What Does Refinancing a Loan Mean?

Refinancing a loan simply means taking out a new loan to replace an existing one. The new loan pays off the old one, and you start making payments on the new loan.

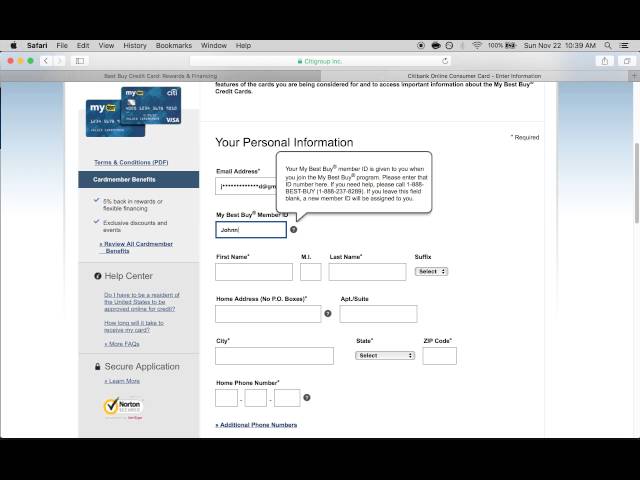

Checkout this video:

What is refinancing?

Refinancing a loan means taking out a new loan with new terms to replace an existing loan. The new loan pays off the old loan, and you can use the extra money for any purpose. Reasons to refinance a loan include getting a lower interest rate, shortening the loan term, and consolidating multiple loans into one.

What are the benefits of refinancing?

While refinancing has many benefits, it’s not the right decision for everyone. You should refinance only if the interest rate on your new loan is lower than the rate on your current loan and you plan to stay in your home for several years.

You may also want to consider refinancing if you have an adjustable-rate mortgage (ARM). If interest rates have gone down since you got your ARM, you may be able to get a lower monthly payment by refinancing into a fixed-rate mortgage.

Refinancing can also be a way to get some equity out of your home if you need cash for a major expense such as home improvements, medical bills, or college tuition. When you refinance, you can borrow money by taking out a larger loan and using your home as collateral. This is called a cash-out refinance.

What are the risks of refinancing?

There are a few risks associated with refinancing that you should be aware of before you make the decision to refinance. First, if you extend the term of your loan, you will end up paying more in interest over the life of the loan. Second, if you refinance with a variable rate loan, your payments could increase if interest rates go up. Finally, it costs money to refinance – There are closing costs associated with taking out a new loan which can include appraisal fees, title insurance, origination fees and more. be sure to factor these costs into your decision to refinance.

How to refinance a loan

The process of refinancing a loan entails taking out a new loan to pay off an existing one. In other words, you replace your current loan with a new one that has better terms. This could mean a lower interest rate, a lower monthly payment, or both. You may also be able to extend the loan term or get a variable-rate loan.

How to compare refinancing offers

When you’re ready to compare offers, look at the Annual Percentage Rate (APR) and the loan term. A lower APR and a shorter loan term will lower your monthly payments, but it might not always be the best deal. Make sure you can afford the monthly payments on a shorter loan before you refinance.

You should also compare the total cost of refinancing. Some lenders charge origination fees, application fees, or appraisal fees. These should be listed in the Loan Estimate you get from each lender. The Loan Estimate will also show you the total costs of refinancing over the life of the loan.

Finally, compare the interest rates and terms from different lenders to get the best deal on your refinanced loan.

How to negotiate with your current lender

If you have a good relationship with your current lender, you may be able to negotiate a lower interest rate or other favorable terms. This is especially true if you’ve been a good customer who has always made your payments on time. To learn more about negotiating with your lender, read our guide: How to Negotiate With Your Lender.

If you’re not able to negotiate a lower rate with your current lender, refinancing may be the best option for you.

When to refinance a loan

Refinancing a loan can save you money if you do it at the right time. It essentially means taking out a new loan to replace an existing one. The new loan pays off the old loan, and you are left with a new loan with new terms. When should you refinance a loan?

When you have improved your credit score

If you’ve made progress in building your credit score since you first obtained your loan, refinancing could help you save money on interest. That’s because a better credit score may help you qualify for a lower interest rate on a new loan.

When interest rates have dropped

When interest rates have dropped, refinancing a loan can save you money. The new loan pays off the old loan, and you start making payments on the new loan. The interest rate on the new loan is usually lower than the interest rate on the old loan. That means you’ll have more money to put toward your principal balance each month, and you’ll pay off your loan sooner.

When you have a financial goal in mind

Start by identifying your financial goals. Maybe you want to free up some cash for a major home improvement project or consolidate high-interest debt. Once you know your goal, research whether refinancing makes sense for you.

Your loan’s interest rate is one of the most important factors in deciding whether to refinance. A lower rate could help you save money on monthly payments and pay off your debt faster. You should also consider the length of time you plan to stay in your home and whether you have enough equity to cover the costs of refinancing, such as appraisal fees, title insurance and closing costs.

You might also need to factor in the potential risk of resetting the clock on your loan’s term. If you have 20 years left on a 30-year mortgage, for example, and you refinance into a new 30-year loan, you’ll be adding 10 years to the length of your loan — and 10 more years of interest payments. Refinancing can make sense if you plan to stay in your home long enough to benefit from the lower interest rate before selling. If not, it might not be worth the upfront costs.