How to Get a Credit Score of 750

Contents

If you’re looking to get a credit score of 750 or above, there are a few things you can do to help improve your chances. Here are a few tips to get you started.

Checkout this video:

Know the credit score range

A credit score is a number that creditors use to help them decide whether to give you credit. The FICO credit score range is 300 to 850. An excellent credit score is anything above 750. A good credit score is from 700 to 749, a fair credit score is from 650 to 699, and a poor credit score is from 300 to 649.

Find out your credit score

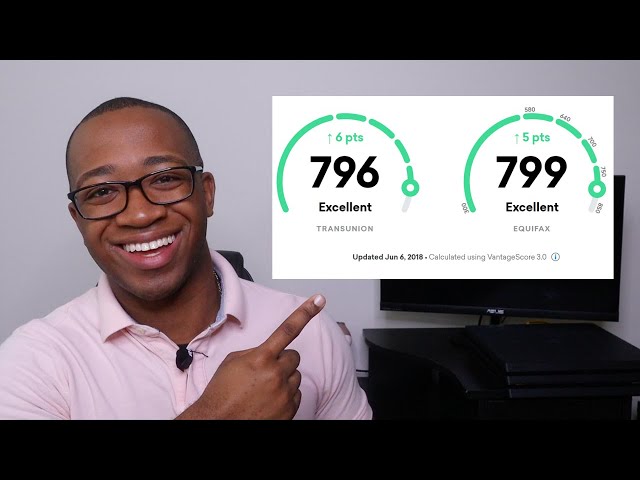

There are many ways to get your credit score. You can check your credit report from each of the three major credit bureaus – Equifax, Experian and TransUnion – for free once a year at AnnualCreditReport.com. You can also get your credit score from some credit card issuers and from personal finance websites, such as Credit Karma and Quizzle. The methods used to calculate your credit score can vary, so you might get slightly different scores from each source.

Most lenders use the FICO score, which is developed by Fair Isaac Corporation. Your FICO score is based on the information in your credit reports from the three major credit bureaus – Equifax, Experian and TransUnion. The information used to calculate your FICO score includes:

-Payment history (35%)

-Amounts owed (30%)

-Length of credit history (15%)

-Credit mix (10%)

-New credit (10%)

Your payment history is the most important factor in your FICO score, so it’s important to pay all your bills on time, every time.Your FICO score ranges from 300 to 850, and the higher your score, the better. A good FICO score is 700 or above. If your score is below 600, you have some work to do before you can qualify for a loan or a credit card with favorable terms.

Understand what the score means

Credit scores are not static; they can change as your credit report is updated with new information. A higher score indicates less risk, and lending institutions may be more likely to approve a loan or extend credit to you if your score is high. Conversely, a lower score may indicate that you’re a higher-risk borrower and that you’ll be charged a higher interest rate for loans.

The most common scoring model is the FICO® Score, which ranges from 300 to 850. Many credit cards and lenders use the FICO® Score when considering applicants, so it’s a good idea to understand where you stand in relation to this scale. Here’s a breakdown of what each credit score range means:

300-579: Poor

580-669: Fair

670-739: Good

740-799: Very Good

800-850: Excellent

Know what goes into a credit score

A credit score is a number that lenders use to decide how likely it is that they will be repaid on time if they lend you money. The higher your credit score, the more likely you are to be approved for a loan with a low interest rate. A credit score of 750 is very good.

Payment history

One of the most important factors in your credit score is your payment history. Lenders want to see that you have a history of making on-time payments, and late or missed payments can have a significant negative impact on your score.

Your payment history makes up 35% of your credit score, so it’s important to make sure you’re always paying your bills on time. If you have trouble doing this, you may want to set up automatic payments from your bank account so you never have to worry about forgetting a payment.

Other factors that make up your credit score include the types of credit you have (10%), the amount of debt you owe (30%), the length of your credit history (15%), and any new credit inquiries (10%).

Amounts owed

One of the most important factors in your credit score is how much you owe compared to your credit limits—that’s your credit utilization ratio. It’s generally best to keep your ratio below 30% of each credit limit (10% is even better). So, for example, if you have a $1,000 limit on a card, you’d ideally want to keep your balance below $300.

Length of credit history

One of the most important factors in your credit score is your length of credit history — in other words, how long you’ve been using credit.

Lenders like to see a long history of on-time payments, so a longer credit history will usually result in a higher score. If you have a shorter credit history, there are still things you can do to improve your score. For example, you can make sure you make all your payments on time and keep your balances low.

The length of your credit history makes up 15% of your FICO® Score, so it’s important to know where you stand.

Types of credit used

There are many factors that go into a credit score, but one of the most important is the types of credit used. A mix of different types of credit can help boost your score, so it’s important to know the difference between them.

There are two main types of credit: revolving and installment.

Revolving credit is a type of credit that allows you to borrow money up to a certain limit and then pay it back over time. The limit is typically determined by the issuer, and you can usually choose to make minimum payments or pay off your balance in full each month. Credit cards are the most common type of revolving credit.

Installment credit is a type of credit that requires you to make fixed payments over a set period of time. Personal loans, student loans, and car loans are all examples of installment credit. The term of the loan, interest rate, and monthly payment amount are all determined in advance.

Take steps to improve your credit score

A credit score of 750 or higher is considered excellent by most lenders. If your score is lower than that, there’s still room for improvement. Follow the steps below to get your score into the excellent range. With a little time and effort, you can enjoy the benefits of having a great credit score.

Check for errors on your credit report

The first step is to check your credit report for errors. You’re entitled to a free copy of your credit report from each of the three major credit bureaus every 12 months. You can get them at AnnualCreditReport.com. Review your reports carefully and dispute any errors you find with the appropriate bureau.

It’s important to catch errors early because they could drag down your score for months or even years if you don’t take action. In addition to checking for errors, also take this opportunity to look for signs of fraud, such as accounts you don’t recognize.

Make payments on time

One of the most important things you can do to improve your credit score is to pay your bills on time. Payment history is one of the biggest factors in your credit score, so it’s important to make sure you’re always making at least the minimum payment on all of your bills. You can set up automatic payments for many bills, which will help you stay on top of your payments and avoid late fees.

Pay down your debts

One of the biggest factors in your credit score is how much debt you owe. If you’re carrying a lot of debt, it’s going to drag down your score. The best way to improve your credit score in this area is by paying down your debts.

The best way to do this is to focus on your debts with the highest interest rates first. This will save you the most money in the long run. You should also make sure that you’re making more than the minimum payments on all of your debts.

If you can’t afford to pay down your debts, you may want to consider consolidating them with a personal loan or a balance transfer credit card. This can help you get a lower interest rate and make it easier to pay off your debt.

Use credit wisely

You’ve probably heard the advice before: use credit wisely. But what does that really mean? Here are a few things you can do to make sure you’re using credit in a way that will help, not hurt, your credit score:

-Keep your balances low. The amount of debt you have is one factor that affects your credit score, so it’s important to keep your balances low. Aim for using no more than 30% of your available credit at any given time.

-Pay your bills on time. This one is important! Your payment history makes up 35% of your credit score, so it’s crucial to always make your payments on time. Missing even one payment can negatively impact your score.

-Don’t open a bunch of new accounts at once. When you open a new credit account, it can temporarily lower your credit score. So if you’re planning on applying for a loan or another type of credit in the near future, you may want to hold off on opening any new lines of credit.

following these tips can help you use credit wisely and improve your credit score over time.

Monitor your credit score

If you’re looking to improve your credit score, the first step is monitoring your credit report. This will give you an idea of where you stand and what areas you need to work on. You can get a free copy of your credit report from annualcreditreport.com. Once you have your report, take a close look at it to see if there are any errors. If you find any, dispute them with the credit bureau.

Check your credit report regularly

You can get a free copy of your credit report from each of the three major credit bureaus (Experian, TransUnion and Equifax) once every 12 months at AnnualCreditReport.com. Reviewing your report regularly is the best way to catch errors and identify potential signs of identity theft.

If you see something on your report that doesn’t look right, you can dispute it by following the instructions on the report. You should also keep an eye out for any red flags that could indicate identity theft, such as accounts you didn’t open or suspicious activity on existing accounts.

Check your credit score regularly

You should check your credit score regularly to ensure that it is accurate and up to date. You can get a free credit report from each of the three major credit bureaus once every 12 months. However, you may want to check your credit score more often if you are planning on making a major purchase, such as a home or a car.

If you find that your credit score is not where you want it to be, there are steps you can take to improve it. One of the best things you can do is to make sure that you make all of your payments on time and in full. You should also try to keep your balances as low as possible. If you have any outstanding debt, consider making a plan to pay it off as quickly as possible.

In general, it is a good idea to keep an eye on your credit score so that you can be aware of any changes and take steps to improve it if necessary.