How to Get Preapproved for a VA Home Loan

Contents

You’ve served your country and now you’re ready to realize the dream of homeownership.

One of the first steps you’ll need to take is to get preapproved for a VA home loan.

This will give you a clear idea of how much house you can afford and help you move forward in the homebuying process.

Follow these steps to get preapproved for a VA home loan.

Checkout this video:

Understanding the VA Loan Process

If you’re a veteran or active service member, then you may be eligible for a VA home loan. Getting preapproved for a VA loan is a great first step as it allows you to understand how much house you can afford and what kind of interest rates you’ll be looking at. It’s also a good idea to get preapproval before you start house hunting so that you know what kind of budget you’re working with.

Prequalification vs. Preapproval

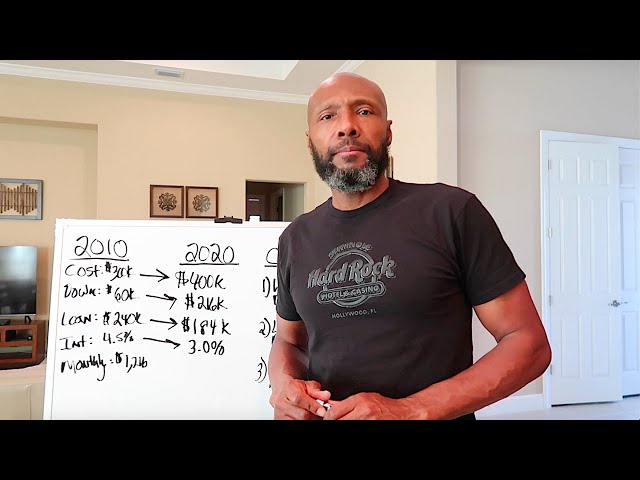

Prequalification is the initial step in the mortgage process, and it’s generally pretty simple. You supply a bank or lender with your overall financial picture, including your debt, income and assets. After evaluating this information, a lender can give you an idea of the mortgage amount for which you qualify.

Preapproval is the second step in the mortgage process, and it’s much more involved. An application — complete with documentation of your financial history — is sent to a lender. This time, though, you’ll hear back with a definite loan amount that you’re approved for. You’ll also get an idea of what interest rate you will pay on that loan, as well as its monthly and total payments.

The Importance of a Preapproval

One of the most important steps in buying a home is obtaining preapproval for a mortgage. Preapproval is when a lender reviews your financial information—such as your income, debt, and credit score—and agrees to provide a loan up to a certain amount. Having a preapproval letter in hand makes you a more competitive buyer and gives you peace of mind knowing how much house you can afford.

How to Get Preapproved

If you’re a veteran, you might be eligible for a VA home loan. VA home loans are a type of mortgage backed by the U.S. Department of Veterans Affairs. They’re available to eligible service members, veterans, and their spouses. If you’re interested in buying a home with a VA loan, you’ll need to get preapproved. Getting preapproved for a VA loan is a little different from getting preapproved for a conventional mortgage, but it’s not difficult.

The Documents You’ll Need

If you’re married, both spouses will need to provide these documents regardless of whether both spouses are applying for the loan.

If you have dependent children, you’ll need to provide proof of their existence and your relationship to them. The following documents count as proof:

-A birth certificate

-A passport

-Adoption papers

-A foster care placement letter

You’ll also need to provide proof of your military service. The following documents count as proof:

-A DD 214 form

-An NGB 22 form

-An active duty orders form

How to Submit Your Documents

Initiate your VA home loan preapproval by gathering all the required documentation from your lender. This will include proof of income, such as W-2 statements or pay stubs going back at least three months, bank statements and tax returns. The lender will also need to pull your credit report.

What Happens After You’re Preapproved

You’ve done your research and you’re now ready to apply for a VA home loan. The first step is getting preapproved by a lender. But what happens after you’re preapproved? In this article, we’ll walk you through what to expect after you’re preapproved for a VA home loan.

The Next Steps in the Loan Process

Now that you have a certificate of eligibility (COE) you can apply for your loan. This is how you’ll provide proof of your service to the lender. If you’re buying a home, you’ll also need a real estate agent.

The next steps in the loan process will be:

1. Applying for your loan

2. Getting a property appraisal

3. Completing a loan underwriting review

4. Closing on your loan