What Does Loan Term Mean?

Loan term is the length of your loan , typically expressed in years. Here’s how it works and how it affects your monthly payments.

Checkout this video:

Loan Basics

A loan’s term can refer to the length of time that you have to repay the loan. For example, a 30-year mortgage loan has a term of 30 years. The term of a loan can also refer to each payments due date. For example, if you have a loan with a term of “due on the 1st of the month,” that means your payments are due on the first day of each month.

Define “loan term”

The loan term is the length of time you have to repay your loan. The average loan term is about 5 years, but you may be able to get a longer or shorter loan depending on the type of loan you get.

Compare and contrast different types of loans

There are many different types of loans available, and it can be difficult to navigate the world of borrowing. This guide will help you understand the basics of loans so that you can make an informed decision when it comes time to borrow money.

Loans can be broadly categorized into two categories: private loans and public loans. Private loans are offered by banks, credit unions, and other financial institutions, and are not backed by the government. Public loans, on the other hand, are offered by the government and usually have lower interest rates and more favorable repayment terms.

Within these two categories, there are further distinctions between different types of loans. For example, Some loans are secured, meaning that they are backed by collateral such as a home or a car. Unsecured loans, on the other hand, are not backed by collateral and often have higher interest rates.

Other distinction between different types of loan products have to do with their terms. Loan term is the amount of time that you have to repay your loan. Some loans have shorter terms, while others have longer terms. The length of your loan term will affect your monthly payments and the total amount of interest that you pay over the life of the loan.

Choosing the right loan for your needs is an important decision. Be sure to compare different products carefully before making a decision.

The Importance of Loan Term

Loan term is the length of time a borrower has to repay a loan. The term of a loan can have a significant impact on the total amount of interest that a borrower will pay over the life of the loan. A longer loan term will typically result in a lower monthly payment, but will also generally result in more interest paid over the life of the loan.

How loan term affects monthly payments

The length of your loan term will affect both your monthly payment and the total amount of interest you pay over the life of the loan. A shorter loan term (such as five years) will have higher monthly payments, but you’ll pay less interest over the life of the loan. A longer loan term (such as 15 years) will have lower monthly payments, but you’ll pay more interest over the life of the loan.

In general, the longer the loan term, the more interest you will pay. This is because a longer loan term means you are paying interest for a longer period of time. However, a longer loan term may also mean you are able to qualify for a larger loan amount and lower interest rate.

When considering a loan, be sure to compare offers with different terms to find the one that best meets your needs.

How loan term affects the total cost of the loan

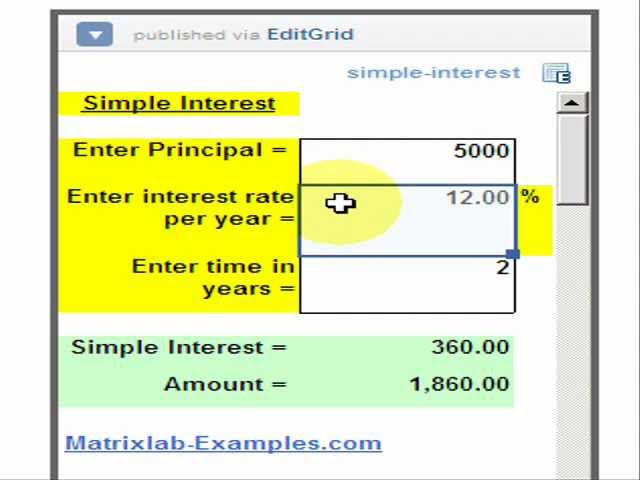

The loan term is the length of time you have to repay your loan. It can be as short as a few months or as long as a few years. The shorter the loan term, the higher the monthly payments will be, but you will pay less in interest over the life of the loan. The longer the loan term, the lower the monthly payments, but you will pay more in interest over the life of the loan.

The other factor that affects your monthly payments is the interest rate. The higher the interest rate, the higher your monthly payments will be. The lower the interest rate, the lower your monthly payments will be.

You can choose to make extra payments on your loan without penalty. This will reduce the total amount of interest you pay over the life of the loan and help you pay off your loan faster.

How to Choose the Right Loan Term

The loan term is the length of time you have to repay your loan. It can range from a few months to a few years. The loan term you choose will affect how much you pay in interest and how much you can afford to pay each month. It’s important to choose a loan term that’s right for you.

Consider your financial goals

When you’re trying to choose the right loan term, it’s important to consider your financial goals. If you want to pay off your debt as quickly as possible, you might want to choose a shorter loan term. On the other hand, if you’re trying to minimize your monthly payments, you might want to choose a longer loan term.

There are other factors to consider as well. If you have a variable-rate loan, for example, you might want to choose a shorter loan term so that you can lock in a lower interest rate. And if you have a balloon payment at the end of your loan, you might want to choose a longer loan term so that you can spread out your payments.

Ultimately, the best loan term is the one that meets your specific financial goals. If you’re not sure what those goals are, it might be helpful to talk to a financial advisor or a housing counselor. They can help you understand your options and make the best decision for your situation.

Consider your budget

The first thing you need to consider when choosing a loan term is your budget. How much can you afford to pay each month? Loan payments are typically spread out over a period of years, so you’ll want to make sure your monthly payment is something you can comfortably afford.

You should also consider the total cost of the loan. A longer loan term will usually mean lower monthly payments, but it will also mean you’ll be paying more interest overall. A shorter loan term will have higher monthly payments, but you’ll save money on interest in the long run.

Consider your loan’s interest rate

Interest rates on loans can vary greatly, so it’s important to shop around for the best rate. The loan term also affects the interest rate you’ll pay. A loan with a shorter term will typically have a lower interest rate than a loan with a longer term, as the lender is expecting to be paid back relatively quickly. In general, shorter-term loans have higher monthly payments but lower overall costs, while longer-term loans have lower monthly payments but higher overall costs.

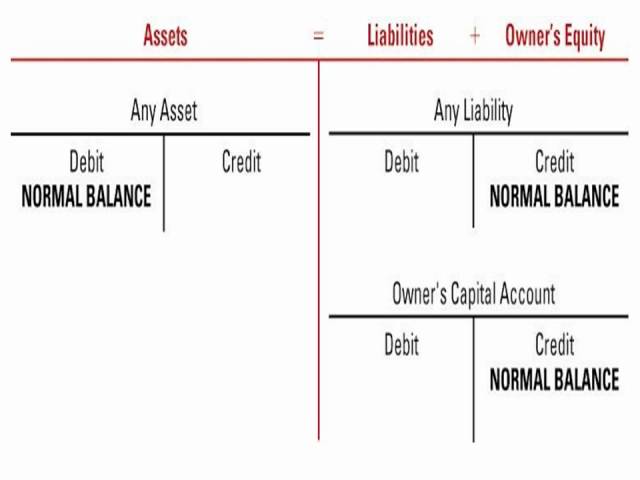

The type of loan you choose will also affect your interest rate. For example, secured loans (such as mortgages and car loans) typically have lower interest rates than unsecured loans (such as personal loans). This is because the lender can take possession of your collateral if you default on the loan, which gives them some security against losses.

When considering a loan, it’s important to compare not only the interest rate but also the Annual Percentage Rate (APR). The APR includes not only the interest rate but also any fees that are charged upfront, so it’s a better measure of the true cost of a loan.