How to Increase Your Credit Limit

Contents

Having a high credit limit can be a great way to improve your credit score and give you some financial flexibility. If you’re looking to increase your credit limit, here are a few tips to get you started.

Checkout this video:

Check your credit report for mistakes

If you find any errors on your credit report, dispute them with the credit bureau. If the dispute is successful, your credit score will go up and you may be able to get a higher credit limit.

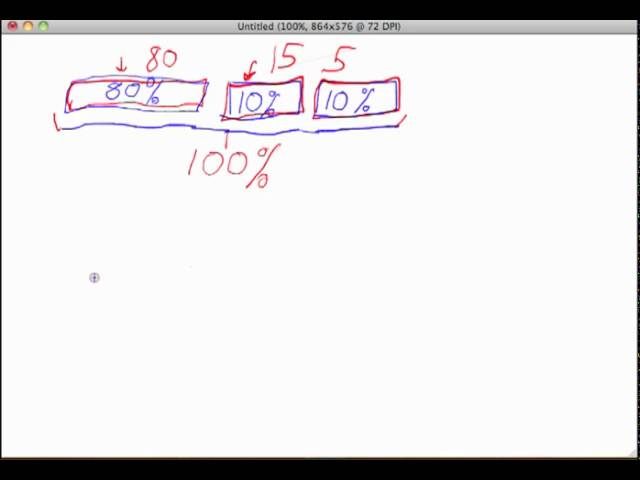

You should also check your credit utilization ratio. This is the percentage of your available credit that you are using. For example, if you have a $1000 credit limit and a balance of $500, your credit utilization ratio is 50%.

A high credit utilization ratio can hurt your credit score, so it’s important to keep it below 30%. If you can pay off some of your debts, or get a higher credit limit, your credit utilization ratio will go down and your score will go up.

Pay your bills on time

One of the best ways to increase your credit limit is to show that you’re a responsible borrower by paying your bills on time. Payment history is one of the most important factors in your credit score, so demonstrating a track record of timely payments will not only help you get a higher credit limit, but also improve your chances of getting approved for other types of credit in the future. You can set up automatic payments from your bank account to help make sure you never miss a due date.

Another way to give your credit score a boost is to use a credit card responsibly by keeping your balance well below your credit limit. This shows lenders that you’re not overextending yourself financially and that you’re able to manage your credit card debt responsibly. Try to keep your credit utilization below 30%, which is the threshold at which damage to your credit score begins to occur. If you have a balance that’s close to or exceed your credit limit, consider making a payment or transferring some of the balance to another card before your statement closes.

Keep your credit utilization low

Credit utilization is the second most important factor in credit scoring, after payment history. Utilization is the amount of your credit that you use, compared to your credit limit. For example, if you have a credit limit of $1,000 and a balance of $500, your utilization is 50%.

It’s important to keep your utilization low because it shows lenders that you’re a responsible borrower who doesn’t max out their credit cards. A high utilization ratio can also indicate that you’re in financial distress and may be at risk of defaulting on your debt obligations.

There are a few things you can do to lower your utilization ratio:

1. Increase your credit limits: One way to lower your utilization ratio is to simply ask your card issuer for a higher credit limit. If you have a good payment history and low balances on other debts, there’s a good chance your issuer will approve your request.

2. Pay down your balances: Another way to lower your utilization ratio is to pay down the balances on your credit cards. If you can’t afford to pay off your debt in full, try to at least reduce your balances to below 30% of your credit limits.

3. Use multiple cards: If you have multiple credit cards, spread out your spending across all of them instead of maxing out one card. This will help keep your overall utilization ratio low and improve your chances of getting new lines of credit in the future.

4. Avoid opening new accounts: Opening new lines of credit can actually hurt your score in the short term by increasing your overall utilizat

Use a mix of credit products

One way to help improve your credit score is by using a mix of credit products. This can include a mix of revolving credit, such as credit cards, and installment loans, such as auto loans. Using a mix of different types of credit can help show lenders that you’re a responsible borrower.

another way to potentially increase your credit limit is by maintaining a good credit history. This means making your payments on time, keeping your balances low, and not opening new accounts too often. If you have a good track record with your current lender, they may be more likely to offer you an increased limit in the future.

Apply for a credit limit increase

One way to quickly increase your credit limit is to simply ask your credit card issuer for a higher limit. This is usually as easy as calling up customer service and requesting a credit limit increase.

In most cases, the issuer will automatically approve your request as long as you have a good history with them and you’re not requesting an unreasonable amount. For example, it’s unlikely that they’ll Approved a request for a $10,000 credit limit increase if your current limit is $2,000.

If you don’t want to go through the hassle of calling customer service, you can also request a credit limit increase online through your issuer’s website.