How to Get a College Loan

Contents

If you’re looking for information on how to get a college loan, you’ve come to the right place. This blog post will provide you with everything you need to know about securing financing for your education. We’ll cover the different types of loans available, how to apply for them, and what to do if you’re having trouble getting approved. By the end of this post, you’ll be armed with the knowledge you need to get the money you need for college. Let’s get started

Checkout this video:

Introduction

There are a few different ways to get a college loan. You can take out a federal student loan, a private student loan, or you can get a loan from your school.

Federal student loans are loans that are backed by the government. These loans have fixed interest rates and you don’t have to start paying them back until after you graduate. Private student loans are loans that are not backed by the government. They have variable interest rates and you have to start paying them back right away.

Most schools have their own financial aid office that can help you with getting a loan. They will also have information on scholarships and grants that you may be eligible for. You can also find information on how to get a college loan on the websites of the Department of Education and the Federal Student Aid website.

How to Get a College Loan

If you’re looking for information on how to get a college loan, you’ve come to the right place. This guide will provide you with everything you need to know about taking out a loan for college, including how to apply for a loan, how to qualify, and what you can expect.

Fill out the FAFSA

One of the best ways to get a college loan is to fill out the FAFSA. The FAFSA is the Free Application for Federal Student Aid. It is a form that you fill out that is used to determine your eligibility for federal student aid. The FAFSA is also used to determine your eligibility for state and school aid. You can fill out the FAFSA online at fafsa.ed.gov.

Compare federal and private loans

There are two main types of college loans: federal and private. Federal loans are made by the government and typically have lower interest rates and more flexible repayment terms than private loans. Private loans are made by banks, credit unions, and other financial institutions, and they may have higher interest rates and less flexible repayment terms than federal loans.

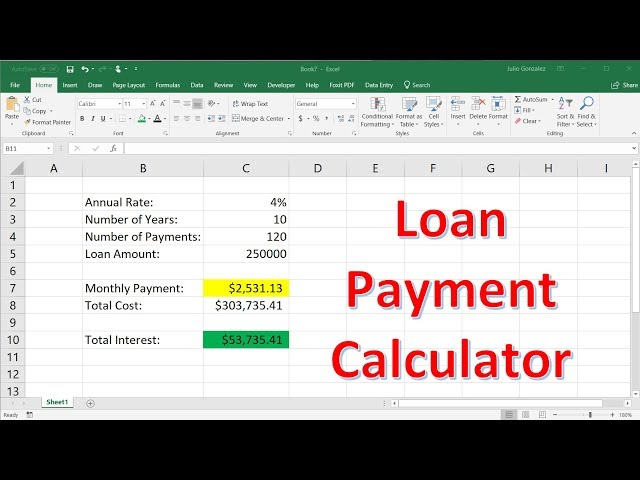

The best way to compare federal and private loans is to use a loan calculator. This will help you see how much you would need to borrow, what your monthly payments would be, and how long it would take you to pay off the loan.

Consider other financing options

In addition to government loans, there are other options to consider when financing your college education. Private loans, scholarships, and grants are all potential sources of funding that can help you pay for school.

Private loans are typically offered by banks or other financial institutions and are not backed by the government. These loans often have higher interest rates than federal loans, so it’s important to compare options carefully before taking out a private loan.

Scholarships and grants are two other types of financial aid that can help you pay for college. Unlike loans, scholarships and grants do not have to be repaid. Scholarships are typically awarded based on academic merit or other achievements, while grants are typically need-based.

When considering how to finance your college education, it’s important to explore all of your options and choose the option that best suits your needs.

Conclusion

There are a few things to keep in mind when you’re looking for a college loan. First, shop around and compare interest rates. Second, make sure you understand the repayment terms and conditions. And finally, remember to factor in the impact of loan fees when you’re calculating your total costs.

With these tips in mind, you should be able to find a college loan that meets your needs and helps you finance your education.