How to Qualify for the Earned Income Credit

Contents

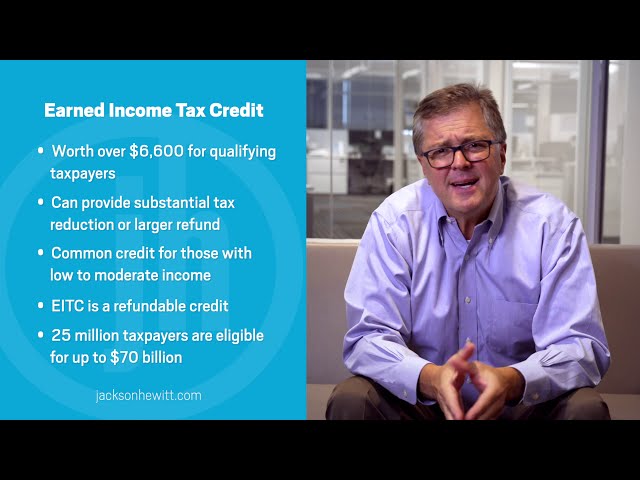

The Earned Income Tax Credit, EITC or EIC, is a benefit for working people with low to moderate incomes. To qualify, you must have earned income from working for someone or from running or owning a business or farm.

Checkout this video:

The Basics of the Earned Income Credit

The Earned Income Credit is a refundable tax credit for eligible taxpayers who have earned income from working. The credit is calculated based on the amount of income earned and the number of qualifying children in the household. To qualify for the Earned Income Credit, you must have earned income from working and meet certain other requirements. This section will provide an overview of the Earned Income Credit and how to qualify for it.

What is the Earned Income Credit?

The Earned Income Credit is a tax credit for certain low- and moderate-income earners. To qualify, you must have earned income from working for someone else or from running your own business or farm. You also must meet certain rules related to investment income and filing status. If you qualify, the credit can reduce the amount of taxes you owe, or even give you a refund.

Who is eligible for the Earned Income Credit?

To qualify for the Earned Income Tax Credit (EITC), you must have earned income from working for someone or from running or owning your own business or farm. You cannot earn more than:

$51,567 ($56,844 married filing jointly) and have three or more qualifying children

$47,447 ($52,744 married filing jointly) and have two qualifying children

$41,094 ($46,444 married filing jointly) and have one qualifying child

$15,820 ($21,137 married filing jointly) and not have a qualifying child

Your investment income must also be less than $3,650 in order to qualify.

What are the income limits for the Earned Income Credit?

The Earned Income Credit, often called the EITC or Earned Income Tax Credit, is a refundable tax credit for low- to moderate-income working families. The credit can be worth up to $6,557 for 2021.

You may qualify for the credit if you have qualifying children and meet the other requirements. To claim the credit, you must file a tax return even if you don’t otherwise have to file.

Income Limits

To qualify for the Earned Income Credit, your earned income and adjusted gross income (AGI) must each be less than:

● $51,567 ($57,567 married filing jointly) with three or more qualifying children

● $47,440 ($53,440 married filing jointly) with two qualifying children

● $41,756 ($47,756 married filing jointly) with one qualifying child

● $15,010 ($21,010 married filing jointly) with no qualifying children

The dollar amounts above are increased for inflation each year.

How to Qualify for the Earned Income Credit

The earned income credit is a refundable tax credit for eligible taxpayers who have low to moderate incomes. To qualify, you must have earned income from working or from certain types of businesses. You also must meet certain other requirements.

Have qualifying children

To qualify for the EIC, you must have qualifying children. “Qualifying child” is defined as a son, daughter, stepchild (including legally adopted child), foster child, brother, sister, stepbrother, stepsister or a descendant of any of them (for example: your grandchild, niece or nephew). The child must also be:

1. Under age 19 at the end of the year and younger than you (or your spouse if filing jointly)

2. Under age 24 at the end of the year, a full-time student and younger than you (or your spouse if filing jointly)

3. Any age if permanently and totally disabled

4. Age 18 or younger at the end of the year and not married

Meet the income requirements

To qualify for the Earned Income Credit (EIC), you must have earned income from employment or self-employment during the tax year. The amount of earned income you need to qualify for the EIC depends on your filing status and whether you have any qualifying children.

If you don’t have any qualifying children,

-you must have earned income from employment or self-employment during the tax year that is less than $15,278 ($20,433 if married filing jointly) if you file as single, head of household, or qualifying widow(er) with a dependent child,

-$20,433 if you’re married filing jointly,

-$10,216 if you’re married filing separately and did not live with your spouse at any time during the tax year.

If you have one qualifying child,

-you must have earned income from employment or self-employment during the tax year that is less than $41,094 ($46,703 if married filing jointly) if you file as single, head of household, or qualifying widow(er) with a dependent child,

-$46,703 if you’re married filing jointly.

-$23352 if you’re married filing separately and did not live with your spouse at any time during the tax year.

If you have more than one qualifying child:

-you must have earned income from employment or self-employment during the tax year that is less than $46,884 ($52,493 if married filing jointly) if you file as single, head of household ,or qualifying widow(er),

-less than $52 ,493if you’re married filing jointly ,or

-$26247if you’re married filing separately and did not live with your spouse at any time during the tax year

Be a U.S. citizen or resident alien

To qualify for the Earned Income Credit (EIC), you must be a U.S. citizen or resident alien all year and meet certain other rules. If you’re married, you also must file a joint return in most cases.

You (or your spouse if married filing jointly) must have:

-A valid Social Security number,

-Worked for at least part of the year, and

-Earned less than the following amounts:

--$50,594 ($56,844 married filing jointly) if you have three or more qualifying children

--$47,619 ($53,799 married filing jointly) if you have two qualifying children

--$41,131 ($46,884 married filing jointly) if you have one qualifying child

--$15,570 ($21,370 married filing jointly) if you don’t have a qualifying child

File a tax return

To qualify for the Earned Income Credit (EIC), you must file a tax return, even if your income is below the filing requirement or you do not owe any tax. You must also meet certain other requirements.

If you have a qualifying child, you must meet all the following requirements:

-You, as well as your spouse if filing a joint return, must have a valid Social Security number that is issued by the Social Security Administration before the due date of your return.

-You cannot be a qualifying child of another person.

-You must be age 19 or younger at the end of the year and younger than the person who is claiming you as a dependent, unless you are disabled. There are special rules for children who are temporarily away from home, such as being away at school.

-You must have lived with your parent or stepparent for more than half of the year. There are special rules for children of divorced or separated parents or parents who did not live together at any time during the last six months of the year.

-You cannot provide more than half of your own support during the year.