What Are Three Different Ways An Entrepreneur Can Finance A New Business Venture?

Contents

There are three primary ways that an entrepreneur can finance a new business venture: personal savings, investment from friends and family, and venture capital. Each has its own set of pros and cons, so it’s important to choose the right option for your individual situation.

Checkout this video:

Traditional methods of financing a new business venture

There are three primary methods of financing a new business venture: debt financing, equity financing, and hybrid financing.

Debt financing is when a business borrows money from investors and is required to pay that money back over time, usually with interest. Equity financing is when a business sells ownership stakes in the company (in the form of stocks or equity) in exchange for capital. Hybrid financing is a combination of both debt and equity financing.

Traditional methods of financing a new business venture:

– Debt Financing: Borrowing money from investors and paying it back over time

– Equity Financing: Selling ownership stakes in the company in exchange for capital

– Hybrid Financing: A combination of both debt and equity financing

Alternative methods of financing a new business venture

There are a few alternative methods of financing a new business venture. Friends and family, credit cards, and loans are all popular methods of financing a new business. However, each method comes with its own set of pros and cons.

Friends and family:

The biggest advantage of using friends and family to finance your new business is that they are more likely to be understanding and flexible if you run into financial trouble. They may also be more forgiving if you are not able to repay them as quickly as you had planned. The downside is that if things do not go well, it could strain your personal relationships.

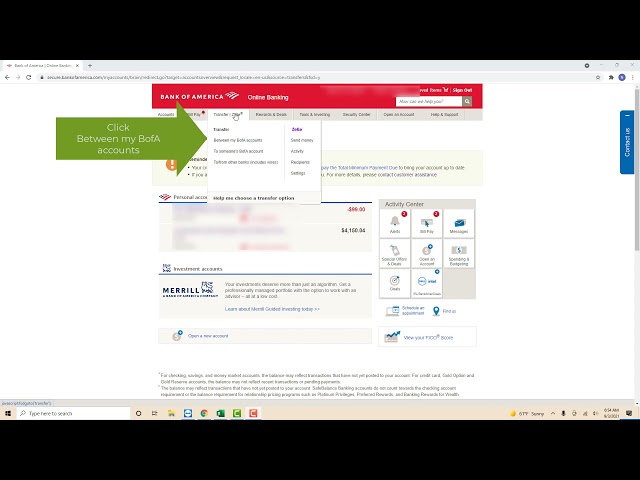

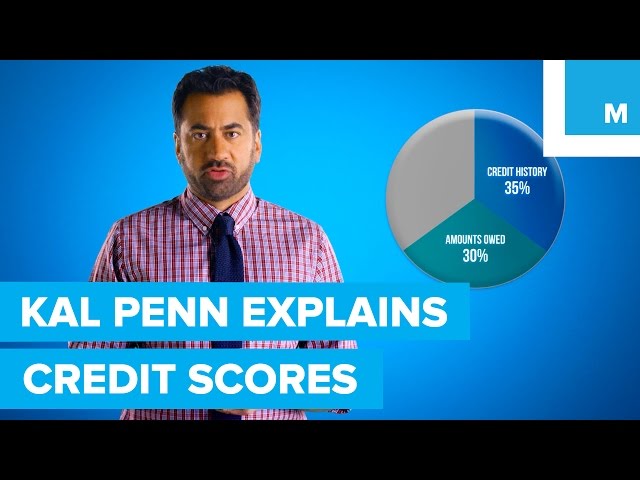

Credit cards:

Credit cards can be a quick and easy way to finance your new business venture. However, the interest rates on credit cards can be high, which can make it difficult to repay the debt in a timely manner. Additionally, missed payments can damage your personal credit score.

Loans:

Taking out a loan to finance your new business venture can give you the funds you need to get started without putting any personal assets at risk. However, loans must be repaid even if your business is unsuccessful, which can put a strain on your finances.

Creative methods of financing a new business venture

There are many ways to finance a new business venture. Here are three creative methods:

1. Bootstrapping: This involves using your own personal resources, such as savings, to finance your business. This is a good option if you have a low-risk business idea and don’t need a lot of capital to get started.

2. Crowdfunding: This involves raising money from a large group of people, typically through an online platform. This is a good option if you have a compelling story and are able to generate interest and excitement around your business.

3. Angel investors: This involves raising money from one or more wealthy individuals who are willing to invest in your business. This is a good option if you have a high-growth potential business idea and are able to pitching it effectively to potential investors.