How to Remove a Dispute from Your Credit Report

Contents

If you have a dispute on your credit report, it can be tough to get it removed. But it’s not impossible. Here’s a step-by-step guide on how to remove a dispute from your credit report.

Checkout this video:

Introduction

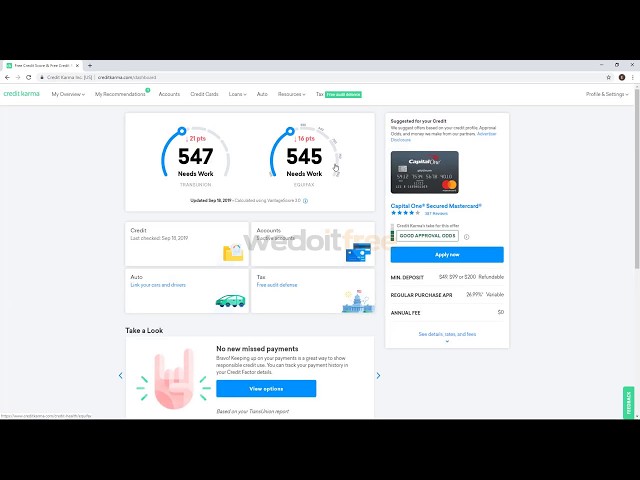

If you have a dispute on your credit report, you can take steps to remove it. First, check your credit report to make sure the dispute is actually listed. If it is, you’ll want to contact the credit bureau and ask them to remove the dispute. You can also send a letter to the creditor asking them to remove the dispute. If all else fails, you can file a complaint with the Consumer Financial Protection Bureau.

What is a dispute?

A dispute is when a creditor or other party reports something on your credit report that you believe is inaccurate. This could be an error, such as an incorrect account balance, or something that you believe is fraudulent, such as a charge for a purchase you didn’t make.

If you find a mistake on your credit report, you can file a dispute with the credit bureau to have it removed. You can also file a dispute with the company that provided the information to the credit bureau.

It’s important to note that filing a dispute will not remove accurate information from your credit report. accurate information can only be removed if it is outdated (for example, if it’s more than seven years old) or if you can prove that it’s fraudulent.

If you have questions about how to remove a dispute from your credit report, please contact us and we would be happy to help!

How to remove a dispute from your credit report

If you have a dispute on your credit report, you may be wondering how to remove it. While it’s possible to remove a dispute from your credit report, it’s important to understand how credit reporting works before you try to remove any negative information.

Step 1: Gather your documentation

If you have documentation to support your position, send it to the credit bureau(s) along with a cover letter requesting that the dispute be removed. The credit bureau(s) will investigate and send you a written report of their findings. If the dispute is resolved in your favor, the bureau(s) will remove the dispute from your report and notify all three national credit reporting companies so they can correct your report.

If you do not have documentation or if you disagree with the credit bureau’s findings, you can file a statement of dispute. This statement will appear on your credit report next to the disputed information and can be read by anyone who checks your report.

Step 2: Write a dispute letter

If you find a mistake on your credit report, you can file a dispute with the credit bureau to have it removed.

Before taking this step, try to contact the creditor directly to resolve the issue. If you’re not able to do that, or if the creditor doesn’t respond to your request, then you can file a dispute with the credit bureau.

When you file a dispute, you’ll need to provide supporting documentation to show why the item should be removed from your credit report.

For example, if you dispute an account that you never opened, you can include a copy of a government-issued ID that shows your name and address. If you dispute an account that’s been reported incorrectly, you can include documentation that shows the correct information.

Once the credit bureau receives your dispute letter and supporting documentation, they’ll investigate and make a determination about whether or not the item should be removed from your credit report.

If they find that the item is inaccurate, they’ll contact the creditor and ask them to verify the information. If the creditor can’t verify the information, then it will be removed from your credit report.

Step 3: Send your dispute letter

If you want to remove a dispute from your credit report, you’ll need to follow the instructions for disputed items outlined in your credit report. If the instructions aren’t clear, you can always reach out to the credit reporting agency for more information.

Once you’ve gathered all the required information, craft a dispute letter that includes your name, address, contact information, and a list of the items you’re disputing. Be sure to include copies of any documentation you have to support your case. Keep a copy of the letter for your records.

Send your dispute letter by certified mail with return receipt requested so you have proof that it was delivered. The credit reporting agency has 30 days to investigate and resolve the dispute.

Conclusion

If you have a dispute on your credit report, it is important to take action to remove it. There are a few different ways to do this, and the best approach will depend on the specifics of your situation.

If you have a dispute with a creditor, you can try to negotiate with them directly to have the dispute removed. If you are unable to reach an agreement, you can also file a complaint with the Consumer Financial Protection Bureau (CFPB).

If you have a dispute with a collection agency, you can send them a “cease and desist” letter telling them to stop contacting you. You can also ask the credit bureaus to remove the collection account from your credit report.

If you have a dispute with a credit bureau, you can file a complaint with them online or by mail. You should also include any supporting documentation that you have to back up your claim.