How to Build My Credit with a Credit Card

If you’re looking to build your credit , using a credit card is a great way to do it. But how do you go about doing it? In this blog post, we’ll give you some tips on how to build your credit with a credit card.

Follow these tips and you’ll be on your way to a great credit score in no time!

Checkout this video:

What is credit?

Credit is the act of borrowing money from a financial institution with the intention of repaying the debt over time. Credit is an important part of financial health, but it’s important to use credit responsibly. In this section, we’ll discuss how to build credit with a credit card.

The difference between good and bad credit

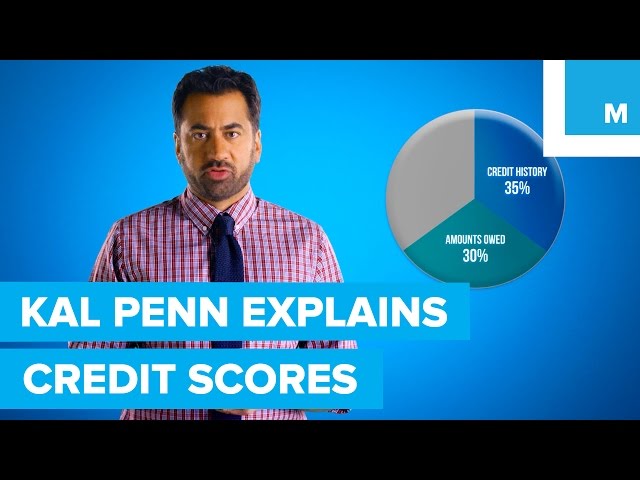

There are many things that affect your credit score, but the two most important are your payment history and how much debt you have. Your payment history is a record of whether you pay your bills on time. It makes up 35% of your credit score. Having a good payment history shows lenders that you’re likely to repay any loan they give you.

How much debt you have makes up 30% of your credit score. If you have a lot of debt, it means you’re more likely to default on a loan. That’s why it’s important to keep your debt-to-income ratio low. This is the amount of debt you have compared to your income. Most experts recommend keeping it below 36%.

How can I build my credit?

There are a few things you can do to help build your credit, and using a credit card is one of them. If you use a credit card and make your payments on time, you can improve your credit score. Paying your balances in full and on time is the best way to improve your credit score.

Use a credit card responsibly

One of the best ways to build your credit is to use a credit card responsibly. That means making your payments on time, every time. It also means keeping your credit card balances low.

Here are a few other things you can do to build your credit with a credit card:

– Use your card regularly. If you don’t use your card, some issuers may close your account. And if you have a good history with that issuer, that could hurt your credit score.

– Pay more than the minimum payment each month. This will help you pay down your balance faster and improve your payment history.

– Keep an eye on your credit utilization ratio. That’s the amount of debt you have divided by the amount of credit you have available. The lower that number is, the better it is for your credit score.

Pay your bills on time

One of the most important things you can do to improve your credit score is to pay your bills on time. This includes both credit card bills and other loans you may have, such as a car loan or a mortgage. Payment history is one of the biggest factors that go into your credit score, so it’s important to make sure you are always paid up and on time.

One way to make sure you never miss a payment is to set up automatic payments with your lender. That way, you can be sure that the bill will be paid each month even if you forget. Another option is to set up reminders for yourself so that you remember to make the payment each month. You can set up a reminder on your phone, in your email calendar, or even write it down in a physical planner.

Whatever system you use, just be sure that you always pay your bills on time! This is one of the best things you can do to improve your credit score.

Keep your credit utilization low

One of the best ways to build your credit is to keep your credit utilization low. Credit utilization is the ratio of your credit card balances to your credit limits. For example, if you have a $1,000 credit limit and you carry a balance of $250, your credit utilization is 25%.

Ideally, you should keep your credit utilization below 30%. The lower your credit utilization, the more positive impact it will have on your credit score.

What are the benefits of having good credit?

There are many benefits of having good credit. Good credit can help you get a lower interest rate on a loan, it can help you get a better job, and it can even help you get insurance. Having good credit is important and there are a few things you can do to help build your credit. One way to build your credit is by using a credit card.

You’ll save money on interest

If you’re borrowing money—for a car loan, mortgage, or even a credit card—you’ll probably get a lower interest rate if you have good credit. That’s because lenders see people with good credit scores as less of a risk, so they offer better rates to lure them in.

You’ll be able to qualify for better loans

When you have good credit, you’ll be able to qualify for better loans with lower interest rates. This can save you a lot of money over the life of a loan, and it can also make it easier to qualify for a loan in the first place. That’s because lenders will see you as a lower-risk borrower and be more likely to approve your loan application.

You’ll have more financial options

A good credit score gives you a better chance of qualifying for loans with favorable terms, such as a lower interest rate. This can save you money on large purchases like a home or car. A good credit score can also help you get approved for a mortgage and can potentially save you thousands of dollars in interest over the life of your loan.

A good credit score can also help you qualify for credit cards with rewards programs and other perks, such as cash back or travel points. And if you’re ever in a financial emergency, having good credit may allow you to qualify for a low-interest loan or line of credit.