How to Get a Loan for Buying a Business

Contents

It can be difficult to obtain a loan for buying a business. However, by following these best practices, you can increase your chances of getting the loan you need.

Checkout this video:

Introduction

There are a number of ways to finance the purchase of a business. One option is to take out a loan. This can be a good option if you have the necessary collateral and a good credit history. However, it is important to be aware of the risks involved in taking out a loan to buy a business. In this article, we will discuss some of the things you should consider before taking out a loan to finance the purchase of a business.

Before taking out a loan to finance the purchase of a business, there are a few things you should consider. First, you need to make sure that you have the necessary collateral. This includes things like property or equipment that can be used as collateral for the loan. If you do not have collateral, you may still be able to get a loan, but it will likely have a higher interest rate.

Another thing to consider is your credit history. If you have bad credit, it may be difficult to get a loan with favorable terms. However, if you have good credit, you should be able to get a lower interest rate on your loan.

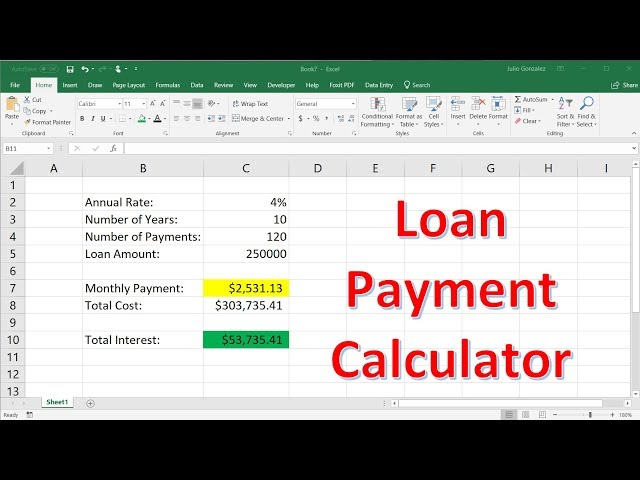

Another factor to consider is the amount of money you need to borrow. You should only borrow as much money as you need for the purchase price of the business. Be sure to factor in any other costs associated with buying the business, such as closing costs and fees associated with loans.

When taking out a loan to finance the purchase of a business, it is important to shop around for the best deal. There are many lenders who offer loans for businesses, so be sure to compare interest rates and terms before choosing one. You should also make sure that you understand all of the fees associated with taking out a loan before signing any paperwork.

How to Get a Loan for Buying a Business

Applying for a loan to buy a business can be a daunting task, but it doesn’t have to be. There are a few things you can do to increase your chances of being approved for a loan. First, you need to have a good credit score. Second, you need to have a strong business plan. Third, you need to show the lender that you have the financial ability to repay the loan.

SBA Loans

Small business loans from the Small Business Administration (SBA) can be a great option for business owners who are looking to buy an existing business. SBA loans are government-backed loans that are available through participating lenders, and they can offer some advantages over other types of financing.

One of the biggest advantages of an SBA loan is that they can offer very attractive terms, including low down payments and long repayment terms. SBA loans can also be used for a wide variety of purposes, including purchasing an existing business, refinancing existing business debt, or even expanding your business.

Another advantage of an SBA loan is that they are typically easier to qualify for than other types of financing. This is because the SBA guarantees a portion of the loan, which reduces the risk for the lender and makes it more likely that you will be approved for the loan.

If you are interested in applying for an SBA loan to buy a business, there are a few things you should keep in mind. First, you will need to have a strong business plan and financials in order to qualify. Second, you will need to work with a participating lender in order to apply for the loan. Lastly, the process can take several weeks or even months from start to finish, so be sure to factor that into your timeline.

Business Credit Cards

There are a few different options when it comes to business credit cards. The best option for you will depend on your business’s needs and your credit score.

One option is to get a business credit card with rewards. This can be a good option if you travel frequently for business or if you have a lot of business expenses that you can put on the card. Just be sure that you are able to pay off the balance in full each month, as the interest rates on business credit cards can be high.

Another option is to get a business credit card with 0% APR for an introductory period. This can be a good option if you need to make a large purchase for your business or if you need to carry a balance for a short period of time. Just be sure that you pay off the balance before the intro period ends, as the interest rates after the intro period can be high.

If your business has been in operation for at least two years, you may be able to qualify for a traditional business loan from a bank or other financial institution. The rates and terms of these loans will vary based on your credit score and the financial strength of your business, but they can provide you with the funds you need for major purchases or expansions.

Traditional Bank Loans

Most banks will require that you have at least 20% equity in the business, which means that you will need to have a down payment of at least 20%. If you do not have the cash on hand to make a 20% down payment, you may still be able to get a loan from a bank, but it will likely come with a higher interest rate.

In addition to equity, banks will also look at your credit score and your ability to repay the loan. If you have a strong credit score and a solid business plan, you should be able to get a traditional bank loan.

Conclusion

If you’re interested in buying a business, you may need to take out a loan to finance the purchase. There are a few things you should keep in mind when considering a loan for this purpose.

First, you’ll need to have a good credit score in order to qualify for a loan. Lenders will also want to see that you have some experience running a business, as this will give them confidence that you’ll be able to make the payments on the loan.

You’ll also need to come up with a down payment for the loan. This is typically 20% of the purchase price of the business. For example, if you’re interested in buying a business that costs $100,000, you would need to come up with a down payment of $20,000.

Once you’ve considered these factors, you should start shopping around for loans from different lenders. Be sure to compare interest rates and terms before selecting a loan. With careful planning and consideration, taking out a loan to buy a business can be a great way to finance your purchase.