How to Qualify for an FHA 203k Loan

FHA 203k loans are a unique mortgage program that allows homeowners to finance the purchase and renovation of a property all in one loan.

Checkout this video:

The FHA 203k Loan Process

The FHA 203k Loan program is designed to help borrowers finance the purchase of a home and the cost of its renovation or “rehabilitation” with a single loan. The loan is available to buyers who may not otherwise qualify for a conventional mortgage because the FHA insures the loan.

Applying for the loan

The 203k loan process is fairly straightforward. First, you need to find a lender that is approved to offer this type of loan. Once you have found a lender, you will need to fill out an application and provide supporting documentation. Once your application is approved, the lender will issue a commitment letter which outlines the terms of the loan.

The next step is to find a property that meets the guidelines set forth by the FHA. Once you have found a property, you will need to have an appraisal done in order to determine its value. After the appraisal has been completed, the lender will issue a loan approval which outlines the amount of money that you are eligible to borrow.

The final step in the process is to close on the loan and begin making repairs/improvements to your new home. The 203k loan process can take anywhere from 30-90 days to complete from start to finish.

The loan approval process

The FHA 203k loan approval process is somewhat different than your typical home loan. Because you are borrowing money for both the purchase of a home and for home improvements, there are two separate Loan Origination Dates (LOD). The first LOD is the date when you close on the purchase of the property. The second LOD is the date when you close on the loan for the home improvements.

The 203k loan approval process will take longer than a typical home loan because there are two loans being processed at the same time. In addition, you will need to provide detailed plans and specifications for the proposed home improvements. The lender will use these plans to determine if the repairs are feasible and if they fall within the FHA guidelines.

If you are approved for a 203k loan, you will be required to put down a 3.5% down payment. You can use gifted funds or your own savings for this down payment. If you use gifted funds, you will need to provide documentation showing that the funds are truly gifted and not just a loan that needs to be repaid.

Once you have been approved for a 203k loan, you will work with your lender to select a contractor who will complete the repairs/improvements on your home. The contractor must be licensed and insured and must agree to complete the work within a specified time frame. Once the repairs/improvements have been completed, you will then make your final mortgage payment and own your home outright!

The loan closing process

The loan closing process is the final step in applying for an FHA 203k loan. Once you have been approved, your lender will work with you to close on the loan. This process can take anywhere from a few weeks to a few months, depending on the situation.

When you close on the loan, you will sign a promissory note and mortgage. You will also need to provide proof of homeowner’s insurance and pay any closing costs that are due. Once the loan is closed, the funds will be disbursed to you so that you can begin renovations on your home.

Qualifying for an FHA 203k Loan

If you’re looking to purchase a home that needs repairs or renovations, you might be eligible for an FHA 203k loan. This type of loan allows you to finance the purchase price of the home plus the cost of the repairs or renovations. To qualify for an FHA 203k loan, you’ll need to meet the same qualifications as any other FHA loan.

Credit score requirements

In order to qualify for an FHA 203k loan, you will need to meet the following requirements:

-A credit score of 620 or higher

-A debt-to-income ratio of 50% or less

-A down payment of 3.5%

-Ability to show proof of employment and income

-A property that meets the FHA’s minimum property standards

If you do not meet the above requirements, you may still qualify for an FHA 203k loan if you can provide a cosigner who meets the above requirements.

Employment history requirements

In order to be eligible for an FHA 203k loan, borrowers must meet the following employment requirements:

-Borrowers must be employed for at least two years consecutively in the same line of work.

-Borrowers must show a consistent work history and cannot have any large gaps in employment.

-Borrowers who are self-employed must have been operating their business for at least two years.

Debt-to-income ratio requirements

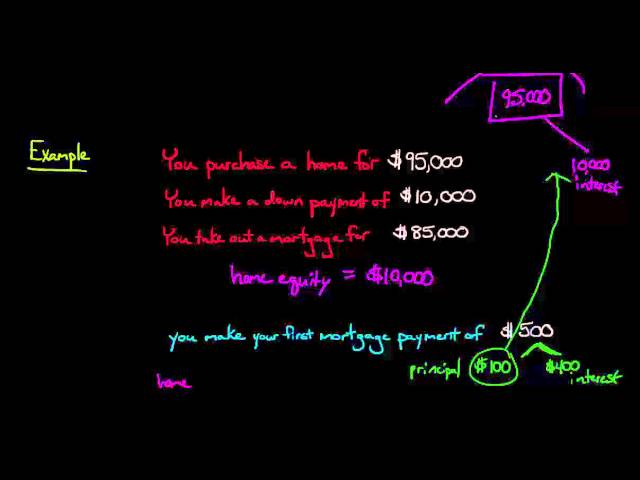

FHA loans have specific debt-to-income ratio (DTI) requirements. Your DTI is calculated by adding up all of your monthly debt obligations and dividing that number by your gross monthly income. For example, say your monthly debt obligations are $1,500 and your monthly income is $4,000. Your DTI would be $1,500/$4,000 = .375.

In order to qualify for an FHA 203k loan, you must have a DTI of less than 50%. If you want to qualify for a loan with a lower interest rate, you may need a DTI of less than 45%.

The Benefits of an FHA 203k Loan

An FHA 203k loan is a government-backed loan that allows you to finance the purchase of a home and include the cost of necessary repairs and renovations in the mortgage. This can be a great way to finance a fixer-upper or make energy-efficient improvements to your home. There are a few things to keep in mind if you’re thinking of applying for an FHA 203k loan.

The loan allows you to purchase a fixer-upper

The FHA 203k loan is a government-backed mortgage that allows you purchase a home in need of repairs, or make improvements to an existing home. This loan is perfect for buyers who want to purchase a home but can’t find one that meets their needs, or who want to make improvements to their current home.

FHA 203k loans are available in two types:

-Standard 203k loans are for homes that need major repairs, such as structural damage or replacement of major systems. These loans can be used for both purchase and refinancing.

-Limited 203k loans are for homes that need cosmetic upgrades, such as painting, new appliances, or minor repairs. These loans can only be used for purchase; they cannot be used for refinancing.

To qualify for an FHA 203k loan, you must:

-Be a first-time buyer or have not owned a home in the past three years

– Have a credit score of 580 or higher

– Have a debt-to-income ratio of no more than 43%

– Be able to make a down payment of at least 3.5% of the total loan amount

– Have enough income to cover both your current mortgage payments and the additional costs associated with renovating your home

The loan allows you to roll the cost of repairs into your mortgage

If you qualify for an FHA 203k loan, you can roll the cost of repairs and improvements into your mortgage. This means you don’t have to come up with all the cash for the repairs or improvements. The loan is available for single-family homes, two-to-four unit homes, and condominiums and townhomes. The loan amount is based on the “after improved” value of the home. This means that you can borrow enough money to make the repairs or improvements and still have a low mortgage payment.

The loan has lower credit score and employment history requirements

The FHA 203k loan is a government-backed mortgage that’s designed to finance both the purchase of a home and the cost of its renovations. The loans are available to buyers who either don’t have the cash on hand to pay for the repairs or who are unable to get traditional financing because of the home’s condition. The loans are also open to people who want to refinance their current home and include the cost of repairs in their new mortgage.

In order to qualify for an FHA 203k loan, you must have a credit score of at least 620. The loans are available with both fixed and adjustable interest rates, although you’ll likely get a better deal if you choose a fixed rate. You’ll also need to meet standard FHA employment requirements in order to qualify.

If you’re looking for a way to finance the purchase of a fixer-upper, an FHA 203k loan might be right for you.