How to Get a Business Credit Card

Contents

Get tips for how to get a business credit card , including what to look for and how to use it wisely.

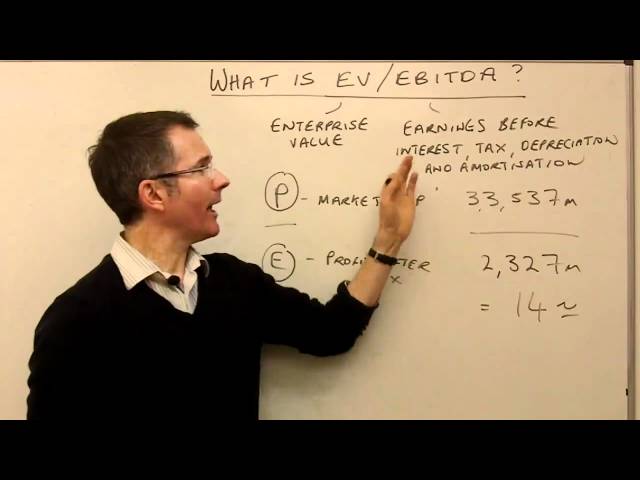

Checkout this video:

Why get a business credit card?

A business credit card can be a great tool for managing business expenses and can even help you earn rewards for your spending. If you are a small business owner, a business credit card can help you manage your cash flow and keep track of business expenses. Let’s take a look at some of the other benefits of getting a business credit card.

Build business credit

Building business credit can be important for several reasons. First, it can help you get approved for loans and lines of credit in the future. Lenders often look at business credit when considering a loan application, so it’s helpful to have a strong business credit score. Additionally, building business credit can help you get better terms on loans and lines of credit. Lenders may be more likely to offer favorable terms to businesses with strong credit scores.

Business credit can also help you manage your cash flow. For example, if you have a business credit card with a high limit, you may be able to use it to make large purchases when cash is tight. This can help you avoid taking out a short-term loan or using personal funds for business purposes.

Finally, having strong business credit can be helpful if your business is ever in financial difficulty. If your company experiences financial difficulties, lenders may be more willing to work with you if you have strong business credit. This may include extending the terms of your loans or offering more favorable interest rates.

Get rewards and perks

When you use a business credit card for your business spending, you can earn rewards like cash back or points that you can redeem for travel. You may also get other perks, like extended warranties on purchases and free employee cards.

A business credit card can also help you keep track of your business expenses. Most cards come with free online tools that let you track and categorize your spending. And at tax time, it can be easier to file your taxes if you have all your business expenses in one place.

How to get a business credit card

Small business owners often need access to business credit to help with cash flow or to make large purchases. But good business credit can be hard to come by, especially for new businesses. A business credit card can be a helpful tool in building business credit. Let’s explore how to get a business credit card and some of the best options out there.

Check if you’re eligible

The first step in getting a business credit card is to check if you’re eligible. You may be eligible if you have a good credit score and a strong business credit history. You can check your credit score for free with a service like Credit Karma.

If you don’t have a strong business credit history, you may still be eligible for a business credit card if you can provide personal guarantees. A personal guarantee means that you’re personally responsible for repaying the debt if your business can’t.

Find the right card for your business

There are a lot of business credit cards out there, and it can be tough to decide which one is right for your business. Do you want a card with cash back rewards or travel points? Should you get a card with 0% APR?

The best way to decide which business credit card is right for you is to first think about what kind of spender you are and what kind of rewards you are looking for. If you are a small business owner who likes to travel, you might want a business credit card that offers travel rewards. Or, if you are a business owner who likes to keep track of your spending, you might want a business credit card with features like transaction tracking and expense reports.

Once you know what kind of spender you are and what kind of rewards you are looking for, it will be much easier to find the right business credit card for your needs.

Apply for a business credit card

When you’re ready to apply for a business credit card, you’ll need to provide some basic information about your business, including your:

-Business name

-Address

-Phone number

-EIN (Employer Identification Number)

You will also need to provide your personal information, including your:

-Name

-Address

-Social security number

-Date of birth

Once you have all of the required information, you can begin the application process. Most business credit card applications can be completed online, and you should receive a decision within a few minutes. If you’re approved, you’ll receive your new business credit card in the mail within a few days.

What to do after you get a business credit card

After you’ve applied and been approved for a business credit card, you’ll need to do a few things to get started. First, you’ll need to activate the card and start using it for your business expenses. You’ll also need to keep track of your spending and make sure you’re paying your bill on time each month. In this section, we’ll cover what you need to do to get started with your new business credit card.

Use it wisely

Now that you have a business credit card, it’s important to use it wisely in order to get the most out of it. Here are a few tips:

* Use your business credit card for business expenses only. This will help you keep track of your spending and ensure that you’re only using your card for things that will benefit your business.

* Pay your balance in full and on time every month. This will help you avoid interest charges and late fees, and it will also help you build a good payment history with your credit card issuer.

* Keep an eye on your credit limit. It’s important to avoid maxing out your credit card, as this can damage your credit score. Try to keep your balance below 30% of your credit limit.

* Review your statement carefully each month. This will help you catch any unauthorized or fraudulent charges, and it will also help you keep track of your spending.

By following these tips, you can make sure that you get the most out of your business credit card and use it in a way that benefits both you and your business.

Monitor your business credit

One of the most important things you can do after you get your business credit card is to monitor your business credit reports. By law, you are entitled to a free credit report from each of the three national credit bureaus every 12 months. You can request your report online at www.annualcreditreport.com.

Checking your report regularly will help you catch errors and identify any potentially fraudulent activity. If you find any incorrect information on your report, you can file a dispute with the credit bureau.

In addition to monitoring your reports, it’s also important to keep an eye on your credit score. Your score is a three-digit number that summarizes your creditworthiness and is used by lenders to determine whether or not to approve you for loans and lines of credit. You can get your score for free from a number of sources, including www.creditkarma.com and www.creditscorecard.com.

Monitoring your business credit is an important part of managing your finances and ensuring the health of your business. By staying on top of your reports and score, you can make sure that you always have access to the capital you need to grow and thrive.

Pay your balance in full and on time

One of the most important things you can do with a business credit card is to pay your balance in full and on time every month. This will help you avoid interest charges and keep your account in good standing. It’s also a good idea to set up automatic payments so you don’t have to worry about missing a payment.

Another important tip is to keep track of your spending. This can be done by creating a budget or tracking your expenses in a spreadsheet. Doing this will help you stay within your credit limit and avoid overspending.

If you do carry a balance on your business credit card, it’s important to make sure you are paying more than the minimum due. This will help you pay off your debt more quickly and avoid paying interest charges.

Finally, remember to use your business credit card responsibly. This means only charging what you can afford to pay back and not using it for personal expenses. By following these tips, you can make the most of your business credit card and keep your finances on track.