate loan is that the terms of your loan could change. For example, if the interest rate on your loan goes up, the length of your loan could be shortened. This would mean that you would have to pay off your loan faster than you had originally planned.

Lastly, if you take out a variable rate loan, you could end up owing more money than you originally borrowed. This is because the interest rate on a variable rate loan can go up over time. If this happens, you’ll have to pay back more money than you originally borrowed, and this could lead to financial problems.

You may have to make higher monthly payments

With a variable rate loan, your interest rate can change over time. This means your monthly payments could go up or down. If rates go up, you may have to make higher monthly payments. This extra payment may be a hardship for you, especially if your income has not increased. If you cannot make the new payment, you maydefault on your loan, and this could lead to foreclosure.

You may end up owing more money than you borrowed

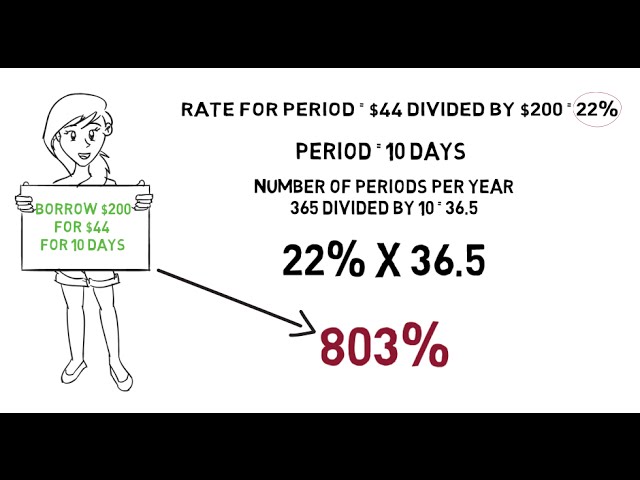

If you have a variable rate loan, your monthly payments can change. If rates go up, your payments will go up. If rates go down, your payments will go down.

The problem is that if rates go up, you could end up owing more money than you borrowed. That’s because the amount you pay each month will not cover the full amount of interest that is accruing on your loan.

This can be a real problem if you have a lot of debt and can’t afford to make higher payments. It can also be a problem if you’re close to retirement and don’t have time to make up the difference.

So, while a variable rate loan may start off with lower payments, it could end up costing you more in the long run. That’s why it’s important to understand the risks before you sign on the dotted line.

How to Avoid the Dangers of a Variable Rate Loan

A variable rate loan can be a great way to get a lower interest rate on your loan. However, there are some dangers that you should be aware of before you take out a variable rate loan. The biggest danger is that your interest rate could go up, which could make your monthly payments more than you can afford.

Shop around for the best interest rate

When you’re looking for a loan, it’s important to compare offers from multiple lenders. Interest rates can vary greatly from one lender to the next, so it pays to shop around. Keep in mind that the interest rate is only one factor in the overall cost of the loan. You should also compare the fees and terms of each loan before deciding which one is right for you.

One type of loan that can be especially difficult to compare is the variable rate loan. Variable rate loans typically have lower interest rates than fixed rate loans, but they also carry the risk that the interest rate could increase in the future. If you’re considering a variable rate loan, be sure to ask your lender how often the interest rate can change and how high it could go. You should also make sure you understand all of the terms and conditions before signing on the dotted line.

Understand the terms of your loan

A variable rate loan is a loan where the interest rate can change over time. The interest rate on these loans is usually linked to an economic index, such as the Prime Rate. This means that when the index goes up, so does your interest rate.

The danger of taking a variable rate loan is that if the index increases dramatically, your monthly payments could become unaffordable. For this reason, it’s important to understand the terms of your loan and make sure you can afford the payments if the interest rate increases.

Make extra payments when possible

If you have a variable rate loan, make extra payments when possible. This will help you pay off the loan quicker and reduce the amount of interest you pay. Variable rate loans typically have lower interest rates than fixed rate loans, but the interest rate can increase over time.

You may also want to consider refinancing your loan to a fixed rate loan. This way, you will know exactly how much your monthly payment will be and you will not have to worry about the interest rate increasing.