How to Ask for a Credit Limit Increase

Contents

If you’re looking to increase your credit limit, there are a few things you can do to increase your chances of being approved. Follow these tips and you’ll be on your way to a higher credit limit in no time.

Checkout this video:

Why You Might Need a Credit Limit Increase

There are a few reasons you might need to ask for a credit limit increase from your issuer. If you have a high credit score, you might need a higher credit limit to make large purchases or to have a cushion in case of an emergency. You might also need a higher credit limit if you plan on making a major purchase soon and you want to avoid maxing out your credit card. Whatever your reason, asking for a credit limit increase is a relatively easy process.

You want to avoid maxing out your credit card

If you use your credit card frequently, you may find that you need to increase your credit limit. There are a few reasons why you might need a credit limit increase, but the primary one is to avoid maxing out your credit card.

When you max out your credit card, it can damage your credit score in two ways. First, your credit utilization ratio will skyrocket, which is the percentage of your available credit that you’re using. Second, maxing out your credit card can be a sign of financial distress, which is something that creditors don’t like to see.

If you find that you’re regularly close to or at your credit limit, it’s probably time to request a credit limit increase from your creditor. banks are usually happy to give their customers a little more breathing room, and it can be as simple as calling up customer service and asking for an increase.

You want a better credit utilization ratio

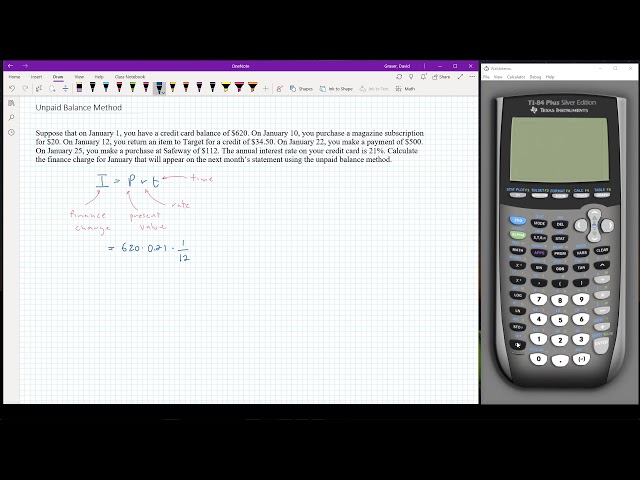

One of the main reasons to ask for a credit limit increase is to improve your credit utilization ratio, which is the amount of credit you’re using vs. your total available credit.

Your credit utilization ratio makes up 30% of your FICO score, which is the most widely used score by lenders, so it’s an important factor in your creditworthiness. Generally, it’s best to keep your ratio below 30%, but if you can keep it below 10%, that’s even better.

If you have a low credit limit and you carry a balance on your card from month to month, your utilization ratio is likely quite high. Asking for a credit limit increase can help lower your ratio and improve your credit score.

You want to take advantage of rewards programs

If you’re trying to take advantage of rewards programs like travel rewards or cash back, you may need to increase your credit limit. That’s because most rewards cards have spending thresholds you need to reach in order to earn the bonus. For example, you might need to spend $3,000 in the first three months after opening the card in order to earn a sign-up bonus of 50,000 points. If your credit limit is only $1,000, you’ll never be able to reach that threshold and earn the bonus.

How to Request a Credit Limit Increase

Requesting a credit limit increase is a relatively easy process that can be done online, over the phone, or by mail. It’s a good idea to request a credit limit increase when you have a good history of making on-time payments and keeping your balance low. requesting a credit limit increase can also help improve your credit score.

Check your credit score

If you think you’re ready for a credit limit increase, the first step is to check your credit score and make sure it’s in good shape. A good credit score is usually considered to be anything above 700, and a great credit score is anything above 750. If your score is below 700, you may want to take some time to improve it before asking for a credit limit increase. You can check your credit score for free with a service like Credit Karma or Credit Sesame.

Once you know your credit score is in good shape, you can move on to the next step.

Call your credit card issuer

Calling your credit card issuer is the best way to request a credit limit increase. You can find the customer service phone number on your credit card statement or by visiting the issuer’s website. When you call, be prepared to provide your account information and explain why you believe you deserve a higher credit limit.

Your chances of being approved for a credit limit increase are usually highest if you have a history of timely payments and low credit utilization. If you’ve had your credit card for at least six months and haven’t requested a credit limit increase previously, you may also be more likely to be approved.

Be prepared to answer questions about your finances

Be prepared to answer questions about your finances

When you contact your credit card issuer to request a credit limit increase, the customer service representative will likely ask you some questions about your current financial situation. They may ask about your income, housing situation, whether you have any other debts and how long you’ve been using the credit card. Answering these questions truthfully will give the customer service representative a better idea of whether you can handle a higher credit limit.

What to Do If You’re Denied

If you’re denied a credit limit increase, don’t despair. You have a few options for what to do next. You can try again in six months, you can ask why you were denied and what you can do to improve your chances, or you can look for a different credit card. Let’s take a closer look at each of these options.

Try again in six months

Even if you’re denied, it doesn’t mean you’re out of options. You can always try again in six months. In the meantime, you can work on building your credit score so you’re more likely to be approved the next time around. Check your credit report for any errors that could be dragging down your score, and start making payments on time and keeping your balances low. If you need help boost your credit score, consider signing up for a credit monitoring service.

Look for other ways to improve your credit score

If you’re denied for a credit limit increase, there are other ways you can improve your credit score. One way is to use your credit responsibly and make all of your payments on time. You can also try to reduce your debt-to-credit ratio by paying down some of your outstanding debts. Additionally, you can keep an eye on your credit report for any errors that may be impacting your score. If you find any, you can dispute them with the credit bureau. Finally, you may want to consider opening a new line of credit to help improve your credit utilization ratio.

Use a secured credit card

If you have credit card debt, you’re not alone. In fact, the average American household has over $5,000 in credit card debt.1 If you’re struggling to keep up with your credit card payments, you may be considering a balance transfer or personal loan to pay off your debt. But what if you’re denied for a loan or balance transfer?

There are a few things you can do if you’re denied for a balance transfer or personal loan. First, you can check your credit report to see if there are any errors that are hurting your credit score. You can also try using a secured credit card, which is a type of credit card that requires a security deposit. Or, you can get a cosigner on a personal loan or balance transfer.

If you’re having trouble getting approved for a balance transfer or personal loan, there are still options available to help you pay off your debt.