How to Get a Loan with No Income

Contents

Wondering how to get a loan with no income? It may not be as difficult as you think. Find out what options are available to you.

Checkout this video:

Introduction

There are a few ways to get a loan when you don’t have income. One way is to get a co- signer. Another way is to find a lender who uses alternative income documentation. Read on for more information about how to get a loan with no income.

What You Need to Know About No Income Loans

No income loans are designed for people who are employed but do not have a regular income. This type of loan can be useful for people who are self-employed, commission-based, or have a seasonal job. The main advantage of this type of loan is that you can get the money you need without having to prove your income. However, there are a few things you should know before you apply for a no income loan.

The Different Types of No Income Loans

There are a few different types of loans that you can apply for if you don’t have a steady income. The first is an unsecured personal loan, which doesn’t require any collateral. These loans are typically available from banks and credit unions, and you can use the money for anything you want.

The second type of loan is a secured personal loan, which uses something you own as collateral. The most common type of secured loan is a home equity loan, which uses your home as collateral. If you default on the loan, the lender can foreclose on your home. You can also use other assets, such as a car or savings account, as collateral.

The third type of loan is a payday loan, which is a short-term loan with high interest rates. Payday loans should only be used as a last resort, as they can trap you in a cycle of debt.

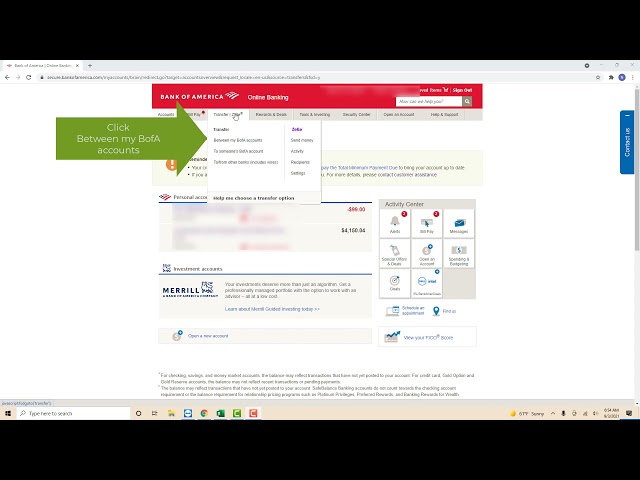

If you’re self-employed or have an erratic income, you might also consider an alternative payment option such as a debit card or prepaid card. These cards let you spend only what you have deposited into the account, so there’s no danger of overspending or accruing debt.

The Pros and Cons of No Income Loans

No income loans are a great way to get financing for a major purchase or project without having to prove your income. However, these loans come with both advantages and disadvantages that you should be aware of before taking one out.

The biggest advantage of a no income loan is that you don’t have to prove your income in order to get financing. This can be helpful if you’re self-employed or have other sources of income that are difficult to document.

The downside of no income loans is that they often come with higher interest rates and shorter repayment terms than traditional loans. This means that you could end up paying more in interest over the life of the loan. Additionally, defaulting on a no income loan can damage your credit score more severely than defaulting on a traditional loan.

Before taking out a no income loan, make sure you understand the risks and terms associated with these types of loans.

How to Get a Loan with No Income

The first step is to fill out a loan application. Be sure to list all sources of income, even if it is not from employment. Include money from investments, child support, alimony, social security, disability, and any other reliable sources. After the application is complete, the lender will review it and make a decision.

Find a Lender That Offers No Income Loans

There are a few different lenders that may offer you a loan even if you don’t have any income to show. Here are some of the best options to consider:

1. Avant: Avant is a great option for people with no income who are looking for a personal loan. The lender offers loans of up to $35,000 with flexible repayment terms ranging from 24 to 60 months. You can check your rate on Avant without affecting your credit score, and the lender offers pre-qualification so you can see what kind of loan you’re likely to be approved for.

2. OneMain Financial: OneMain Financial offers personal loans of up to $20,000 with repayment terms as long as 60 months. OneMain financial has more than 1,600 branch locations across 44 states, so it’s likely that there’s a location near you. You can check your rate on a OneMain Financial personal loan without affecting your credit score.

3. Marcus by Goldman Sachs: Marcus by Goldman Sachs offers loans of up to $40,000 with repayment terms ranging from 36 to 72 months. The lender does not have any origination fees or prepayment penalties, and you can check your rate on a Marcus personal loan without affecting your credit score. Marcus also offers access to free financial tools and resources to help you manage your finances.

4. Peerform: Peerform is a peer-to-peer lending platform that offers loans of up to $25,000 with repayment terms of up to three years. With Peerform, you can check your rate without affecting your credit score, and the platform doesn’t have any origination fees or prepayment penalties.

Gather the Required Documentation

In order to get a loan with no income, you will need to provide some documentation to prove that you have the means to repay the loan. This can include asset documentation, such as stock portfolios or property deeds, as well as bank statements and tax returns. You may also need proof of employment, such as pay stubs or a letter from your employer. If you are self-employed, you will need to provide even more documentation, such as financial statements and business licenses. Once you have gathered all of the required documentation, you can begin shopping around for lenders who may be willing to give you a loan with no income.

Apply for the Loan

There are a few ways that you can apply for a loan with no income. One way is to go through a private lender. There are many private lenders who are willing to give loans to people without a regular income, as long as they have some sort of collateral. Another way is to go through the government. The government offers many programs that give loans to people without a regular income. These programs usually have very low interest rates and long repayment terms.

Conclusion

There are a few ways that you can get a loan with no income. You can use collateral, find a cosigner, or get a no income verification loan. It’s important to remember that getting a loan with no income comes with some risks, so make sure you weigh your options carefully before you decide to go this route.