How to Build Credit for the First Time

If you’re looking to build credit for the first time, you’ll need to follow a few key steps. In this blog post, we’ll outline how to get started so that you can establish a good credit history.

Credit for the First Time’ style=”display:none”>Checkout this video:

Open a Secured Credit Card

A secured credit card is a great way to build credit for the first time. You put down a deposit, which is usually a few hundred dollars, and then you’re able to spend up to that amount on the card. You’ll need to make sure that you make your payments on time and in full each month, but if you do, you’ll start to build a good credit history.

Find a card issuer that reports to the credit bureaus

You’ll need to find a card issuer that reports to the credit bureaus in order for your activity on the card to help your credit scores. Some issuers don’t report secured cards’ activity to the credit bureaus, or might only report it if you become delinquent on your payments. You can check whether an issuer reports by contacting customer service or looking for disclosures in the application process.

Make small purchases and pay off the balance in full each month

If you’re new to credit, one of the best things you can do is open a secured credit card and make small purchases with it. Then, be sure to pay off the balance in full each month. Doing this will help you build a good credit history, which is important for getting loans and other types of financing in the future.

There are a few things to keep in mind when you’re using a secured credit card:

– Make sure the card issuer reports your activity to the major credit bureaus. Otherwise, you won’t be building your credit history.

– Try to keep your balance below 30% of your credit limit. This will help improve your credit score.

– If possible, make payments on time and in full every month. This will also help improve your credit score.

Get a Co-Signer

One way to help build credit for the first time is to get a co-signer. This is someone who will sign on the loan with you and be equally responsible for making the payments. This can be a great way to help build credit because the co-signer’s good credit will help offset any negative marks on your credit report.

Find a friend or family member with good credit

A co-signer is someone who agrees to be responsible for your debt if you can’t or don’t pay it. Co-signing is a big responsibility, so be sure to ask someone you trust—someone with good credit who is also comfortable taking on the risk.

Your co-signer will need to fill out an application and may have to pay a fee. Once they’re approved, they’ll sign your loan agreement along with you. From there, they’re legally obligated to make sure your debt gets paid even if you can’t or stop making payments. So if you default on your loan, your co-signer will have to step in and make the payments for you.

This can wreak havoc on their finances and their credit score, so make sure you’re able to take on this responsibility before asking someone to co-sign for you.

Apply for a credit card or loan with them

A co-signer is someone who agrees to be equally responsible for repaying a loan or credit card balance. Essentially, they’re vouching for you. So if you don’t make your payments on time, they’re on the hook too.

There are a few reasons you might need a co-signer:

-You have no credit history.

-Your credit score is low.

-You have a limited income.

When you apply for a credit card or loan with a co-signer, the lender will look at their credit history and income as well as yours. This can help you get approved for a higher credit limit or lower interest rate.

Keep in mind that being a co-signer is a big responsibility. If you don’t make your payments on time, you could damage your co-signer’s credit score. So it’s important to only apply for a loan or credit card with a co-signer if you’re confident that you can make the payments on time and in full every month.

Become an Authorized User

One way to build credit is to become an authorized user on someone else’s credit card. This means that you are authorized to use the credit card, but are not legally responsible for paying the debt. This can be a great way to build credit because you can piggyback off of someone else’s good credit history.

Find a friend or family member with good credit

One way to build credit when you don’t have any history is to become an authorized user on another person’s credit card. This strategy can work well if you know somebody with good credit — ideally, a friend or family member — who is willing to add you to their account.

If you become an authorized user, the primary cardholder’s payment history will appear on your credit report. So, if they always make their payments on time and keep their balances low, your credit will benefit. Conversely, if they make late payments or carry a high balance, your score could suffer.

Before you ask somebody to add you to their credit card account, make sure they understand that they’ll be responsible for all the charges you make. You should also find out if the card issuer reports authorized users to the credit bureaus; not all do.

If you’re looking to build credit for the first time, one option is to ask to be added as an authorized user on another person’s credit card. As an authorized user, you’ll have access to the credit card and will be able to use it for purchases, but you won’t be held liable for any debts incurred on the card.

Being an authorized user can be a great way to build credit because your activity will be reported to the credit bureaus. However, it’s important to keep in mind that you’ll be relying on someone else to make timely payments – if they don’t, your credit score could suffer.

If you’re considering becoming an authorized user, talk to the person who would be adding you to their account and make sure you understand all of the terms and conditions involved. Once you’re added as an authorized user, start using the credit card responsibly and make sure you always make your payments on time.

Use a Credit Builder Loan

Find a credit union or online lender that offers credit builder loans

A credit builder loan is a type of loan that is specifically designed to help people who are looking to build their credit for the first time. These loans are usually small, with terms of 12 months or less, and they require the borrower to make regular, on-time payments in order to improve their credit score.

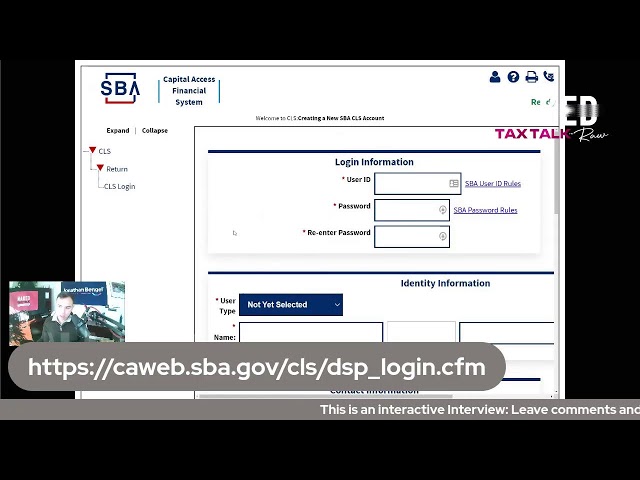

There are a few different ways to find a credit builder loan. One option is to look for a local credit union or online lender that offers this type of loan. Another option is to use a service like Credit Karma, which can help you find lenders that offer loans for people with bad credit.

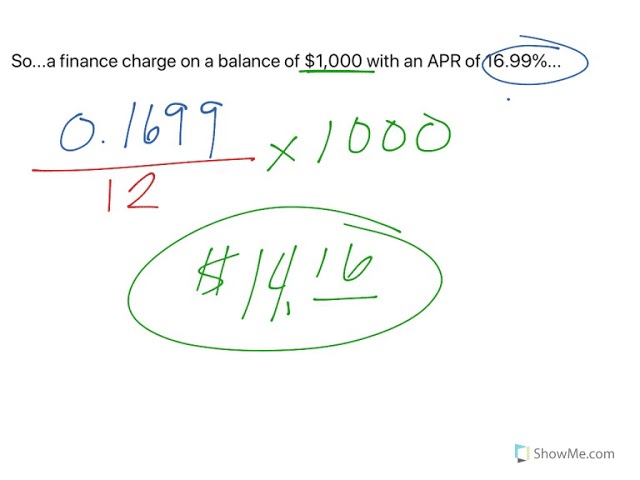

Once you have found a few potential lenders, it is important to compare the terms of each loan in order to find the one that is best for you. Make sure to look at the interest rate, fees, and repayment terms before you apply.

If you have bad credit, a credit builder loan can be a great way to improve your score and get on the path to financial success.

Borrow a small amount of money and make payments on time

A credit builder loan is a small loan that you repay over time. This type of loan can help you build credit if you make your payments on time.

Credit builder loans are also sometimes called credit-building loans or trust-building loans. They may be offered by a bank, credit union, or other financial institution.

The loans are typically for a small amount of money, such as $500 to $1,000. You may have to pay an origination fee to get the loan. You will then make monthly payments on the loan, and the money will be deposited into a savings account or used to pay off debt. Once you have repaid the loan in full, you will have access to the money in the account.

Credit builder loans can help you build credit because they show that you can borrow money and repay it on time. The loans can also help you build a positive payment history, which is one of the factors that lenders look at when considering a loan application.

If you are looking for a way to build credit, consider getting a credit builder loan. Be sure to shop around and compare terms before taking out any loan.