How to Get a Bad Credit Auto Loan

Contents

If you have bad credit, you may be wondering how to get a bad credit auto loan. Here are some tips to get you started.

Checkout this video:

Introduction

If you have bad credit, you may still be able to get an auto loan by working with a subprime lender. These lenders work with borrowers who have lower credit scores and may offer higher interest rates and less favorable terms than prime lenders. But by understanding how the process works and preparing in advance, you can get a bad credit auto loan with a car you can afford.

What is a Bad Credit Auto Loan?

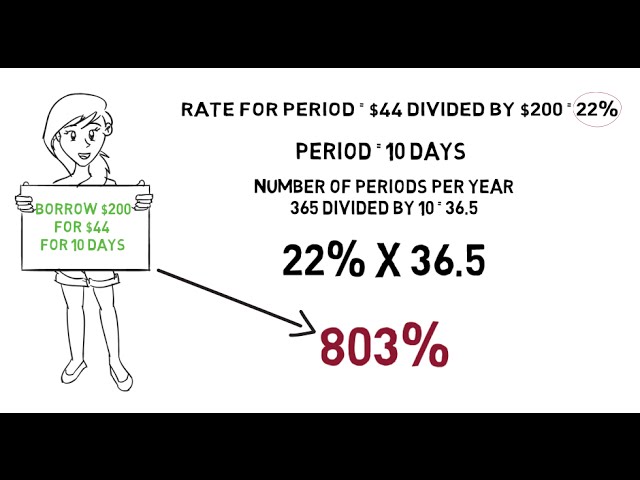

A bad credit auto loan is a loan that is specifically designed for people with bad credit. There are a few different types of bad credit auto loans, but they all have one thing in common: they come with higher interest rates than regular loans.

The interest rate on a bad credit auto loan is important, because it will determine how much you end up paying for your car. In general, the higher the interest rate, the more you will end up paying for your car.

Bad credit auto loans are available from a number of different lenders, including banks, finance companies, and even some dealerships. However, not all lenders offer bad credit auto loans. And of those that do, not all offer them at the same interest rates.

To get the best deal on a bad credit auto loan, it’s important to compare offers from multiple lenders. When you’re comparing offers, be sure to pay attention to the interest rate and the terms of the loan. The terms of a loan include things like the length of the loan (how many months or years you’ll be making payments) and the amount of your down payment.

Once you’ve found a lender who is willing to give you a bad credit auto loan at an affordable interest rate, you can begin the process of applying for the loan. The application process for a bad credit auto loan is similar to the process for any other type of loan. You’ll need to provide some basic information about yourself and your finances, and you may also need to submit some supporting documentation.

Once you’ve been approved for a bad credit auto loan, you can start shopping for your car!

How to Get a Bad Credit Auto Loan

Check your credit score

Your credit score is one of the first things a lender will check when you apply for a loan. A high score indicates to the lender that you’re a low-risk borrower, which could lead to a lower interest rate on your loan. A low score could lead to a higher interest rate and could mean that you won’t be approved for the loan at all.

You can check your credit score for free with many personal finance apps, like Credit Karma or Mint. If you find that your score is lower than you’d like, there are steps you can take to improve it, like paying down debts and maintaining a good payment history.

Find a cosigner

A cosigner is someone who agrees to take on the responsibility of repaying your loan if you can’t or don’t make the payments. Having a cosigner with good credit can greatly increase your chances of getting approved for a bad credit auto loan, as well as help you get a lower interest rate. If you’re considering getting a cosigner, make sure it’s someone you trust and be aware that they’ll be on the hook financially if you miss any payments.

Get pre-approved for a loan

There are a few things you can do to increase your chances of getting approved for a bad credit auto loan. The first is to get pre-approved for a loan. This means that you will fill out an application with a lender and they will give you a decision based on the information you provide. This can help you narrow down your search to lenders who are more likely to approve you.

Another thing you can do is to improve your credit score before you apply for a loan. This means paying down any outstanding debt and making sure that all of your payments are up to date. You can get free copies of your credit report from the three major credit bureaus (Experian, TransUnion, and Equifax) once per year, so be sure to check them before you apply for a loan.

Finally, be sure to shop around for the best rates and terms. Different lenders will offer different rates and terms, so it’s important to compare them before you decide on a loan. Be sure to read the fine print carefully so that you understand all of the fees and charges associated with the loan.

Shop around for the best interest rate

Bad credit doesn’t have to hold you back from getting a loan to buy a car. Here are a few tips on how to get a bad credit auto loan:

-Start by shopping around for the best interest rate.

-Get pre- approved for a loan before you go to the dealership.

-Choose a vehicle that is within your budget.

-Be prepared to make a down payment.

-Have a co- signer ready if you can not get approved for the loan on your own.

Conclusion

If you have bad credit, you may be wondering how you can get an auto loan. While it may be more difficult to get approved for a loan with bad credit, it is not impossible. There are a few things you can do to increase your chances of approval, such as getting a co-signer or applying for a loan through a subprime lender. With some research and effort, you should be able to get the loan you need.