How to Calculate Home Equity Loan

Contents

How to Calculate Home Equity Loan – A home equity loan is a type of second mortgage. Your first mortgage is the one you used to purchase the property, but you can place additional loans against the home as well if you’ve built up enough equity.

Checkout this video:

What is home equity loan?

A home equity loan is a loan in which the borrower uses the equity of his or her home as collateral. The loan amount is determined by the value of the property, and the value of the property is determined by an appraiser from the lending institution.

How home equity loan work?

A home equity loan is a lump sum of cash that’s essentially borrowed against the equity of a home. Equity is the difference between a home’s appraised value and the outstanding balance of all debts secured by the home, including the current mortgage. When you take out a home equity loan, you receive a lump sum that you repay in fixed monthly payments at a fixed interest rate. Unlike a HELOC, you know exactly how much you’ll need to repay each month for the term of your loan.

How to calculate home equity loan?

A home equity loan is a type of loan in which the borrower uses the equity of his or her home as collateral. The loan amount is determined by the value of the property, and the borrower is usually required to make a down payment equal to a certain percentage of the loan amount. In order to calculate home equity loan, there are a few things you need to know.

The home equity loan calculation formula

To calculate your home equity loan, you will need to know the following information:

-The outstanding balance on your first mortgage

-The appraised value of your home

-The loan to value (LTV) ratio

Once you have this information, you can use the following formula to calculate your home equity loan:

Home Equity Loan = (Appraised Value of Home x Loan to Value Ratio) – Outstanding Balance on First Mortgage

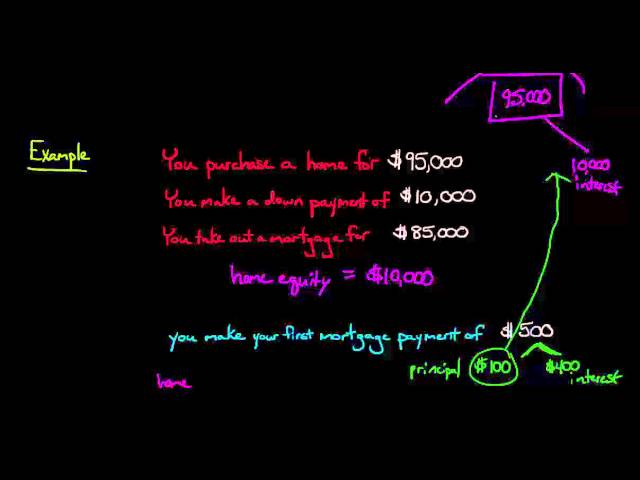

For example, let’s say that you have a $100,000 mortgage on a home that is appraised at $200,000. The LTV ratio is 80%. This means that you can borrow up to 80% of the appraised value of the home. To calculate your home equity loan, you would use the following formula:

Home Equity Loan = ($200,000 x 0.80) – $100,000

Home Equity Loan = $160,000 – $100,000

Home Equity Loan = $60,000

How to use home equity loan calculator?

A home equity loan calculator is a great tool when you are considering taking out a loan against the value of your home. It can help you determine how much equity you have in your home and how much of a loan you could qualify for. It is important to remember that the equity in your home is the difference between the appraised value of your home and the amount you still owe on your mortgage.

Online home equity loan calculator

Our online home equity loan calculator will help you determine how much you can borrow based on the value of your home and your current mortgage balance. Simply enter your information into the calculator and click “Calculate” to see your results.

Keep in mind that this is only a estimation, and the amount you actually qualify for may be different based on a number of factors, including your credit score, employment history and other factors. For more accurate results, please speak to one of our home equity loan specialists.

Phone app home equity loan calculator

If you’re looking for a home equity loan calculator, there are a few different ways to find one. Many banks and financial institutions will have their own online calculators that you can use. You can also find home equity loan calculators offered by third-party websites.

When using a home equity loan calculator, you’ll need to enter some basic information about your home and your finances. This includes the value of your home, the amount of any outstanding mortgage balance, and your current credit score. You’ll also need to specify the loan amount you’re interested in borrowing and the interest rate you expect to pay on the loan.

Once you have all of this information entered into the calculator, it will give you an estimate of how much your monthly payments will be and how much interest you’ll end up paying over the life of the loan. Be sure to compare several different calculators before making a decision about which one to use.

How to get home equity loan?

In order to calculate home equity loan, you need the current market value of your home and the outstanding balance of any debts secured by your home. Once you have this information, you can subtract the outstanding balance of your debt from the market value of your home to get your home equity.

Home equity loan requirements

You can get a home equity loan if you have equity built up in your home. Equity is the portion of your home’s value that you own outright, free and clear. For example, if your home is valued at $250,000 and you owe $150,000 on your mortgage, you have $100,000 in home equity.

In order to qualify for a home equity loan, you’ll need to have a certain amount of equity built up in your home. Lenders typically want to see that you have at least 20% equity in your home before they’ll approve you for a loan. So, if your home is valued at $250,000 and you owe $150,000 on your mortgage, you’ll need to have at least $50,000 in equity built up before most lenders will approve you. That said, there are some lenders that will approve you for a loan with as little as 10-15% equity.

Once you’ve determined how much equity you have in your home, you’ll need to meet some other requirements before being approved for a loan. Most lenders will require that you have a good credit score and a stable income in order to qualify. Additionally, many lenders will only approve loans if the money is being used for specific purposes like paying off debt or making improvements to your home.

Home equity loan process

Most home equity loans follow a similar process. Here’s how it works:

First, you’ll need to figure out how much equity you have in your home. To do this, you’ll need to obtain an appraisal. This is an estimate of your home’s value, which will be used to calculate your loan-to-value ratio (LTV).

Once you have your LTV, you’ll need to shop around for lenders. Be sure to compare interest rates, fees, and terms before choosing a lender.

Once you’ve found a lender you’re comfortable with, you’ll need to apply for the loan. You’ll likely need to provide some financial information, such as your income and debts. The lender will also want to know the value of your home and may request an appraisal.

If you’re approved for the loan, you’ll then need to closing process will typically take place. This is when the paperwork is signed and the loan funds are distributed.