How To Finance Multiple Rental Properties?

Contents

- Can you have 2 primary residences?

- How can I get approved for 2 mortgages?

- How do you own multiple properties?

- What is a blanket loan in real estate?

- Can you buy 2 houses and combine them?

- Can I afford a second property?

- What is the best way to finance a second home?

- What is the debt to income ratio for a second home?

- What is a Brrrr property?

- How do I become a real estate investor with little money?

- How can I make passive income?

- How many properties make a portfolio?

- How can I make my rental portfolio faster?

- How do I build a property portfolio with 100k?

- How many properties can you own?

- What is the 2 out of 5 year rule?

- Can a husband and wife have two separate primary residences?

- How do I avoid capital gains tax on a second property?

- What is a piggyback loan?

- Can I use equity to buy another house?

- What is the difference between a second home and an investment property?

- Conclusion

Similarly, Is having multiple properties a good investment?

Purchasing a property is often seen as a sound investment. Taking it a step further and renting out numerous residences may be a terrific strategy to enhance your assets and generate money.

Also, it is asked, Can I finance 2 homes at once?

However, the quick response is yes with complete seriousness. Many lenders would be pleased to offer you with the money you need if you can afford the down payment and fulfill your lender’s credit score and debt ratio standards.

Secondly, Can I have one mortgage for 2 properties?

Yes, it’s conceivable. It isn’t done very frequently, though, since borrowers seldom find it beneficial and lenders loathe the complexity. The lender in your situation would be combining a home that would be used as a permanent dwelling with a home that will be utilized as an investment.

Also, Can you have 2 mortgages on 2 different properties?

Getting a mortgage on two distinct residences isn’t difficult, but it does need satisfying all of the income and debt requirements. Lenders must be sure that you can afford both homes based on underwriting criteria. Lender approval is also influenced by the timing of the two mortgages.

People also ask, How can I buy multiple properties with no money?

What does it mean to put no money down on a rental property? Make your main property a rental while you look for a new place to live. Use the equity in your house to purchase a rental property. Be a resident as well as a landlord of a multi-unit building. Join forces with a co-borrower. Seek for a lease-to-own option. Assume you already have a mortgage.

Related Questions and Answers

Can you have 2 primary residences?

Increase in the size of the family. If your family has outgrown your present home and the loan-to-value (LTV) ratio is 75 percent or below, you may be qualified for a second main property. If you relocate additional family members in to share expenditures or care for elderly parents, children, or grandkids, this is useful.

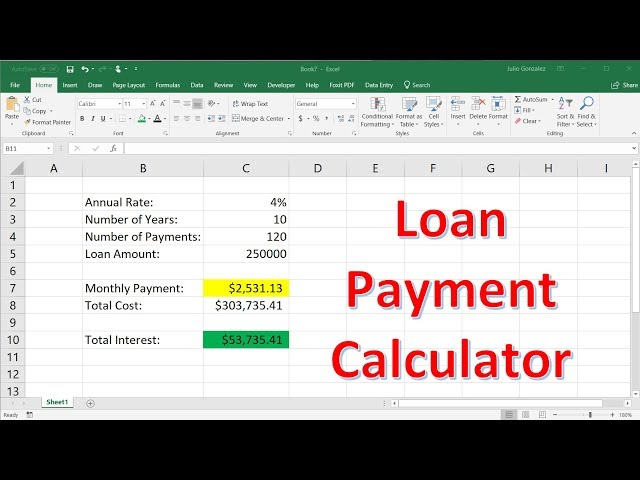

How can I get approved for 2 mortgages?

You’ll most certainly need a credit score of at least 620 to get accepted for a second mortgage, but specific lender requirements may be higher. Also, keep in mind that higher scores correspond to greater rates. You’ll almost certainly require a debt-to-income ratio (DTI) of less than 43 percent.

How do you own multiple properties?

How to Buy Multiple Properties in Real Estate: 10 Expert Tips Purchase at a discount to the market price. Renovations may increase the value of your home. Get your property values checked on a regular basis. Obtain the services of a mortgage broker. Improve your market research skills. Keep up with the latest trends and developments. Wherever feasible, create a positive cash flow.

What is a blanket loan in real estate?

A blanket mortgage is a single loan that covers many properties and uses the assets as security for the loan. Because real estate developers and bigger investors sometimes acquire many properties at once, a blanket mortgage enables them to consolidate those deals into a single loan.

Can you buy 2 houses and combine them?

Is it necessary to get planning clearance to combine two residences into one? Because the majority of the construction is done inside, no planning approval is normally required. However, it’s always a good idea to double-check with your local government. Other important requirements, such as listed building approval, may be communicated to you.

Can I afford a second property?

a borrowing against your home’s equity You may often release up to 80-90 percent of the equity in your home to purchase a second home. On your house loan, you must owe less than 80% of the property value. Your payment history on your mortgage must be flawless.

What is the best way to finance a second home?

The Most Effective Ways to Fund a Second Home Home equity financing is a kind of loan that allows you to borrow money against your home’ Because they provide access to huge quantities of cash at relatively low interest rates, home equity solutions are one of the most popular methods to finance a second property. Reverse mortgage is a kind of loan that allows you to borrow money Cash-Out Refinance is a kind of refinance that allows you to take money out of Assumption of a loan. A 401(k) loan is a kind of retirement savings plan that allows you to borrow money from your

What is the debt to income ratio for a second home?

When buying a second house, the maximum debt-to-income ratio is 45 percent. To buy a second property with this DTI, you’ll probably need offsetting elements like longer months of cash reserves, a bigger down payment, or a better credit score.

What is a Brrrr property?

Share: The BRRRR Method (Buy, Rehab, Rent, Refinance, Repeat) is a real estate investment method that entails flipping distressed property, renting it out, and then cashing out refinancing it to fund other rental property investments.

How do I become a real estate investor with little money?

5 Ways to Get Started in Real Estate Investing with Little or No Money Purchase a house for your main dwelling. Purchase a duplex and live in one while renting out the other. Create a HELOC on your home house or another investment property. Request that the seller cover your closing fees.

How can I make passive income?

Here are a few of the most prevalent techniques for investors to make money passively 10 Ways to Make Money While You Sleep (Passive Income) Stocks that pay dividends. Index funds that pay dividends and exchange-traded funds. Bonds and bond index funds are two types of bonds. Savings accounts with a high rate of return. Property that is rented. Peer-to-peer lending is a kind of lending where people lend to one other. Private equity is a term used to describe a kind of Content.

How many properties make a portfolio?

A portfolio landlord is someone who owns four or more mortgaged properties. If you own three investment properties, you are not a portfolio landlord.

How can I make my rental portfolio faster?

Tips And Hints For Building Your Real Estate Portfolio Begin small. Consider Increasing Your Portfolio in an Exponential Rather Than Linear Way. Learn about the market in your area. Make thorough notes. Investigate Your Financing Alternatives. Numbers are in your blood, and you should be aware of the 1% Rule.

How do I build a property portfolio with 100k?

When it comes to investing your $100,000 in real estate, here are some of our best recommendations for getting the most out of your money: Use your funds to acquire a number of homes. Purchase high-quality real estate in a commuting location. Consider investing in new regions with significant capital growth potential. Increase the size of your portfolio. Make a long-term investment.

How many properties can you own?

According to conventional mortgage standards, you may get a loan if you own up to ten funded properties. Your principal dwelling, as well as residences with owner financing or hard money business loans, are included in this total.

What is the 2 out of 5 year rule?

The two-out-of-five-year rule specifies that you must have resided in your house for at least two of the previous five years prior to the selling date. These two years do not have to be consecutive, and you do not have to be living there at the time of sale.

Can a husband and wife have two separate primary residences?

The IRS is adamant that individuals, even married couples, have just one principal dwelling, referred to as the “main home” by the agency. Your primary house is always the place where you spend the most of your time.

How do I avoid capital gains tax on a second property?

You may be able to decrease your total CGT cost by using Private Residents Relief if you lived in the house for a period of years before renting it out (PRR). Even if the property is leased out, you may claim PRR for the number of years it was your primary residence as well as the final nine months of ownership.

What is a piggyback loan?

A “piggyback” second mortgage is a home equity loan or home equity line of credit (HELOC) taken out simultaneously with your first mortgage. Its goal is to enable borrowers with small down payments to borrow extra funds in order to qualify for a primary mortgage without having to pay private mortgage insurance.

Can I use equity to buy another house?

Yes, if you have enough equity in your present house, you may utilize a home equity loan to make a down payment on a new home—or even purchase it outright without a mortgage.

What is the difference between a second home and an investment property?

A second house is a single-family residence that you plan to live in for at least part of the year or visit often. Typically, investment homes are acquired for the purpose of producing rental revenue and are inhabited for the bulk of the year.

Conclusion

This Video Should Help:

The “how to buy multiple rental properties reddit” is a question that has been asked many times. The article will provide you with the answers on how to finance multiple rental properties.

Related Tags

- How To Finance Multiple Rental Properties? near Minneapolis, MN

- how to buy multiple properties with one mortgage

- how to buy multiple rental properties with little money

- is there a limit to how many rental properties you can own

- rental property financing