How To Finance A Ring?

Contents

- How to finance an engagement ring

- How to finance a wedding ring

- How to finance an eternity ring

- How to finance a ring for an anniversary

- How to finance a ring for a special occasion

- How to finance a ring when you are on a budget

- How to finance a ring if you have bad credit

- How to finance a ring through a layaway plan

- How to finance a ring through a personal loan

- How to finance a ring through a home equity loan

Here are some options for financing a ring, whether it is an engagement ring, wedding ring , or just a ring you fell in love with.

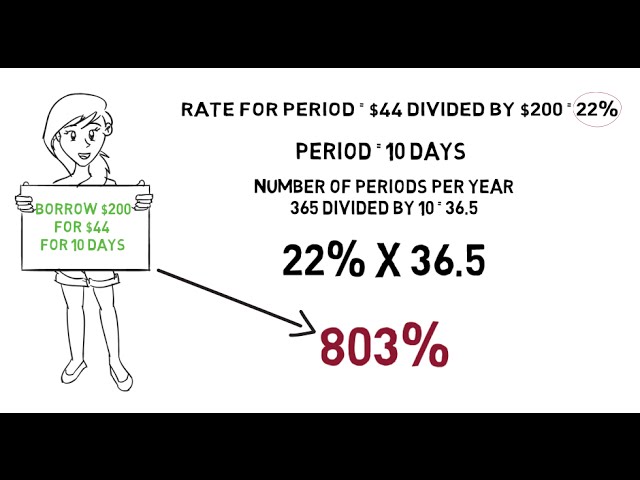

Checkout this video:

How to finance an engagement ring

When you’re in love and ready to propose, you want to give your partner the world. But sometimes, the world (or at least a diamond engagement ring) can be out of your budget. How can you make your proposal dreams a reality?

Here are a few ways to finance an engagement ring:

-Credit cards: Applying for a new credit card with a 0% APR introductory offer can help you finance an engagement ring without accruing any interest. Just make sure you’re able to pay off the balance before the introductory period expires.

-Personal loans: You might be able to qualify for a personal loan with a lower interest rate than a credit card. Plus, you’ll have a set timeline for repayment, which can help you stay on track.

-Home equity line of credit: If you own your home, you could tap into your equity to finance an engagement ring. Just keep in mind that this option comes with some risk — if you can’t make your payments, you could lose your home.

– family member or friend: Borrowing from someone you know comes with its own risks and challenges, but it could be an option worth considering if you have a good relationship and they’re willing to work with you on terms.

No matter how you choose to finance an engagement ring, make sure you do your research and pick the option that makes the most sense for your financial situation.

How to finance a wedding ring

When you’re planning your dream wedding, the last thing you want to worry about is how you’re going to finance it. But if you’re not careful, the cost of the wedding ring can quickly add up. Here are a few tips on how to finance a ring without breaking the bank:

1. Shop around for the best deal. Don’t just go with the first jeweler you find. Do your research and compare prices before making a purchase.

2. Consider financing options. If you can’t afford to pay for the ring outright, there are a number of financing options available. Some jewelers offer interest-free financing for a set period of time, so be sure to ask about this before making your purchase.

3. Put it on layaway. If you need some time to save up for the ring, see if your jeweler offers layaway plans. This way, you can make small payments over time until the ring is paid off in full.

4. negotiate the price. If you’re not comfortable with negotiating, bring along a friend or family member who is. It never hurts to try to get a lower price, especially on something as expensive as a wedding ring

How to finance an eternity ring

Many people choose to finance an eternity ring in order to spread the cost over a longer period of time. This can be a good option if you want to buy a more expensive ring or if you simply want to reduce the monthly cost of your ring. There are a few things to consider before you finance an eternity ring, such as the interest rate, the length of the repayment period and whether you are comfortable with making regular payments. Here are a few tips on how to finance an eternity ring:

1. Talk to your jeweler about financing options. Some jewelers offer financing plans with very low interest rates and flexible repayment terms. This can be a great way to finance an eternity ring without having to pay any interest.

2. Use a credit card with a low interest rate. If you have a credit card with a low interest rate, you may be able to use it to finance your eternity ring. Just be sure that you will be able to make the monthly payments on time and in full, as missed payments can lead to high interest rates and fees.

3. Take out a personal loan. Another option for financing an eternity ring is to take out a personal loan from a bank or credit union. Be sure to shop around for the best interest rates and terms before taking out a loan, as some lenders may offer better deals than others.

4. Save up and pay cash. If you have the patience, another option is to simply save up the money over time and pay for your eternity ring in cash when you are ready to purchase it. This may take longer, but it will allow you to avoid paying any interest on your purchase.

How to finance a ring for an anniversary

When you’re buying an anniversary ring, you may want to finance it. Here are a few tips to help you get the best deal on financing:

-Shop around for the best interest rate. Interest rates on financing deals can vary widely, so it pays to shop around.

-Read the small print. Be sure to understand all the terms and conditions of the financing agreement before you sign anything.

-Build up your credit score. The better your credit score, the more likely you are to qualify for a low-interest loan. You can get a free copy of your credit report from each of the three major credit reporting agencies once a year at AnnualCreditReport.com.

How to finance a ring for a special occasion

There are many ways to finance a ring for a special occasion. The most obvious way is to use credit, which can be a good option if you have good credit and can afford the monthly payments. You can also finance a ring through a personal loan, which may have a lower interest rate than a credit card. Another option is to finance a ring through a jeweler that offers financing, which can be a good option if you have bad credit or cannot afford the monthly payments associated with a personal loan.

How to finance a ring when you are on a budget

When you’re on a budget, the thought of finance can be daunting. But don’t worry, there are options available to help make the process easier. Here are a few tips on how to finance a ring:

– Decide on the style of ring you want. This will help you determine the price range you should be looking at.

– Do your research and compare prices from different jewelers.

– Consider getting a loan from a bank or credit union.

– Use a layaway plan if available.

– Put the ring on a credit card with a low interest rate.

– Look for promotions or discounts that can help reduce the cost of the ring.

How to finance a ring if you have bad credit

There are a few ways to finance a ring if you have bad credit. You can put the ring on Layaway, whereby you make payments over time until the ring is paid off. You can also look for a jeweler that offers in-house financing, which is basically a loan from the jeweler. Another option is to get a personal loan from a bank or credit union. There are also many websites that offer financing for engagement rings, such as www.engagementringsfinance.com. However, if you have bad credit, your best bet is to save up and pay for the ring in cash.

How to finance a ring through a layaway plan

If you’re planning on purchasing a ring, you may be wondering how to finance it. One option is to use a layaway plan. With a layaway plan, you can make payments over time until the purchase price is paid in full. This can be a great option if you need to spread out the cost of the ring over a period of time.

There are a few things to keep in mind if you’re considering using a layaway plan to finance your ring purchase. First, make sure you understand the terms of the plan. Some plans have fees associated with them, so be sure to factor that into your budget. Also, be aware that most layaway plans require that the purchase be paid off within a certain time frame, so be sure you can meet that deadline before you commit to the plan.

If you’re looking for an alternative to traditional financing options, a layaway plan can be a great way to finance your ring purchase. Just be sure to understand the terms and conditions of the plan before you commit to it.

How to finance a ring through a personal loan

There are a few different ways to finance a ring, and taking out a personal loan is one option. Here are a few things to consider if you’re thinking about financing your ring through a personal loan:

– Personal loans can be a good option if you have good credit and can qualify for a low interest rate.

– You’ll need to provide some basic information about yourself and your finances in order to qualify for a personal loan, including your income, employment history, and credit score.

– Personal loans can be used for a variety of purposes, so you’ll need to make sure that you use the loan for the specific purpose of financing your ring.

– You’ll need to make sure that you make your payments on time and in full in order to avoid costly late fees and damage to your credit score.

How to finance a ring through a home equity loan

If you’re planning on financing a ring through a home equity loan, there are a few things you need to know. First, home equity loans usually have lower interest rates than other types of loans, so this can be a good way to save money on the overall cost of the ring. However, you will need to have equity in your home in order to qualify for a home equity loan, so this may not be an option if you’re just starting out. Additionally, home equity loans can come with closing costs and other fees, so be sure to factor those into your budget when considering this option.