How to Use Credit Cards Without a Physical Card

Contents

It’s 2019 and you don’t need a physical credit card to make purchases anymore. Here’s a guide on how to use credit cards without a physical card.

Checkout this video:

Introduction

Almost everyone has a credit or debit card, but not everyone knows how to use them without a physical card. Here are a few tips on how to do just that.

First, you’ll need to find a credit card reader that doesn’t require a physical card. There are a few different types of these readers, so you’ll need to research which one will work best for your needs. Once you’ve found a reader, you’ll need to follow the instructions on how to connect it to your computer or smartphone.

Once the reader is connected, you’ll be able to use your credit or debit card without ever having to take it out of your wallet. You can use it for online purchases, in-app purchases, or even at brick-and-mortar stores that have adopted this type of payment system. All you’ll need to do is hold your card up to the reader and enter your PIN number when prompted.

If you’re worried about security, don’t be. These readers are just as secure as physical credit cards and use the same encryption methods to keep your information safe.

So there you have it! Now you know how to use credit cards without a physical card.

How to Use a Credit Card Without a Physical Card

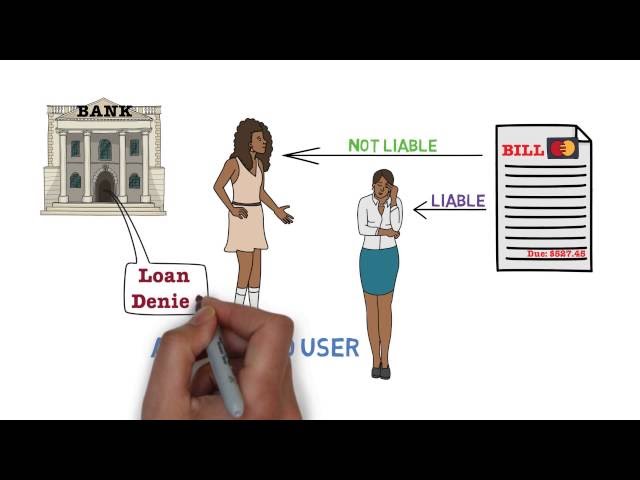

You can use a credit card without a physical card by using a virtual credit card. A virtual credit card is a credit card that is not physical but exists as a card number, expiration date, and security code. You can use a virtual credit card to make online purchases, book travel, and more.

Online Purchases

If you want to make an online purchase but don’t have your credit card on hand, you can still use your credit card number. Most online retailers will require the following information before they will process your transaction:

-The name on the card

-The credit card number

-The expiration date

-The security code

If you have this information, you should be able to make an online purchase without any problem. Just be sure to enter the correct credit card number, as well as the correct expiration date and security code. If you’re not sure about any of this information, you can always call your credit card issuer for help.

In-Store Purchases

In order to make an in-store purchase without a physical credit card, you will need to use a service such as Apple Pay, Google Pay, or Samsung Pay. These services use near-field communication (NFC) technology to communicate with the merchant’s NFC-enabled terminal. When you open the app on your smartphone and hold it near the terminal, your phone will emit a signal that activates the terminal and completes the transaction. If you’re using Apple Pay, you may also need to verify your identity with Face ID or Touch ID.

ATM withdrawals

You can use your credit card at an ATM, but you’ll need to have a PIN for your card. If you don’t have a PIN, you can usually create one by calling your card issuer. To use your credit card at an ATM, just insert your card and enter your PIN.

The Benefits of Using a Credit Card Without a Physical Card

More and more businesses are now accepting credit cards without a physical card. This can be done by using your smartphone or a mobile wallet. There are many benefits to using a credit card without a physical card. This section will cover all benefits of using a credit card without a physical card.

No need to carry a physical card

One of the benefits of using a credit card without a physical card is that you don’t need to carry a physical card with you. This can be helpful if you lose your wallet or if you’re traveling and don’t want to carry a lot of cash. You can also use your credit card without a physical card if your card is stolen or lost.

More secure than carrying a physical card

When you use a credit card without a physical card, you are essentially using a digital version of your credit card. This means that your information is stored on a secure server, and you can use your credit card without having to worry about it being stolen or lost.

There are many benefits of using a credit card without a physical card. For one, it is more secure than carrying a physical card. If your credit card is stolen, the thief would need to have your account information in order to use it. With a digital credit card, the thief would not be able to use your credit card without also having your phone or device.

Another benefit of using a digital credit card is that it can be used at any time, anywhere. All you need is an internet connection. This is especially useful for online shopping or for making purchases when you are traveling.

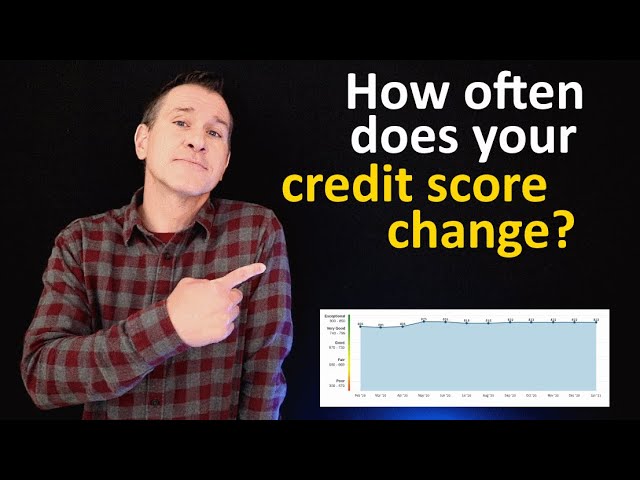

Finally, using a digital credit card can help you keep track of your spending. When you use a physical credit card, it is easy to lose track of how much money you have spent. With a digital credit card, you can see exactly how much money you have spent and where you have spent it. This can help you stay on budget and avoid overspending.

Can be used anywhere that accepts credit cards

Credit cards without a physical card, also called virtual credit cards, are an online version of a regular credit card that can be used to make purchases or withdraw cash. Virtual credit cards are not linked to a physical card, so they can only be used online or over the phone.

There are many benefits of using a virtual credit card, such as the ability to make purchases anywhere that accepts credit cards, the ability to set limits on how much can be spent, and the ability to avoid Late Payment Fees and Interest Charges. Virtual credit cards can also help you build or rebuild your credit history.

The Disadvantages of Using a Credit Card Without a Physical Card

Credit cards are a great way to build credit, but they can also be a hassle. If you lose your credit card, it can be difficult to cancel and get a new one. And if you’re traveling, you may not be able to use your credit card if it’s not in your name. There are a few disadvantages to using a credit card without a physical card.

You may need to enter a PIN for certain transactions

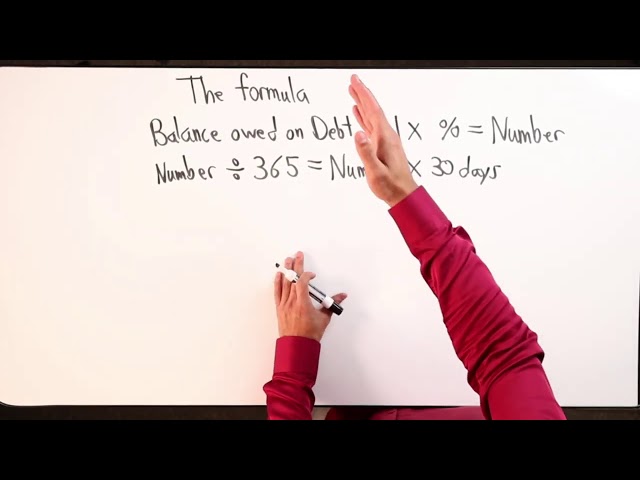

If you’re planning on using your credit card without a physical card, there are a few things you should know. First of all, you may need to enter a PIN for certain transactions, such as withdrawals from an ATM or purchases made at certain retailers. You’ll also need to make sure that you have a mobile device with you that can connect to the internet; otherwise, you won’t be able to use your credit card. Finally, keep in mind that you’ll likely be charged a fee for using your credit card without a physical card.

Some banks may charge a fee for using a credit card without a physical card

apprehensive about using a credit card without a physical card, as some banks may charge a fee for this service. Additionally, if you lose your phone or it is stolen, you may be responsible for any fraudulent charges made to your account. Therefore, it is important to be aware of the potential risks involved in using a credit card without a physical card before you decide to do so.

Conclusion

Overall, using a credit card without a physical card is very convenient. You can use your credit card for online purchases, over the phone, or even in person if you have the right technology. If you are ever in a situation where you do not have your physical credit card, don’t worry! You can still use your credit card and enjoy all the benefits that come with it.