What Account Carries a Credit Balance?

Contents

If you’re trying to figure out what account carries a credit balance, you’re not alone. Many people have trouble understanding credit balances and how they work.

Here’s a quick rundown of what you need to know: a credit balance is an account that has a positive balance, meaning there is more money in the account than is owed. This can happen for a number of reasons, but the most common is when someone makes a payment that is more than the amount owed.

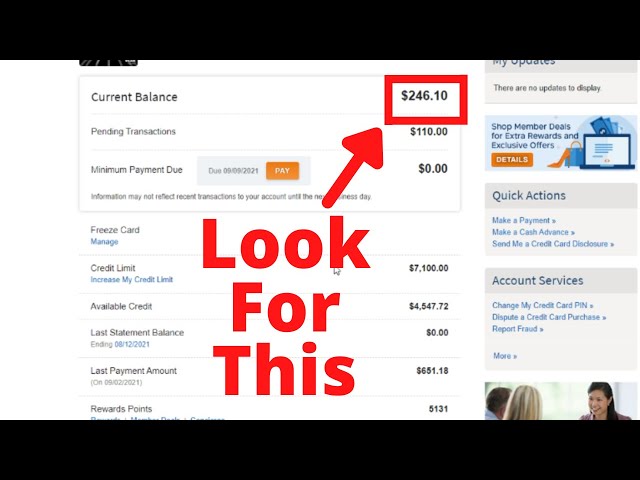

Checkout this video:

Accounts That Always Have a Credit Balance

There are a few types of accounts that will always have a credit balance. This includes asset accounts, such as Cash, Accounts Receivable, and Inventory. Other types of accounts that will always have a credit balance are Income and Equity accounts. Let’s take a closer look at each of these account types.

Service Revenue

Service revenue is reported on the income statement as the amount of revenue earned from providing services to customers. Service revenue is generated by businesses that provide services, such as accounting firms, law firms, and consulting companies. This account will have a credit balance.

Interest Revenue

Interest revenue is the interest income earned by a business on its investments. This account is found in the income statement, under the heading “revenue from operations.” Interest revenue is earned on investments such as bonds, loans, and certificates of deposit.

Sales Revenue

Sales revenue is the income received by a company from its sales of goods or services. … Sales revenue is revenue recognized when goods are shipped or delivered or when services are rendered. This account typically has a credit balance, which means that it will have a debit whenever there is a return.

Accounts That Sometimes Have a Credit Balance

Accounts Receivable

Accounts receivable is an important part of nearly every business, as it represents the revenue that a company is owed by its customers. While most businesses aim to keep their accounts receivable low, there are some instances where a high balance can actually be beneficial.

In general, any account that typically has a positive balance is considered an asset. This includes accounts receivable, as well as cash and investments. A high balance in accounts receivable can be seen as a good thing, since it means that the company is bringing in a lot of revenue. However, it’s important to keep an eye on the balance in accounts receivable, as it can also represent a risk if customers start defaulting on their payments.

Another account that sometimes has a credit balance is inventory. While most businesses strive to keep their inventory levels low in order to avoid carrying costs, there are some instances where it can be beneficial to have extra inventory on hand. For example, if a company knows that it will have a spike in demand for its product in the near future, stocking up on inventory can help to ensure that the company can meet this demand without running into supply constraints. However, like with accounts receivable, there is also a downside to carrying too much inventory, as it can tie up valuable resources and lead to losses if the demand doesn’t materialize as expected.

Unearned Revenue

Unearned revenue is a liability account that is reported on a company’s balance sheet. It represents payments received by a company for goods or services that have not yet been provided. Unearned revenue is recorded as a liability because the company has a legal obligation to provide the goods or services, and it has not yet fulfilled that obligation.

Over time, as the company provides the goods or services, the amount of unearned revenue will decrease, and the related expense will increase. For example, if a company sells annual subscriptions to its magazine, it will record unearned revenue when it receives payment from subscribers. Each month, as the company provides the magazine, it will recognize a portion of the unearned revenue as earned revenue and will record an expense for the cost of producing the magazine.

Accounts That Rarely Have a Credit Balance

Prepaid Expenses

Prepaid expenses are those that have been paid in advance and which will be used up or expired within a year. They are found on the balance sheet as a current asset. Common examples of prepaid expenses are office supplies, insurance, and rent.

Prepaid expenses are initially recorded as an asset because they provide future economic benefits to the company. However, once the prepayment is used up, it becomes an expense, and is recorded as such on the income statement.

Prepaid expenses are classified as a current asset on the balance sheet because they are expected to be used up or expire within one year.

Deferred Revenue

Most businesses receive payments before they provide products or services. When this occurs, the business reports the revenue as a liability on the balance sheet until it provides the product or service. This is called deferred revenue, and it represents money that a business has received but not yet earned.

Prepaid expenses are a type of asset on the balance sheet that consists of cash paid out in advance for goods or services that have not yet been received or used. An example of a prepaid expense would be if you paid your six-month car insurance premium in January.