How to Change Your Direct Deposit for Child Tax Credit

Contents

- Go to the Internal Revenue Service website.

- Click on the “Get My Payment” tool.

- Enter your personal information, including your Social Security number, date of birth and address.

- Click on the “Update My Payment Method” option.

- Enter your new bank account information, including your routing number and account number.

- Click on the “Submit” button.

Get step-by-step instructions on how to change your direct deposit information for the Canada child tax benefit.

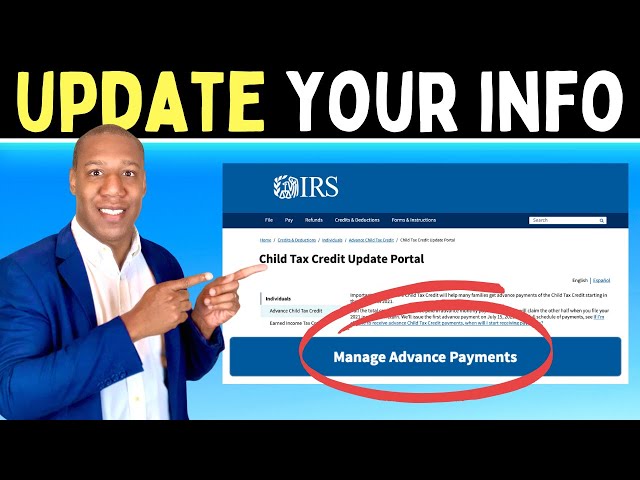

Checkout this video:

Go to the Internal Revenue Service website.

The first step is to go to the Internal Revenue Service website. The address for the website is www.irs.gov. Once you are on the website, look for the section that says “Get My Payment.” Click on that link and then enter your information. The site will ask for your Social Security number, date of birth and mailing address. You will also need to enter the amount of your refund. After you have entered all of your information, click on thesubmit button.

Click on the “Get My Payment” tool.

The Get My Payment tool will allow you to change your direct deposit information if the IRS has your most current contact information on file. To do so:

1. Go to https://www.irs.gov/coronavirus/get-my-payment

2. Enter your Social Security number, date of birth, mailing address and email address

3. Click on the “Get My Payment” button

4. On the next page, click on the “Update my payment method” link under the “Payment Status” section

5. Follow the prompts to provide your new bank account information

Enter your personal information, including your Social Security number, date of birth and address.

To change your direct deposit information, you will need to provide your personal information, including your Social Security number, date of birth and address. You will also need to provide your new bank account number and routing number.

Click on the “Update My Payment Method” option.

If you need to change your direct deposit information for your Child Tax Credit, you can do so by logging into your account on the CRA website. Once you are logged in, click on the “Update My Payment Method” option. From there, you will be able to update your bank account information.

Enter your new bank account information, including your routing number and account number.

If you need to change your direct deposit information for your Child Tax Credit, you’ll need to provide your new bank account information, including your routing number and account number. You can do this by logging in to your online account or by contacting the IRS directly.

Assuming you have already filed your taxes and are expecting a refund, you can change your direct deposit information by logging in to your account on the IRS website. Click on the “Submit” button, then select the “Change my refund” option. From there, you will be able to update your bank account information.