What Do I Need to Get a Business Loan?

Contents

So, you’re thinking about getting a business loan? Whether you’re starting a business or expanding an existing one, a loan can be a great way to get the financing you need. But what do you need to qualify for a loan? Read on to find out.

Checkout this video:

Figure out what type of loan you need

There are a few different types of business loans, and the type you need will depend on your business’s needs. The most common types of loans are:

-SBA loans: These loans are backed by the Small Business Administration and tend to have lower interest rates and longer repayment terms than other types of loans.

-Term loans: These loans are typically used for large purchases, such as equipment or real estate, and have fixed interest rates and repayment terms.

-Lines of credit: This type of loan gives you access to a revolving line of credit that you can draw from as needed. Interest is only charged on the amount of credit you use, and you can typically make repaidments over time.

-Invoice financing: This type of loan allows you to borrow against outstanding invoices in order to free up cash flow.

Once you know what type of loan you need, you can start shopping around for the best options. Be sure to compare interest rates, repayment terms, fees, and eligibility requirements before choosing a lender.

Decide how much money you need

The first step in applying for a business loan is to decide how much financing you need. This will depend on a number of factors, including the cost of your project or expansion, how much working capital you need and how much you can afford to repay. Keep in mind that it’s often better to err on the side of borrowing too little, as you can always apply for additional financing if needed.

Once you have a general idea of the loan amount you need, you can start shopping around for the best deal. Keep in mind that the interest rate is not the only factor to consider when comparing loans. You should also look at the fees charged by each lender, as well as the repayment terms.

Find the right lender

When you’re looking for a business loan, the first step is to find the right lender. There are many different types of lenders, from banks to online lenders. Each has its own strengths and weaknesses, so it’s important to find the one that’s right for your business.

The first thing to consider is what type of loan you need. If you need a small amount of money for a short-term project, you may be able to get a microloan from a community development organization. For larger loans, you’ll probably need to go to a bank or an online lender.

Once you know what type of loan you need, you can start shopping around for lenders. The best place to start is with your local bank or credit union. They may be able to give you a good rate on a loan if you have been a customer for a long time.

If you can’t get a loan from your local bank, there are many online lenders that can help you. The best way to find them is to search for “business loans” on Google or another search engine. You should also read reviews of different lenders before you choose one.

Once you’ve found a lender, the next step is to fill out an application. The application will ask for information about your business, including how much money you need and how you will use it. Be sure to answer all questions honestly, as this will help the lender determine whether or not they can trust you with the loan.

After you submit your application, the lender will review it and make a decision. If they approve your loan, they will send you the money in one lump sum. You can then use it for whatever purpose you need it for, such as buying new equipment or expanding your business

Get a business plan together

The first step is to put together a business plan. This document will serve as your roadmap and will be used to sell your business to potential lenders. Your business plan should include:

-An executive summary

-A description of your business

-Your goals and objectives

-Your marketing strategy

-Your financial projections

-A list of the collateral you have to offer as loan security

Once you have your business plan together, the next step is to find the right lender. There are many different lenders out there, so it’s important to shop around and find one that’s a good fit for your business. When you’re looking for a lender, be sure to consider:

-The type of loan you need

-The terms of the loan

-The interest rate

-The fees and charges

-The repayment schedule

Once you’ve found a lender you’re comfortable with, it’s time to start the application process. The application process can vary from lender to lender, but in general, you can expect to fill out an extensive questionnaire and provide documentation such as:

-Personal financial statements for everyone who owns 20% or more of the company

-Business financial statements for the past three years

-Proof of collateral

Gather your financial documents

When you go to apply for a business loan, the lender is going to want to see proof of your financial stability and your ability to repay the loan. To do this, they’re going to ask for a number of financial documents, which may include:

-Your personal financial statement

-Your business tax returns

-Your business balance sheet

-Your business profit and loss statements

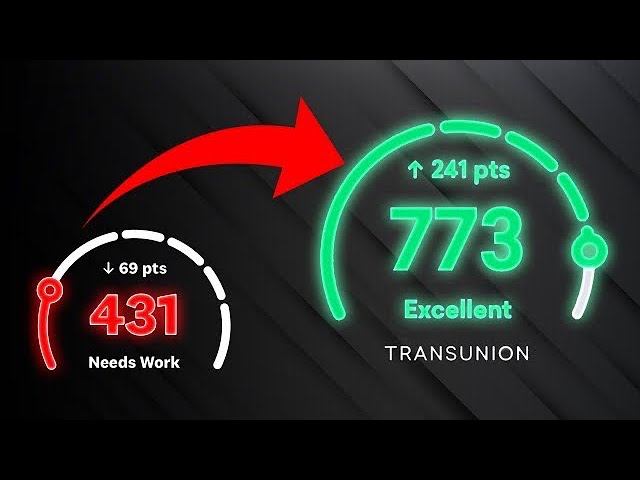

-Your personal credit score

-Your business credit score

-Your business debt schedule

Apply for the loan

You will need to supply the lender with information about your business, including your business plan, tax returns, and financial statements. You will also need to provide personal information, such as your Social Security number and bank statements.