How to Lower Your Interest Rate on Credit Cards

Contents

If you’re carrying a balance on your credit cards, you’re probably paying too much in interest. But there are some simple things you can do to lower your interest rate and save money. Follow our tips and you could be paying a lot less interest on your credit card balance in no time.

Checkout this video:

Check your credit score

Use a service like Credit Sesame or Credit Karma to check your credit score for free

Credit scores are important because they affect the interest rate you’ll pay on credit cards, loans, and other lines of credit. The higher your score, the lower your rate will be.

You can check your credit score for free with a service like Credit Sesame or Credit Karma. Once you know your score, you can take steps to improve it if necessary.

If you have a high score, you’re in good shape. But if your score is low, there are things you can do to improve it. First, check for errors on your credit report and dispute any that you find. Second, make sure you’re paying all of your bills on time. And third, consider using a credit monitoring service like Credit Sesame or Credit Karma to help you keep track of your progress.

Call your credit card company

If you have a good credit score, you can probably lower your interest rate by calling your credit card company and asking for a lower rate. This is especially true if you have been a good customer and have never missed a payment. When you call, be polite and explain your financial situation.

Explain that you’re considering a balance transfer

Call your credit card company and explain that you’re considering a balance transfer. Tell them how much you owe and how much you can afford to pay each month. Ask if they can lower your interest rate or give you a promotional offer with a 0% interest rate for a period of time. If they say no, be sure to ask if there are any other options they can offer you.

Ask if they’re willing to lower your interest rate

When you contact your credit card company, you will likely need to provide some information about your current financial situation. Be prepared with this information so that you can make a convincing case for why you should receive a lower interest rate.

Your credit card company may be willing to lower your interest rate if:

-You have been a customer for a long time

-You have never missed a payment

-Your credit score has improved

Negotiate

If they’re not willing to lower your interest rate, ask if they’re willing to waive any fees

Fees are another way that banks make money off of credit card holders. And much like with interest rates, you can often get these fees waived if you ask.

There are a few different types of fees that you might be charged on your credit card:

-Annual fee: This is a yearly fee that some cards charge just for having the privilege of using the card. If you’re paying an annual fee and not getting any perks or rewards in return, it’s probably not worth it. You can usually get this fee waived by calling up your credit card company and asking them to waive it for you.

-Late payment fee: This is a fee that’s charged if you don’t make your minimum payment by the due date. If you’re ever in danger of missing a payment, call up your credit card company and let them know. They may be willing to work with you and waive the late payment fee.

-Balance transfer fee: This is a fee that’s charged when you transfer a balance from one credit card to another. Balance transfer fees are typically around 3%, so they can add up quickly. If you’re thinking about transferring a balance, call up the credit card company and see if they’re willing to waive the balance transfer fee before you do it.

In general, it’s always worth asking your credit card company if they’re willing to waive any fees that you’re being charged. You might be surprised at how often they say yes!

If they’re not willing to do either of those things, ask if you can speak to a supervisor

If you’re not satisfied with the response you get, ask to speak to a supervisor. If they’re still not willing to work with you, you can try negotiating with your credit card company yourself.

There are a few things you can try to lower your interest rate:

-Call your credit card company and ask if they can lower your rate. If they say no, ask if they can give you a better offer than their current rates.

-If you have a good credit score, you can try asking for a 0% balance transfer credit card. This will give you a 0% interest rate for a certain period of time, usually 6-18 months.

-If you have a good relationship with your credit card company, you can try asking for a lower interest rate. Sometimes they’ll be willing to lower your rate if you’ve been a good customer.

Remember, the worst thing they can say is no!

If all else fails, consider a balance transfer

One way to lower your interest rate is to transfer your balance to a new credit card with a 0% intro APR period. When you do this, you’ll pay no interest on your balance for a set period of time, typically 12 to 21 months. Be sure to find out if there’s a balance transfer fee before you sign up for the new card.

Look for a credit card with a 0% intro APR on balance transfers

Looking to lower your interest rate on credit cards? One option is to find a credit card with a 0% intro APR on balance transfers.

With this type of card, you can transfer your balance from one card to another, usually with a lower interest rate. This can help you save money on interest and pay down your debt faster.

Be sure to read the terms and conditions carefully before you apply, as there may be fees associated with balance transfers. Also, keep in mind that the introductory APR period may only last for a limited time, so you’ll want to make sure you can pay off your debt before the intro period ends.

Transfer your balance to the new credit card

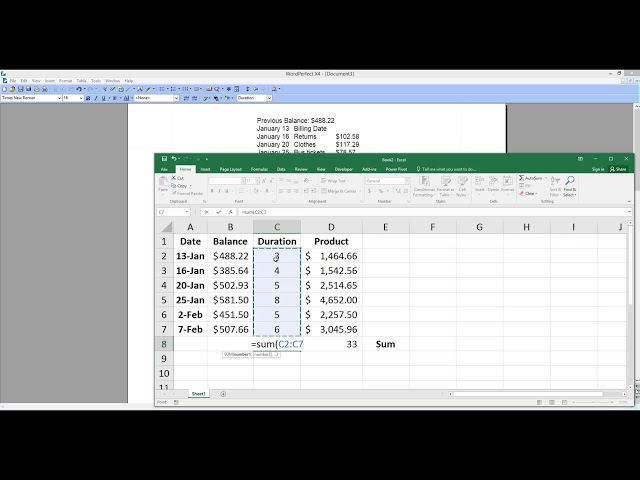

A balance transfer is when you transfer your credit card debt from one card to another that has a lower interest rate. For example, if you have a credit card with an annual percentage rate (APR) of 18%, and you find a new card with an APR of 14%, you can save money on interest by transferring your balance to the new card.

There are a few things to keep in mind when considering a balance transfer:

-Many cards have a balance transfer fee, typically 3% of the amount being transferred. For example, if you’re transferring $5,000, you’ll be charged a $150 fee. Make sure you take this into account when considering whether or not a balance transfer is right for you.

-The lower APR on the new card is usually only introductory, and after 12-18 months, the APR will go up. Make sure you have a plan to pay off your debt before the intro period ends, or you’ll be stuck with a higher interest rate.

-Some cards require good or excellent credit for approval. If your credit is not in good standing, you may not be approved for the new card.

Pay off your balance

One way to lower your interest rate is to pay off your balance. This will reduce the amount of interest you are paying on your credit card. Another way to lower your interest rate is to transfer your balance to a lower interest rate credit card. This will save you money in the long run.

Make sure you pay off your balance before the intro APR expires

If you’re working on paying down your credit card debt, one of the smartest things you can do is to find a card with a 0% introductory APR period and then make sure you pay off your balance before that intro period expires.

A 0% intro APR means you won’t be charged any interest on your balance for a set period of time, which can be anywhere from six months to 21 months depending on the card. That’s valuable because it means you can save on interest and put more money towards paying down your principal balance.

However, once the intro period expires, the APR will jump back up to the normal rate, which could be as high as 20% or more. So if you don’t pay off your balance before the intro period expires, you’ll start racking up interest charges again.

Paying down your balance before the intro APR expires is a great way to save on interest and get out of debt faster. Just make sure you use a budget and set aside enough money each month to pay more than the minimum payment so you can get that balance paid off before the intro period ends.