How to Get an FHA Loan with Bad Credit

Contents

It is possible to get approved for an FHA loan with bad credit . However, it is important to understand that lenders will be closely scrutinizing your credit history and may require you to provide proof of financial stability.

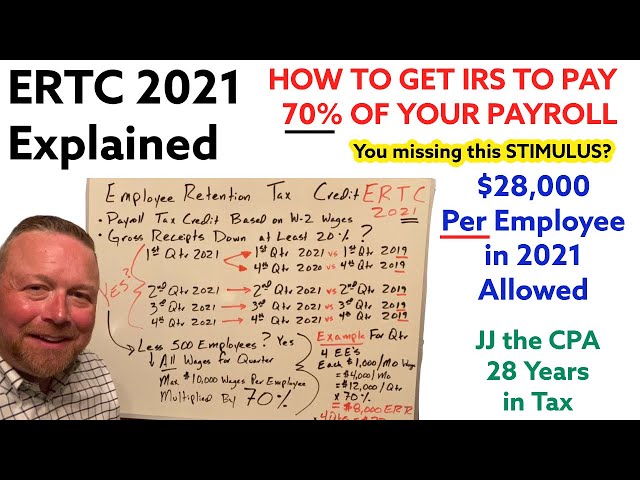

Checkout this video:

The Basics of FHA Loans

If you have bad credit, you might be wondering if you can get an FHA loan. The Federal Housing Administration (FHA) offers loans with low down payments, and that can be especially helpful for first-time homebuyers. Let’s take a look at what an FHA loan is and how it might work for you.

What is an FHA Loan?

FHA loans are mortgages that are issued by banks and finance companies, but they are backed by the Federal Housing Administration. This government agency is part of the Department of Housing and Urban Development (HUD) and insures loans so that lenders can offer potential home buyers better rates and terms. An FHA loan can be used to buy a house or condominium, as well as a manufactured home that is built in accordance with HUD standards. In addition, an FHA loan can be used to purchase a modular or mobile home, though it must be affixed to a permanent foundation to qualify.

Who Can Apply for an FHA Loan?

FHA loans are government-insured mortgages with less-stringent credit and down payment requirements than many conventional loans. An FHA loan may be a good choice if you have poor credit or a limited down payment. However, other mortgage options exist that may better suit your needs.

If you have a credit score of at least 580, you may qualify for an FHA loan with a down payment as low as 3.5%. If your credit score is between 500 and 579, you may qualify for an FHA loan with a 10% down payment. With FHA loans, your down payment can come from gifts or other forms of funding; you don’t necessarily need to have your own money saved up.

How to Get an FHA Loan with Bad Credit

If you have bad credit, you may still be able to get an FHA loan with a credit score as low as 580. But you will most likely need to put down a larger down payment of 10 percent or more. If you have a credit score of 580 or higher, you can qualify for an FHA loan with a 3.5% down payment.

Check Your Credit Score

If you have bad credit, the best thing you can do is work on your credit score. This will take time, but it’s the best way to improve your chances of getting an FHA loan.

You can get a free credit report from each of the three major credit bureaus every year. Check your scores and report any errors. Also, make sure you are paying all your bills on time and not using too much of your credit limit.

If you need help raising your score, consider using a credit counseling or repair service. Just be sure to choose a reputable company that will help you without making false promises or charging excessive fees.

Find a Lender that Works with Bad Credit

If you have bad credit, you might be wondering how you can get approved for an FHA loan. lenders who work with the FHA have flexibility when it comes to approving loans for borrowers with poor credit. However, that doesn’t mean that getting an FHA loan is easy. Here are a few things you need to do in order to get an FHA loan with bad credit:

1. Find a lender that works with Bad Credit

2. Have a down payment ready

3. Be able to show proof of income

4. Be prepared for higher interest rates

Even if you have bad credit, there are still some ways to get approved for an FHA loan. If you can find a lender that is willing to work with your bad credit, then you may be able to get approved for an FHA loan. In order to get approved, you will need to have a down payment ready and be able to show proof of income. Be prepared for higher interest rates if you do get approved.

Improve Your Credit Score

The first thing you need to do is check your credit score. So what credit score is needed to get an FHA loan? An FHA loan has historically been one of the easiest mortgages for people with bad credit to get approved for. But things have changed as the subprime mortgage crisis has deepened. In order for a lender to give you an FHA loan with bad credit, they’ll need to see that you have a good reason for it.

If you have a low credit score because you have a lot of debt, the first thing you need to do is start paying down your debt. The best way to do this is by getting a consolidation loan and using it to pay off all of your other debts. This will not only help improve your credit score, but it will also make it easier for you to make your monthly payments.

If you have a low credit score because you don’t have any history, the best thing you can do is start using credit. Get a secured credit card and use it responsibly. Make sure you make your payments on time and in full every month. After a few months of doing this, you should start seeing your credit score go up.

Once you’ve improved your credit score, you should start shopping around for lenders who specialize in FHA loans for bad credit. These lenders will be more likely to approve you for a loan than a traditional lender would be.

Applying for an FHA Loan

If your credit score is below 580, it will be difficult to qualify for an FHA loan. However, if you have a 580 or higher credit score, you may be able to get approved for an FHA loan with a 3.5% down payment.

Get Pre-Approved

The first step is to get pre-approved for an FHA loan. This can be done with a credit score as low as 580, and it will allow you to put down a 3.5% down payment. If your credit score is lower than 580, you’ll need to put down at least 10%. Once you’re pre-approved, the lender will give you a list of houses that qualify for an FHA loan.

Collect Documentation

Now that you know you have bad credit, you will need to start the process by gathering all of your financial documentation. This means any and all statements for debts and assets you have. Be sure to include:

-Your most recent tax return

-Your most recent pay stub

-Any government benefits or income statements

You will also need to provide an estimate of your monthly expenses, such as:

-Housing costs (mortgage or rent)

-Utilities

-Food

-Transportation

– childcare

-Insurance

etc.

Complete a Loan Application

The first step in applying for an FHA loan is to contact multiple lenders and compare their mortgage interest rates and loan options. Lenders will provide you with a Loan Estimate that includes findings on the interest rate, monthly payments, closing costs and other loan details that you should compare before deciding on a loan.

To find an FHA-approved lender, use the Department of Housing and Urban Development’s (HUD) search tool or visit HUD’s website for a list of approved lenders. You can also contact your state’s housing authority for a list of approved lenders.

Once you have found an FHA-approved lender, you will need to complete a loan application. The application will ask for basic information about your employment, income, debts and assets. Be sure to have this information handy when you begin the application process.

The lender will also order a credit report and assess your financial history to determine if you are eligible for an FHA loan. If you have any derogatory credit items such as collections, foreclosures or bankruptcies, you may still be eligible for an FHA loan if you can demonstrate that the circumstances leading to the negative credit items are in the past and have been resolved.

What to Expect After Applying for an FHA Loan

If you have bad credit, there are still options for securing an FHA loan. The most important thing is to have a down payment of at least 10 percent of the purchase price of the home. You will also need to show a solid employment history and have a lower debt-to-income ratio. Let’s take a closer look at the process of getting an FHA loan with bad credit.

Wait for Underwriting

After you gather your documents, fill out the loan application form and submit it to your chosen lender, you will then need to wait for underwriting. This is the process in which the lender verifies your information and decides whether or not to approve you for the FHA loan.

During this time, the lender will order a credit report, review your employment history and run a background check. They may also request additional documentation, such as tax returns or bank statements. Once they have all the necessary information, they will make a decision about your loan.

If you are approved for an FHA loan, you will receive a commitment letter from the lender detailing the terms of the loan. At this point, you can proceed with finalizing the loan and buying your new home.

Get Approved for an FHA Loan

If you have bad credit, you may still be able to get approved for an FHA loan. Here’s how the process works:

First, you’ll need to complete a standard loan application. The lender will then pull your credit reports from the three major credit bureaus.

Next, the lender will consider your credit score and history. If you have a history of late payments or bankruptcy, you may still be able to get an FHA loan; however, your interest rates will be higher and you’ll need to put down a larger down payment.

If you’re approved for an FHA loan, the lender will give you a list of conditions that must be met before the loan can be finalized. These conditions may include completing a homeownership counseling course or providing proof of employment.

Once all of the conditions have been met, you’ll sign the final loan documents and close on your new home!

Closing on Your Loan

Now that you have been approved for an FHA loan and know how much you can afford to spend on a new home, it’s time to start shopping for properties. Work with your real estate agent to find a home that meets your needs and is also within your price range. Keep in mind that you will need to get a home appraisal as part of the loan process, so be sure to factor that into your budget.

Once you have found a home that you want to purchase, the next step is to begin the loan process. Your lender will work with you to get all of the paperwork completed and will then send your loan package to the FHA for final approval. Once your loan is approved, you will work with your real estate agent and closing agent on a closing date.

Closing on Your Loan

On closing day, you will sign all of the necessary paperwork for your loan and for the purchase of your new home. Be sure to bring a copy of your ID and any other required documentation with you to closing. Once everything is signed and final, you will be given the keys to your new home!