How to Buy a Car with a Pre Approved Loan

If you’re in the market for a new car but don’t have the best credit, you may be wondering how to buy a car with a pre approved loan. Here are a few tips to help you get the best deal.

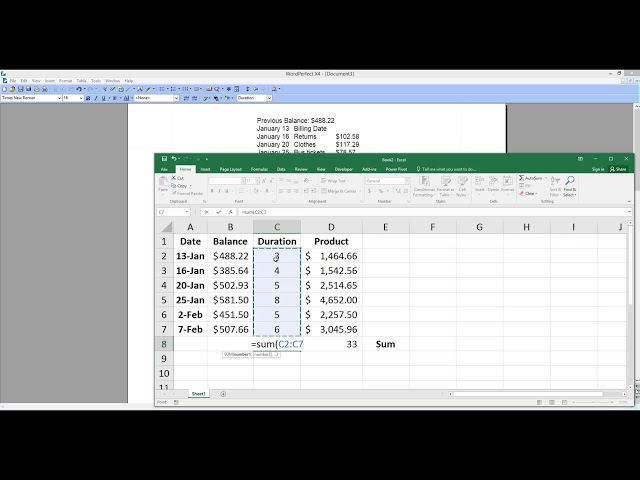

Checkout this video:

Get a pre approved loan

Before you start car shopping, it’s a good idea to get a pre approved loan. This will give you a better idea of how much you can afford to spend on a car. It can also help you get a better interest rate on your loan.

Find a lender

The first step to getting a pre approved auto loan is finding a lender. You can use an online lending network, such as our partner MyAutoLoan.com, to get offers from multiple lenders with just one application. Or you can choose a local bank or credit union.

If you have a strong relationship with your current bank, that might be the best place to start. You may be able to get a lower interest rate if you have a good history with the bank.

Another option is to get pre approved for an auto loan through the dealership. The downside of this is that you might not get the best interest rate available. But it can be a good option if you’re buying from a dealership that doesn’t have any financing options other than their own. And it can be helpful to have the loan lined up before you start negotiating with the salesperson.

Get a pre approved loan from the lender

If you’re car shopping, you may want to get a pre approved loan from the lender. This type of loan gives you the money you need to buy a car. It’s important to know how these loans work before you get one.

Pre approved loans are different from other types of loans. With this type of loan, the lender agrees to give you a certain amount of money before you start looking for a car. This way, you know how much money you have to work with.

The interest rate on a pre approved loan is usually higher than the interest rate on other types of loans. This is because the lender is taking on more risk. They don’t know what kind of car you’re going to buy, so they charge more interest to make up for the risk.

Pre approved loans can be helpful if you’re looking for a specific kind of car. For example, if you’re looking for a luxury car, you may be able to get a better interest rate on a pre approved loan than you would on an unsecured loan. This is because the lender knows that you’re more likely to default on an unsecured loan if you can’t afford the car payments.

You should only get a pre approved loan if you’re sure that you can afford the monthly payments. You should also make sure that you understand all of the terms and conditions before you agree to anything.

Find the right car

You’ve been pre-approved for an auto loan and now it’s time to find the right car. The process is much the same as if you were financing the entire purchase yourself. You’ll need to research different vehicles, narrow down your choices, and then test drive and negotiate the price. The main difference is that you’ll have a much smaller pool of cars to choose from because you’ll need to find one that matches your loan amount.

Research

Before you start shopping for your new car, you’ll want to do some research. This includes deciding on the type of vehicle that’s right for you and your lifestyle and finding out what you can afford.

You’ll also want to research different lenders to find the best interest rate and terms for your loan. Once you’ve done all of this, you’ll be in a much better position to get a great deal on your new car.

Find a car that fits your budget

You’ve been pre-approved for a loan,great! Now all you need to do is find the car that fits your budget. Keep in mindthat just because you’re approved for a certain loan amount doesn’t mean you should max out your budget. You’ll want to have enough wiggle room in your monthly budget for gas, maintenance, and other unforeseen costs. Once you’ve found a few cars that fit your budget, it’s time to start test driving!

Find a car that meets your needs

When searching for a car, you should keep in mind what you need the vehicle for. If you plan to use it for long drives, you will want to make sure it is comfortable and has good fuel efficiency. If you need it for short commutes, fuel economy may not be as important as finding a car that can maneuver well in traffic. Once you have thought about your needs, you can start looking at specific models that fit those needs.

You should also consider your budget when searching for a car. You may want to research the fees associated with different models to find one that fits your budget. Additionally, some models may require more maintenance than others, so be sure to factor that into your budget as well.

When you have found a few models that fit both your needs and your budget, you can start looking at specific dealerships. Once you have found a dealership you trust, you can begin negotiating the price of the car. Remember to be firm but fair in your negotiations, and be willing to walk away if the dealer is not willing to meet your needs.

Test drive the car

The best way to test drive the car is to go to a few different dealerships and test drive as many cars as you can. This will give you a feel for what you like and don’t like. It’s also a good idea to take a friend or family member with you to help you make a decision.

Take the car for a test drive

Before you buy a car, it’s important to take it out for a test drive. This will give you an idea of how the car responds to your input and how comfortable you feel while driving. Make sure to take the car on a variety of roads—highways, city streets, and backroads—to get a sense of how it performs in different conditions. And be sure to try out all the features!

If you’re financing the car, you may not be able to take it for a test drive unless you have a pre-approved loan. In this case, it’s even more important to do your research before heading to the dealership. Once you’ve found the perfect car, be sure to get a loan with terms that work for you.

Make sure the car is right for you

Now that you have a pre approved loan, it’s time to find the perfect car for you. But before you start test driving, there are a few things you should keep in mind.

First, make sure the car is the right size for you. If you’re looking for a family car, make sure it has enough room for everyone and all of your gear. If you’re looking for a commuter car, make sure it’s fuel efficient and comfortable for your daily commute.

Next, think about what you’ll be using the car for. If you’re looking for a car to take on long road trips, make sure it’s comfortable and has plenty of storage space. If you’re looking to use the car primarily in the city, look for something that’s easy to maneuver and park.

Finally, consider your budget. Don’t forget to factor in things like insurance, maintenance, and fuel costs when determining how much you can afford to spend on a car. With a pre approved loan in hand, you’ll be able to shop with confidence knowing exactly how much car you can afford.

Buy the car

If you are looking for a car, you may want to consider getting a pre approved loan. This can help you save money and time. You can also avoid the hassle of going through a bank or dealership. In this section, we will cover how to get a pre approved loan and how to use it to buy a car.

Negotiate the price

The first step is to find the car you want to buy. Once you have found it, research the vehicle to learn about its value. This will help you know if you are getting a good deal on the car.

After you have found the car and researched its value, it is time to negotiate with the seller. Be sure to start low and be willing to walk away if the seller is not willing to meet your price.

If the seller agrees to your price, it is time to finalize the sale. Make sure you get a bill of sale and have the car inspected by a mechanic before you finalize the purchase.

Get the car inspected

You’ve been pre-approved for a loan, so the financing part is taken care of. Now it’s time to focus on the car itself. The first step is to get it inspected by a qualified mechanic. This will give you an unbiased opinion of the car’s condition and can help you negotiate a lower price if there are any problems.

Get the car insured

Now that you have your loan and you have chosen the car you want, it is time to get the car insured. When you buy a car, the dealership will ask you if you want to add insurance to the loan. This is called gap insurance. Gap insurance covers the difference between what you owe on your loan and what the car is worth if it is totaled in an accident or stolen.

If you have a pre approved loan, you may not need gap insurance because your lender will require that you carry full coverage insurance on the car. Full coverage insurance usually includes collision and comprehensive coverage, which will pay to repair or replace your car if it is damaged in an accident, regardless of who is at fault.

Before you buy any type of car insurance, be sure to shop around for the best rates and coverage. You can get quotes from different insurers online or by calling insurers in your area.

Close the deal

If you have a pre approved loan from a bank or other financial institution, you’re in a much better position to buy a car. Here’s how to close the deal and get the car you want.

Sign the paperwork

The last step in the car-buying process is signing the paperwork. This includes the sales contract, which is a binding agreement between you and the dealership. Be sure to read the sales contract carefully before signing it. Pay special attention to the vehicle price, trade-in value, interest rate, monthly payment, and length of the loan. Once you sign the sales contract, you are legally obligated to purchase the car.

Make the down payment

After you’ve shopped around for the perfect car and found a great interest rate on a loan, it’s time to focus on the down payment. A large down payment can reduce your monthly payments and help you pay off your car loan faster, but it’s not always necessary. In fact, many lenders will work with you to get a car loan with a low or no down payment.

If you do have money to put down on a car, consider using it as a bargaining tool. Many dealerships are willing to negotiate on price if you’re putting money down, so you may be able to get a better deal. Just be sure to keep an eye on the total cost of the loan and don’t overpay for your vehicle just because you have a large down payment.

Drive off in your new car!

A pre approved loan is a great way to buy a car. You’ll know exactly how much you can afford and you won’t have to worry about the dealer trying to pressure you into spending more than you’re comfortable with. Here’s how to get a pre approved loan and drive off in your new car!

1. Check your credit score. This will give you an idea of what interest rate you can expect to pay on your loan.

2. Shop around for the best interest rate. Once you know what interest rate you’re qualified for, compare rates from different lenders to get the best deal.

3. Get pre approved for a loan. This will give you the confidence of knowing exactly how much car you can afford. Plus, it’ll put you in a stronger negotiating position when it comes time to purchase your vehicle.

4. Find the car you want and negotiate the price. Be sure to factor in the cost of taxes, registration, and insurance when negotiating the price of your vehicle.

5. Drive off in your new car! With a pre approved loan in hand, you’re ready to purchase your dream car and hit the open road!