How To Calculate Finance Charge?

Contents

- Is finance charge the same as APR?

- How do you find the finance charge per 100?

- What are some examples of finance charges?

- How do finance charges work?

- How can I avoid paying finance charges on my car?

- What is APR financing?

- How do you calculate finance charges on a past due invoice?

- What is the finance charge on a loan?

- How are loan installments calculated?

- How do you calculate principal and interest payments?

- What is the interest formula?

- Is 1.9 percent interest rate good?

- What is the payment on $45000?

- How does BPI calculate finance charge?

- What is purchase finance charge?

- How does the Rule of 78 work?

- Why are my finance charges so high?

- Is it normal to pay a finance charge on a car loan?

- Is a finance charge a down payment?

- What is 24% APR on a credit card?

- What is 0 APR mean?

- Conclusion

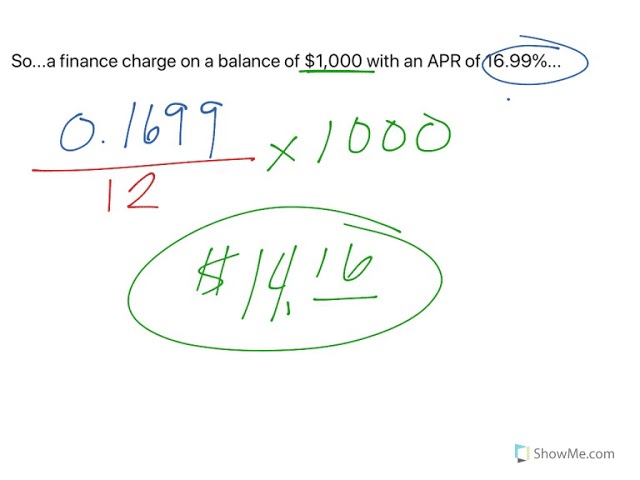

Finance costs differ depending on the sort of loan or credit you have and the organization you are dealing with. Multiplying the average daily amount by the annual percentage rate (APR) and the days in your billing cycle is a popular approach of calculating a financing charge on a credit card. After that, the product is divided by 365.

Similarly, What is the formula for calculating finance charge?

To summarize, the following is the financing charge formula: Finance charge = unpaid balance carried forward * Annual Percentage Rate (APR) / 365 * Billing Cycle Days

Also, it is asked, How do you calculate daily finance charge?

The daily rate, which is 1/365th of your APR, is multiplied by each day’s balance to compute finance costs. In other words, the daily rate is your annual percentage rate divided by 365.

Secondly, How do I calculate the finance charge on a car loan?

Subtract the entire amount of interest, fees, taxes, and charges from the principle (total amount borrowed) on your loan to get your financing costs. Take the monthly payment and multiply it by the number of months left on the loan to obtain a better idea.

Also, What is a typical finance charge?

A typical financing fee, for example, may be 112 percent every month in interest. Finance costs, on the other hand, might range from 1% to 2% to 3% every month. The sums might vary depending on the customer’s size, relationship, and payment history.

People also ask, How do you calculate finance charge in Excel?

The APR, unlike the interest rate, considers the overall finance charge you pay on your loan, including prepaid finance costs such loan fees and interest accrued before your first loan payment. When looking for a loan, make sure you compare the APR of each lender as well as the interest rate.

Related Questions and Answers

Is finance charge the same as APR?

Annual credit card fees, account maintenance costs, late fees paid for making loan or credit card payments beyond the due date, and account transaction fees are examples of financial charges.

How do you find the finance charge per 100?

A financing charge is a cost that you may be obliged to pay on your credit card account, such as interest or other fees. Finance charges are the costs of borrowing money when you use your credit card to make transactions.

What are some examples of finance charges?

How to stay away from financing charges. Paying your payments in whole and on time each month is the easiest way to prevent financing costs. No interest will be charged on your amount if you pay your whole balance during the grace period each month (the time between the end of your billing cycle and the payment due date).

How do finance charges work?

The annual percentage rate (APR) is the total cost of a loan to a borrower, including fees. The APR is stated as a percentage, much like an interest rate. It does, however, contain additional charges or expenses like as mortgage insurance, most closing costs, discount points, and loan origination fees, which are not included in an interest rate.

How can I avoid paying finance charges on my car?

Calculate the amount owed by multiplying it by the daily rate. For example, multiply $200 by 0.06 to obtain a daily financing charge of $1.20 if the consumer owes $200. Charge $1.20 every day for 20 days if the consumer pays late, for a total of $200 + $24 in interest costs.

What is APR financing?

A finance charge is the total amount of interest and loan fees you’ll pay over the course of your mortgage loan’s life. This includes all pre-paid loan expenses and implies you hold the loan until it matures (when the final payment is due). 4 September 2020

How do you calculate finance charges on a past due invoice?

THE APPLICATION OF MATHEMATICAL FORMULAS EMI = [P x R x (1+R)N]/[(1+R)N-1], where P represents the loan amount or principle, R represents the monthly interest rate [if the annual interest rate is 11%, the rate of interest will be 11/(12 x 100)], and N represents the number of monthly instalments.

What is the finance charge on a loan?

Calculation Calculate your annual interest rate by multiplying it by the amount of payments you’ll make that year. To figure out how much interest you’ll pay that month, multiply that amount by your remaining loan sum. Subtract the interest from your set monthly payment to find out how much you’ll have to pay in principle the first month.

How are loan installments calculated?

Basic Interest Formulas and Calculations: Using the simple interest formula, calculate A, the Final Investment Value: P is the Principal amount of money to be invested at an Interest Rate R percent per period for t Number of Time Periods, and A = P(1 + rt), where P is the Principal amount of money to be invested at an Interest Rate R percent per period for t Number of Time Periods.

How do you calculate principal and interest payments?

While lower interest rates may be available, 1.9 percent might be a fair value in certain situations. An interest rate of 1.9 percent APR may not add much to the final cost of your automobile purchase. On a $30,000 SUV, we estimate that a 5-year loan with a 1.9 percent APR would cost $1,471 in interest alone. 7 February 2022

What is the interest formula?

Depending on the APR and the length of the loan, the monthly payment on a $45,000 loan might vary from $615 to $4,521. For instance, if you borrow $45,000 for a year at a 36 percent APR, your monthly payment would be $$4,521.

Is 1.9 percent interest rate good?

The nominal rate is calculated by multiplying the relevant rate by the Average Daily Balance. The effective interest rate is calculated by dividing the average monthly interest by the average principal balance.

What is the payment on $45000?

A purchase finance charge is a fee that is charged on purchases made using a credit account such as a credit card. Although certain accounts may have different terms, this usually takes the form of an interest charge.

How does BPI calculate finance charge?

The Rule of 78 states that the borrower must pay a larger fraction of the interest rate early in the loan cycle, implying that the borrower would pay more than they would with a traditional loan.

What is purchase finance charge?

Every loan term is unique, and it is determined by criteria such as your credit score and the amount you want to borrow. Smaller loans often carry higher monthly financing charges since the bank profits from these fees and knows that a smaller loan would be paid off faster.

How does the Rule of 78 work?

This financing price comprises interest as well as any fees associated with the borrowing arrangement. The fee is added to the amount you borrow, and you return the whole amount during the period, usually in monthly installments.

Why are my finance charges so high?

Definition of a Finance Charge A finance charge is a fee paid to a lender or creditor for borrowing money. This is how lenders generate money while lowering the risk of lending. Borrowers may be less likely to pay down or repay their debts if there is no financing fee.

Is it normal to pay a finance charge on a car loan?

A credit card with a 24 percent APR means that the interest you pay over the course of a year is approximately equivalent to 24 percent of your balance. For example, if your APR is 24% and you carry a $1,000 amount for a year, you would owe $236.71 in interest.

Is a finance charge a down payment?

A 0% APR implies you don’t have to pay interest on certain purchases for a certain period of time. When it comes to credit cards, a 0% APR is often connected with a promotional rate offered when you start a new account. A card’s purchase or balance transfer APRs, or both, may have a 0% promotional APR.

What is 24% APR on a credit card?

The new yearly payment of $12,300 is then calculated using the 6% interest rate. To get the APR, divide the $12,300 yearly payment by the $200,000 initial loan amount to get 6.15 percent.

What is 0 APR mean?

Explanation of Finance Fees A financing charge, often known as a late fee, is a penalty that clients suffer after their payment window and grace period have passed. Most invoices will contain a payment term that defines a time frame, such as Net 30, which means a client has 30 calendar days to pay a bill after receiving it.

Conclusion

Watch This Video:

To calculate finance charge in Excel, you will need to use the “finance charge” formula. The formula is as follows: Reference: how to calculate finance charge in excel.

Related Tags

- how to calculate finance charge on a car loan

- how to calculate finance charge on credit card

- how to calculate finance charge on closing disclosure

- monthly finance charge formula

- how to calculate daily finance charge