How to Calculate Your Monthly Loan Payment

Contents

How to Calculate Your Monthly Loan Payment. You can use this calculator to figure out your monthly loan payments. Just enter the loan amount, term and interest rate in the fields below and click calculate.

Checkout this video:

Introduction

Calculating your monthly loan payment is an important task when you’re considering a new loan. By knowing how much your payment will be, you can budget accordingly and make sure that you’ll be able to make the payments. Luckily, calculating your monthly loan payment is relatively simple – all you need is some basic information about the loan and a calculator.

How to Calculate Your Monthly Loan Payment

You can use this calculator to calculate your monthly loan payment. You will need to enter the loan amount, the interest rate, and the loan term. The loan payment will be calculated and shown on the screen. This calculator can be used for any type of loan, including a mortgage, car loan, or personal loan.

Determine the loan amount

To calculate your monthly loan payment, you will need to know the following information:

-The amount of money you borrowed (the loan amount)

-The interest rate on your loan

-The number of years you have to repay the loan (the term)

You can use an online calculator, such as the one at Bankrate.com, or do the math yourself.

To calculate your monthly payment by hand, follow these steps:

1. Determine the interest rate on your loan. This is typically given as a percentage, such as 5%.

2. Convert that percentage to a decimal by moving the decimal point two places to the left. In this example, 5% would become 0.05.

3. Multiply the decimal interest rate by the amount of money you borrowed. In this example, if you borrowed $100,000, you would multiply 0.05 by 100,000 to get 5,000.

4. Divide that number by 12 to find the monthly interest charge for your loan. In this example, 5,000 divided by 12 would equal 416.67.

Determine the loan term

The loan term is the length of time you have to repay your loan. The typical personal loan term is two to five years.

Determine the interest rate

The interest rate (also called the “rate of interest”) is the percentage of the principal loan amount that you will pay each year. This rate can be fixed for the life of the loan or variable, meaning it can change over time.

To calculate your monthly loan payment, you will need to know:

– The amount of money you borrowed (principal)

– The length of time you have to pay it back (term in years)

– The interest rate

Calculate the monthly payment

To calculate your monthly loan payment, you will need to know the following information:

-The loan amount

-The interest rate

-The number of years of the loan

Once you have this information, you can use a simple formula to calculate your monthly payment. The formula is as follows:

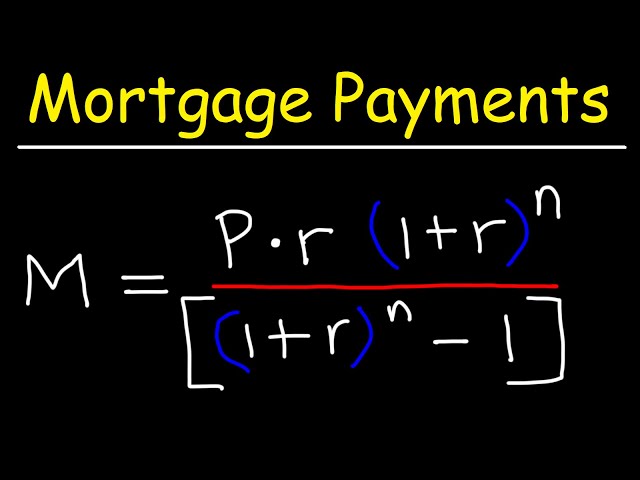

M = L[i(1 + i)n]/[(1 + i)n – 1]

M = monthly payment

L = loan amount

i = interest rate (for example, 0.05 for 5%)

n = number of payments (for example, 60 for a 5-year loan)

Conclusion

To calculate your monthly loan payment, you will need to know the interest rate, the term of the loan, and the amount of the loan. You can use an online calculator to easily calculate your monthly payments.

The interest rate is the cost of borrowing money, and is expressed as a percentage. The term is the length of time you have to repay the loan, and is typically expressed in years. The amount of the loan is the total amount of money you are borrowing.

To calculate your monthly payment, simply divide the interest rate by 12 (to get the monthly interest rate), multiply that by the amount of the loan, and then divide that by the term of the loan. For example, if you had a $10,000 loan with an interest rate of 6%, and a term of 5 years, your monthly payment would be $167.50 ((0.06 / 12) x 10000) / 5).