How to Start a Credit Score

A credit score is a numerical expression based on a level analysis of a person’s credit files, to represent the creditworthiness of an individual. A credit score is primarily based on credit report information typically sourced from credit bureaus.

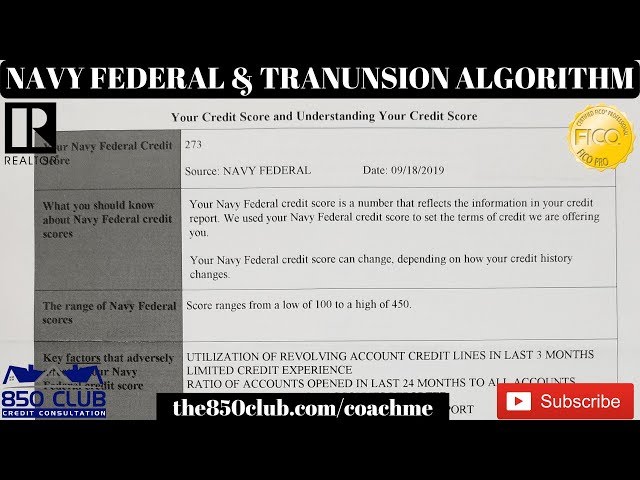

Checkout this video:

What is a Credit Score?

A credit score is a numeric value that represents your creditworthiness. It is based on your credit history, which is a record of your borrowing and repayment activity. The higher your credit score, the more likely you are to be approved for a loan or credit card. A low credit score could result in you being denied for a loan or credit card, or you may be offered a higher interest rate.

What is a FICO Score?

FICO scores are the most widely used credit scores, and lenders may use different versions of the FICO score when considering a loan application. However, all FICO scores use the same 300-to-850 credit score range.

A FICO score of 800 or above is considered exceptional, and a score of 650 is considered poor. A good FICO score is in the 670 to 739 range. Scores below 580 are generally considered to be poor, and scores between 580 and 669 are considered fair.

Your mix of credit accounts also plays a role in your credit score. Having a mix of different types of accounts, such as installment loans, revolving credit lines and other types of accounts, can help your score.

What is a VantageScore?

VantageScore is a credit scoring model used by lenders to help assess credit risk. It was created by the three major credit bureaus – Equifax, Experian and TransUnion – and was first introduced in 2006.

A VantageScore may be used by lenders in addition to or instead of a traditional FICO score when considering a loan application. However, because each scoring model uses different criteria to assess credit risk, a borrower’s VantageScore may be higher or lower than their FICO score.

There are two major types of VantageScore: 3.0 and 4.0. The most recent version, VantageScore 4.0, was introduced in early 2017 and is currently the only version being used by lenders.

Here are some key differences between VantageScore 3.0 and 4.0:

-VantageScore 4.0 uses a scale of 300 to 850, while 3.0 uses 500 to 990;

-4.0 considers your payment history for all types of debts, while 3.0 considers only certain types;

-4.0 excludes medical collections from your score, while 3.0 does not;

-4.0 treats all late payments the same, regardless of when they occurred, while 3.0 has different scoring criteria for late payments depending on how recently they occurred;

-And finally, 4.0 allows for “trended data” to be factored into your score computation, while 3

How is a Credit Score Calculated?

Your credit score is a number that represents your creditworthiness. It’s used by lenders to determine whether you’re a good candidate for a loan and how much interest to charge you. A higher credit score means you’re a lower-risk borrower, which could lead to a lower interest rate on a loan.

Payment History

One of the most important factors in your credit score is your payment history. This includes whether you have made your payments on time, and if you have a history of late or missed payments. Payment history is generally the biggest factor in your credit score, so it’s important to make sure you always make your payments on time.

If you have a history of late or missed payments, you can still improve your payment history by making your payments on time from now on. As time goes on, your payment history will become less and less of a factor in your credit score.

Credit Utilization

Credit utilization is one of the most important factors in credit scoring. It refers to the amount of your credit limit that you use on a monthly basis. For example, if you have a credit limit of $1,000 and a balance of $500, your credit utilization would be 50%.

Ideally, you want to keep your credit utilization below 30%. This shows lenders that you can manage your credit responsibly and that you’re not overextending yourself. If your credit utilitzation is too high, it could be a red flag to lenders that you’re at risk of defaulting on your debts.

There are a few different ways to lower your credit utilization. One is to simply pay down your balances so that you’re using less of your available credit. Another is to ask for a higher credit limit from your lender. This will effectively increase the size of your “safety net” and could help lower your utilization rate.

Of course, it’s important to use credit responsibly no matter what your utilization rate is. Making timely payments and keeping balances low will help you improve your score in other ways and position yourself for financial success in the long run.

Length of Credit History

Length of credit history is one factor that makes up your credit score. Credit scoring models generally give more points for a longer credit history because it shows you’re a responsible borrower who has managed credit for a long time.

Your length of credit history is the average age of your credit accounts. So, if you have two accounts — one that’s been open for four years and one that’s been open for eight months — your length of credit history would be 2.5 years.

Generally, the older your oldest account is, the better it is for your length of credit history. That’s why it can be helpful to keep older accounts open even if you don’t use them often.

Types of Credit

There are four types of credit:

-Installment credit: This type of credit includes auto loans and mortgages. You borrow a set amount of money and make equal payments each month until the loan is repaid.

-Revolving credit: This type of credit includes lines of credit and credit cards. With revolving credit, you can borrowing up to your limit and then pay off the balance over time or in full each month.

-Open-ended credit: Open-ended credit lines, like those offered by department stores, can be used repeatedly as long as you make timely payments.

-Closed-ended credit: Closed-ended lines of credit, like auto loans or loans from a lender, can only be used once for the specific amount borrowed.

New Credit

One of the biggest influences on your credit score is whether you have new credit. Part of your score is based on the length of your credit history — generally speaking, the longer your positive payment history, the better your score. So, if you have new credit, it can temporarily lower your score.

When you open a new credit account, the creditor will report it to the credit bureaus, and a “hard inquiry” will appear on your report. This will lower your average age of accounts and may also lower your score slightly. However, as you establish a good payment history with that creditor, your score will likely improve.

It’s important to keep in mind that opening a new credit account is just one factor that can influence your score. If you manage your new credit responsibly and make payments on time, you can offset any negative impact on your score.

How to Start Building Credit

A credit score is a number that reflects the creditworthiness of an individual. It is used by lenders to determine whether or not to extend credit to an individual. A high credit score indicates that an individual is a low-risk borrower, while a low credit score indicates that an individual is a high-risk borrower. If you’re looking to build credit, there are a few things you can do.

Apply for a Credit Card

One way to start building credit is to apply for a credit card. You can start by looking for a credit card that requires no or low deposits, has high credit limits, and reports to all three credit bureaus. It’s also important to make sure you’re using your credit card responsibly by making timely payments and keeping your balances low. Once you’ve established a good payment history with your credit card, you can begin to explore other options for building credit, such as loans and lines of credit.

Use a Secured Credit Card

Using a secured credit card is one of the simplest and most effective ways to start building your credit history. A secured credit card is a regular credit card that is backed by a deposit you make with the issuing bank. This deposit serves as collateral in case you don’t pay your bill, and it also determines your credit limit.

For example, if you open a secured credit card with a $500 deposit, your credit limit will also be $500. The benefit of a secured credit card is that it reports to the major credit bureaus just like a regular credit card, so as long as you use it responsibly, it can help you build your credit score. Just be sure to make your payments on time and keep your balance low relative to your credit limit.

Become an Authorized User

One way to start building credit is to become an authorized user on someone else’s credit card. As an authorized user, you’ll have access to the credit card and can use it to make purchases, but you won’t be legally responsible for repaying the debt.

If you’re thinking about becoming an authorized user, it’s important to choose a credit card account wisely. You’ll want to select an account that has a good history of on-time payments and a low balance. That way, you can be sure that the account will reflect positively on your credit report.

It’s also important to remember that as an authorized user, you won’t have full control over the account. The primary cardholder will still be responsible for making payments and managing the account. So if they miss a payment or run up a high balance, your credit score could be affected.

If you decide that becoming an authorized user is right for you, talk to the primary cardholder about adding you to their account. They may need your Social Security number and date of birth so that the credit card issuer can run a credit check. Once you’re added to the account, make sure to keep tabs on your credit score and report any changes promptly.

Use a Credit Builder Loan

A credit builder loan is a small loan that is used to help build or rebuild your credit. The loan is repaid over a set period of time, and as you make your payments on time, you can improve your credit score.

There are two types of credit builder loans: secured and unsecured. A secured loan is one that is backed by an asset, such as a car or home. An unsecured loan is not backed by an asset but may have higher interest rates.

If you are thinking about using a credit builder loan to improve your credit score, here are a few things to keep in mind:

-Make sure you can afford the payments. A credit builder loan should not put you in a financial bind. Make sure you can afford the monthly payments before you sign up for the loan.

-Only borrow what you need. There is no need to borrow more than you need. Borrow only what you can afford to repay.

-Make your payments on time. One of the best ways to improve your credit score is by making your payments on time each month. Set up automatic payments if possible so you don’t have to worry about forgetting a payment.

-Keep the balance low. Another way to improve your credit score is by keeping the balance on your credit builder loan low relative to the loan amount. For example, if you have a $1,000 loan, try to keep the balance below $500.

Use a Co-Signer

If you’re having trouble getting approved for lines of credit, a co-signer can help. A co-signer is someone who agrees to be equally responsible for repaying a loan or line of credit. This person must have good to excellent credit.

When you have a co-signer on your account, the lender will report your payments to the credit bureaus. If you make on-time payments, you’ll start to build a good credit history. This will help you qualify for lines of credit in the future without a co-signer.

Keep in mind that if you don’t make your payments on time, your co-signer’s credit will be affected. So it’s important to only apply for credit products that you know you can afford.