How to Get an Apartment Without Credit

Contents

- Introduction

- The first step is to start building your credit

- The second step is to find a co-signer

- The third step is to get a secured credit card

- The fourth step is to become an authorized user

- The fifth step is to get a car loan

- The sixth step is to get a personal loan

- The seventh step is to get a student loan

- The eighth step is to get a credit builder loan

- Conclusion

If you’re looking for an apartment but don’t have any credit, don’t worry! There are a few ways you can still get approved. Check out our blog post for more information.

Checkout this video:

Introduction

Nearly half of young adults in the U.S. don’t have credit scores, according to a 2017 report from the Consumer Financial Protection Bureau. And that can make it tough to rent an apartment.

Landlords typically check credit scores as part of their screening process for tenants. A low score may lead a landlord to believe you’re a higher risk for not paying rent on time or damaging the property, which could result in a rejection of your application.

Fortunately, there are a few things you can do if you’re looking to rent an apartment but don’t have a credit score. Here are four tips:

1. Get a cosigner

If you can find someone with good credit who is willing to sign your lease with you, that may help increase your chances of being approved for an apartment. The cosigner would be responsible for paying rent if you were to default on the lease, so it’s important to choose someone you trust and who is financially stable.

2. Pay more upfront

Paying a larger security deposit or the first and last month’s rent upfront may help convince a landlord to approve your application even if you don’t have a credit score. This shows that you have the financial means to cover your rental payments even if something unexpected comes up.

3. Offer references

If you have rental references from previous landlords or roommates, be sure to include them with your application. These references can vouch for your character and rental history, which may help fill in some of the gaps for landlords who are missing information about you due to your lack of credit history.

4. Get creative

There may be other ways to show a landlord that you’re responsible and capable of making timely rental payments even without a credit score. This could include providing bank statements or pay stubs to demonstrate your income and financial stability, or offering character references from people who know you well and can attest to your good character.

The first step is to start building your credit

The first step is to start building your credit. You can do this by paying your bills on time, maintaining a good credit score, and using a credit monitoring service. Once you have established good credit, you can apply for an apartment with confidence.

The second step is to find a co-signer

A co-signer is someone who agrees to take financial responsibility for your apartment along with you. This means that if you can’t make your rent payments, they will step in and cover them. Most landlords will require a co-signer if you don’t have credit, so this is an important step in getting an apartment without credit.

There are a few things to keep in mind when finding a co-signer:

-They should have good credit: This is the whole reason you need a co-signer in the first place, so their credit needs to be good enough to offset your lack of credit.

-They should be employed: Again, this person is essentially taking on part of your financial responsibility, so they need to be in a good position to do so.

-They should be reliable: You need to be able to trust this person to make your rent payments if you can’t. Make sure you choose someone who is responsible and reliable.

The third step is to get a secured credit card

A secured credit card is a type of credit card that is backed by a security deposit. The deposit is usually equal to the credit limit on the card, which means that if you deposit $200, you’ll have a $200 credit limit. Secured cards are an option for people with bad credit or no credit history because they’re less risky for issuers.

To get a secured credit card, you’ll need to open an account with a bank or credit union and make a deposit. Once your account is open and the deposit is made, you’ll be able to use your card just like any other credit card. You’ll need to make timely payments and keep your balance below your credit limit to avoid fees and maintain a good Credit score.

One way to establish credit without taking on debt is to become an authorized user on someone else’s credit card. As an authorized user, you’ll have access to the account and can use it just like the primary cardholder. But because you’re not legally responsible for the debt, there’s no risk involved.

The primary cardholder will need to contact the credit card issuer and add you to the account. Once you’re added, you should start seeing activity on your credit reports within 30 to 60 days. And as long as the account is in good standing, that positive activity will help boost your scores.

The fifth step is to get a car loan

If you don’t have any credit, one way to start building it is to get a car loan. You can get a loan from a bank, credit union, or online lender.

Before you apply, compare rates from several lenders to make sure you’re getting the best deal. Also, ask if the lender reports your payments to the credit bureaus. This can help you build your credit if the lender reports to at least one of the major credit bureaus.

If you have a cosigner with good credit, you may be able to get a lower interest rate on your loan. And if you make your payments on time and keep your balance low, you can help build your credit so you can eventually qualify for an apartment on your own.

The sixth step is to get a personal loan

If you don’t have any credit, one option is to get a personal loan from a lender that doesn’t use traditional credit reports, such as a community bank or a credit union. Personal loans can be used for many purposes, including moving expenses, rent deposits, and first and last month’s rent. When you apply for a personal loan, the lender will look at factors such as your employment history and income to decide whether or not to approve you.

The seventh step is to get a student loan

To get an apartment without credit, the seventh step is to get a student loan. This is an option for those who are attending college or university. The student loan will help cover the cost of renting an apartment, and it will also help boost your credit score.

The eighth step is to get a credit builder loan

Step 1:Pay Your Bills on Time

One of the most important things you can do to improve your credit score is to pay all of your bills on time. This includes rent, utilities, credit cards, and any other type of bill you have. If you can’t afford to pay all of your bills on time, try to at least make the minimum payments.

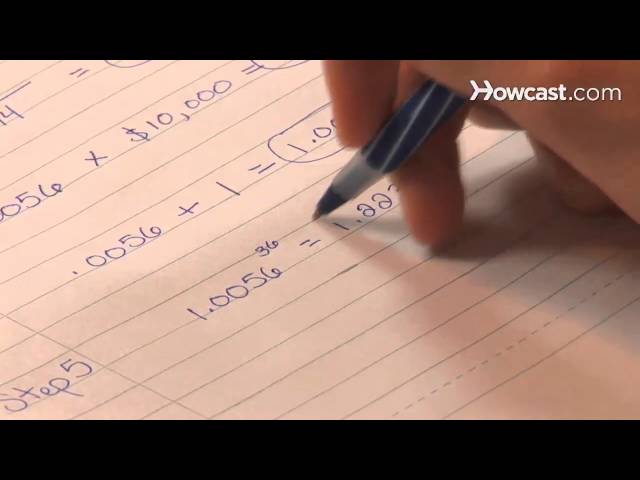

Step 2: Keep Your Balances Low

Your credit utilization ratio is the amount of credit you’re using compared to the amount of credit you have available. For example, if you have a $1,000 credit limit and you’re using $500 of that credit, your credit utilization ratio is 50%. The lower your credit utilization ratio, the better it is for your credit score.

Step 3: Use a Credit Monitoring Service

There are a number of different credit monitoring services that can help you keep track of your credit score and report any changes. This can be helpful in spotting any potential identity theft or fraud.

Step 4: Monitor Your Credit Report for Errors

It’s important to monitor your credit report for errors or inaccuracies. You can get a free copy of your credit report from each of the three major credit bureaus every year at AnnualCreditReport.com. If you spot an error on your report, you can file a dispute with the respective bureau.

Step 5: Get a Secured Credit Card

A secured credit card is a good option for people with bad or no credit because it requires a security deposit, which acts as collateral for the issuer in case you default on your payments. This deposit also usually serves as your credit limit, so it’s important to choose an amount that you can comfortably afford to pay back each month. Once you’ve established a good payment history with a secured card, you may be able to transition to an unsecured card down the road.

Step 6: Become an Authorized User on Someone Else’s Credit Card

If someone with good or excellentcredit agrees to add you as an authorized user on their account, their positive payment history will become part of yourcredit profile. Just make sure that the primary cardholder pays their bills on time and keeps their balances low so that their good behavior rubs off on you!

Step 7: Use a Cosigner

If you need help qualifying for an apartment or rental home, consider finding someone who is willing and able to cosign for you. A cosigner agreesto be responsible for making sure that rent is paid ifyou default on payments. This option may be difficultto find depending on your situation and relationshipswith others, but it’s worth considering if it’s anoption for you.

Conclusion

There are a few options available to those looking for an apartment without credit. The first is to find a co-signer who is willing to sign the lease with you. This person will be held responsible for rent if you are unable to pay, so it is important to choose someone you trust.

Another option is to find a landlord who is willing to rent to you without a credit check. This may be difficult, but it is possible if you are persistent. You can also try looking for apartments in smaller towns or cities, as they may be more likely to rent to someone without credit.

Whatever option you choose, remember that it is important to be honest with your landlord about your credit situation. Lying on your application is never a good idea, and it may lead to problems down the road. Be upfront and honest, and you should be able to find an apartment even without credit.