How To Calculate Finance Charges On Past Due Invoices

Contents

- What are finance charges?

- How are finance charges calculated?

- What is the average finance charge?

- How can I avoid finance charges?

- What if I can’t pay my finance charges?

- Can I negotiate my finance charges?

- What are the consequences of not paying finance charges?

- How can I dispute a finance charge?

- What are some tips for managing finance charges?

- Where can I find more information about finance charges?

If you have customers that frequently pay their invoices late, you may want to start charging finance charges. Here’s how to calculate finance charges on past due invoices.

Checkout this video:

What are finance charges?

Finance charges are fees assessed by creditors when an account is delinquent. The amount of the charge is based on the interest rate stated in the account agreement, the outstanding balance, and the number of days the balance is past due. The purpose of finance charges is to compensate the creditor for the loss of use of the funds and to cover administrative costs associated with billing late payments.

Federal law requires that creditors give customers a written notice of their right to avoid finance charges by making at least minimum payments on time. This notice must be provided at least once a year and must be included with any written notice of an increase in the interest rate or other change in terms.

Minimum payments are usually calculated as a percentage of the outstanding balance, plus any fees and finance charges that have accrued. For example, if your outstanding balance is $100 and your minimum payment is 2%, you would owe at least $2 in finance charges if you failed to make a payment by the due date.

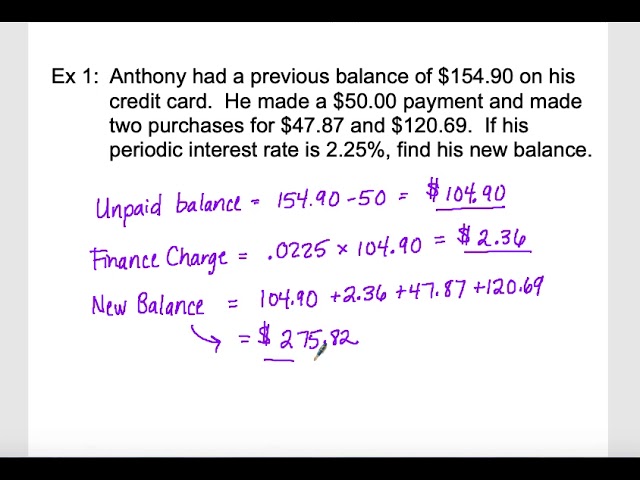

How are finance charges calculated?

Finance charges are calculated using a daily rate, which is then applied to the balance of the invoice. The daily rate is calculated by dividing the monthly interest rate by 30. For example, if the monthly interest rate is 1.5%, the daily rate would be 0.05%.

The following steps are used to calculate finance charges on past due invoices:

1. Determine the monthly interest rate. This is typically stated as a percentage, such as 1.5%.

2. Divide the monthly interest rate by 30 to calculate the daily rate. In our example, 1.5% divided by 30 equals 0.05%.

3. Multiply the number of days that have passed since the invoice was due by the daily rate. In our example, if 45 days have passed since an invoice was due, we would multiply 45 by 0.05% to get 2.25% (45 x 0.05% = 2.25%). This is the finance charge that would be applied to the outstanding balance of the invoice if it were paid today.

What is the average finance charge?

The average finance charge is the amount of interest that you will be charged on a past due invoice. This can be a fixed percentage rate or it may be a variable rate that is based on the prime lending rate. In order to calculate the finance charge, you will need to know the outstanding balance of the invoice and the number of days that it is past due.

How can I avoid finance charges?

You can avoid finance charges on your past due invoices by paying the full amount of the invoice before the late payment date. If you cannot pay the full amount, you can contact the company to arrange a payment plan. Most companies will be willing to work with you to avoid finance charges.

What if I can’t pay my finance charges?

If you can’t pay your finance charges, you may be charged a late fee. The late fee will be added to your balance and will accrue interest at the same rate as your finance charges. If you’re still unable to pay, you may be sent to collections. This will damage your credit score and may result in legal action against you.

Can I negotiate my finance charges?

Finance charges are the cost of borrowing money, and they are typically assessed on a monthly basis. If you have past due invoices, you may be wondering if you can negotiate your finance charges.

The answer to this question depends on your specific situation. If you have already negotiated a lower interest rate with your creditor, then you may be able to negotiate a lower finance charge. However, if you have not already negotiated a lower interest rate, it is unlikely that you will be able to negotiate a lower finance charge.

If you are having difficulty making payments on your past due invoices, you may want to consider consolidating your debt. Debt consolidation can help reduce your monthly payments and make it easier to pay off your debt.

What are the consequences of not paying finance charges?

If you don’t pay finance charges on your past due invoices, you may be subject to late fees, additional interest, and other consequences. Your credit score may also be affected.

How can I dispute a finance charge?

If you believe a finance charge on your past due invoices is incorrect, you can contact the creditor to dispute the charge. According to the Federal Trade Commission, you should do this in writing, and keep a copy of your dispute letter and any enclosures for your records. You can also find sample letters of dispute on the FTC’s website.

What are some tips for managing finance charges?

If you’re a business owner, it’s important to understand how finance charges work. This way, you can better manage your finances and avoid Late payments.

Finance charges are the fees charged by a lender for the use of borrowed money. The charge is generally a percentage of the outstanding balance on an account. For example, if you have an overdue invoices totaling $1,000 and the finance charge is 10%, you’ll owe an additional $100 in finance charges.

There are a few things you can do to avoid or minimize finance charges:

-Keep track of your due dates and make sure you pay your invoices on time.

-If you can’t pay the full amount owed, try to at least make a partial payment. This will reduce the balance on which the finance charges are calculated.

-Some businesses offer discounts for early payments. Take advantage of this if possible.

-If you’re having trouble making payments, contact your lender as soon as possible to arrange a payment plan or extend the due date.

Where can I find more information about finance charges?

There is a lot of information available on finance charges, and it can be tricky to know where to start. However, if you want to find out more about how to calculate finance charges on past due invoices, there are a few key resources that can be helpful.

One resource is the Federal Trade Commission’s website. The FTC has a section on their website dedicated to credit and debt, and this includes information on finance charges. Another resource is the Consumer Financial Protection Bureau’s website. The CFPB is a government agency that protects consumers from unfair or deceptive practices, and they have a section on their website devoted to credit and debt issues. Finally, your local library or bookstore may have some helpful books or pamphlets on this topic.