Tips on How to Pay Off Credit Card Debt

Are you buried in credit card debt? Check out these tips on how to pay off your debt and get back on track financially.

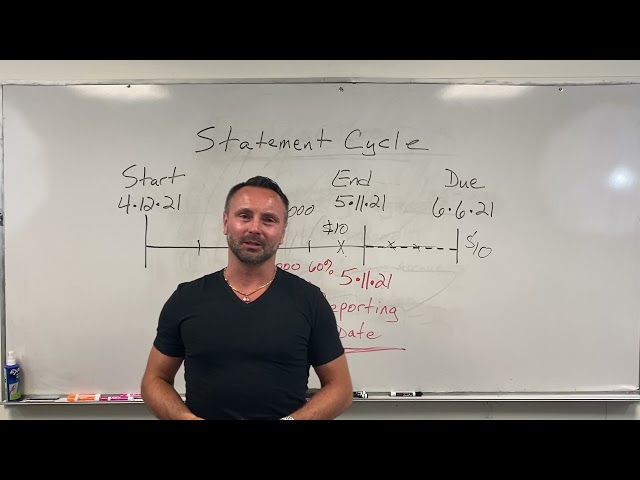

Checkout this video:

Assess your current situation

Before you start looking for ways to pay off your credit card debt, you need to assess your current situation. This means taking a look at how much debt you have, what your interest rates are, and what your budget is. Once you have a good understanding of your situation, you can start exploring your options.

How much debt is there?

To get started, you need to find out how much debt you actually have. This includes both the credit card debt that you’re currently paying interest on, as well as any other outstanding balances you may have.

The first step is to make a list of all your debts, including the name of your creditor, the outstanding balance, the interest rate, and the minimum monthly payment. This will give you a good idea of where you stand and help you create a plan to pay off your debt.

If you have multiple debts with different interest rates, you may want to consider a debt consolidation loan to simplify your payments and save on interest. A debt consolidation loan can also help you pay off your debt faster.

What is the interest rate?

The interest rate is the amount of money that you are charged for borrowing money. The higher the interest rate, the more money you will have to pay back in total. If you are trying to pay off credit card debt, it is important to know what the interest rate is on your cards.

Are there any fees?

Check for any fees associated with your credit card before you start using it. These can include an annual fee, a balance transfer fee, a cash advance fee, and more. Knowing what fees you’ll be charged will help you to avoid them when possible and budget for them when necessary.

You’ll also want to take a close look at the interest rate being charged on your credit card. This is the rate that will be applied to any balance you carry on your card, so it’s important to know what it is. If you have a high interest rate, you may want to consider transferring your balance to a card with a lower rate.

Create a plan

If you’re one of the many Americans struggling with credit card debt, you may be feeling overwhelmed. But don’t despair! There are steps you can take to get your debt under control. The first step is to create a plan. Sit down and list all of your debts, including the interest rate, minimum payment, and outstanding balance for each one. Then, prioritize your debts from the highest interest rate to the lowest.

Decide on a method

There are a few different methods you can use to pay off your credit card debt, and the method you choose will depend on your financial situation and goals. Two of the most popular methods are the debt snowball method and the debt avalanche method.

With the debt snowball method, you focus on paying off your smallest balance first, while making minimum payments on your other debts. Once your smallest balance is paid off, you move on to paying off your next smallest balance, and so on. The advantage of this method is that it can give you a quick win to help motivate you to keep going.

With the debt avalanche method, you focus on paying off your debt with the highest interest rate first, while making minimum payments on your other debts. Once that debt is paid off, you move on to paying off your next highest interest rate debt, and so on. The advantage of this method is that it saves you money in interest charges over time.

There are pros and cons to both methods, so it’s important to decide which one is right for you before you get started. If you’re not sure which method to use, there are many online calculators that can help you decide based on your financial situation and goals.

Set a budget

The first step in any plan to pay off credit card debt is to set a budget. This will help you see where your money is going and how much you can realistically afford to put towards your debt each month. To do this, start by listing all of your income and expenses in a budgeting app or spreadsheet.

Once you have all of your expenses listed, total them up and compare that number to your income. If your expenses are more than your income, you’ll need to find ways to cut back so that you can free up some cash to put towards your debt. If your income is more than your expenses, you’ll have room in your budget to make extra payments on your debt each month.

Once you have a realistic understanding of where your finances stand, you can begin creating a plan to pay off your credit card debt.

Take action

It can be difficult to manage credit card debt, but there are some things you can do to make it more manageable. You can start by making a budget and sticking to it. You should also try to pay more than the minimum payment each month. If you can, you should also consider consolidating your debt.

Make more than the minimum payment

If you only make the minimum payment each month, it will take you a long time to pay off your credit card debt and you will end up paying a lot of interest. Try to pay as much as you can afford each month, even if it’s just an extra $10 or $20. Every little bit helps and will get you out of debt faster.

Negotiate with your credit card company

If you find yourself struggling to make your monthly credit card payments, the first step is to contact your credit card company and try to negotiate a lower interest rate. Many times, credit card companies are willing to work with customers who are having financial difficulty.

If you are unable to negotiate a lower interest rate, your next option is to transfer your balance to a 0% APR credit card. There are many credit cards on the market that offer 0% APR for an introductory period of time, usually 12-18 months. This will give you some time to pay off your debt without accruing any additional interest.

If you are still struggling to pay off your debt after taking these steps, you may need to consider more drastic measures such as debt consolidation or filing for bankruptcy. These options should be considered as a last resort, as they can have a significant impact on your credit score.

Consider a balance transfer

If you’re struggling to pay off credit card debt, you might want to consider a balance transfer. This involves transferring the balance of your credit card debt to another card with a lower interest rate. This can help you save money on interest and pay off your debt more quickly.

There are a few things to keep in mind if you’re considering a balance transfer. First, you’ll need to find a card with a lower interest rate than your current card. You’ll also need to make sure you can qualify for the new card and that there are no balance transfer fees. Finally, you’ll need to be prepared to make regular payments on your new card in order to pay off your debt within the intro period (usually 12-18 months).

Stay on track

If you’re one of the many Americans with credit card debt, you’re not alone. In fact, according to CNBC, the average American has about $6,194 in credit card debt. That can feel like an insurmountable amount, but there are things you can do to pay it off. Start by evaluating your current situation and coming up with a plan. This may involve consolidating your debt, making more than the minimum payment each month or finding a way to earn extra money. Whatever route you decide to take, stick to your plan and don’t add to your debt. Paying off credit card debt is possible, but it takes discipline and time.

Set up reminders

If you’re trying to pay off credit card debt, one of the best things you can do is set up reminders. Whether it’s a calendar entry or setting an alarm on your phone, reminders can help keep you on track.

If you’re not sure how much you can afford to pay each month, start with a small amount and increase it gradually over time. Even an extra $5 or $10 each month can make a big difference over the long term.

And if you’re really struggling to make payments, reach out to your credit card issuer and see if they offer any hardship programs. These programs can help lower your interest rates or waive late fees, making it easier to get out of debt.

Monitor your progress

Progress isn’t always easy to see when you’re in the midst of a long-term goal, but it’s important to monitor your debt-payoff journey to stay motivated. By tracking your progress, you can also adjust your strategy if you find you’re not making as much headway as you’d like.

One way to do this is to set up a Debt Reduction Calculator in Excel or Google Sheets. This type of calculator can help you quickly see how different payoff strategies will affect your timeline and total interest paid. You can also use a Debt Snowball Calculator to compare the debt avalanche and debt snowball methods.

Another way to track your progress is to create a Debt Reduction Chart. This can be as simple as a line graph that shows your remaining balance over time. Or, for a more visual representation, you can use a Debt Payoff Thermometer Chart. This type of chart allows you to record your starting balance, monthly payments, and interest rate so you can fill in the thermometer as you make progress.

No matter which method you choose, monitoring your progress is an important part of staying on track with your debt payoff goals.