How to Apply for a Wells Fargo Credit Card

Contents

Applying for a Wells Fargo credit card is easy. You can either apply online, by phone, or in person at a Wells Fargo branch. However you choose to apply, you’ll need to provide some basic information about yourself, including your name, address, and Social Security number.

Checkout this video:

Research the best Wells Fargo credit card for you

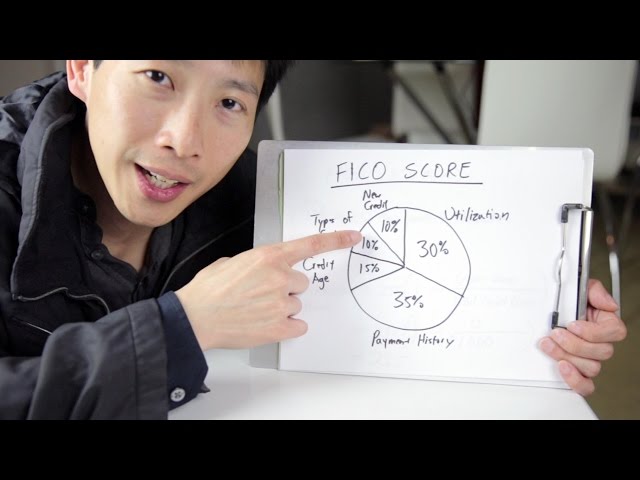

Consider your credit score

One important factor to consider when choosing a Wells Fargo credit card is your credit score. Your credit score is a number that lenders use to evaluate your creditworthiness. It is based on your credit history, which includes factors such as your payment history, the types of credit you have, the length of your credit history, and how much of your available credit you are using.

Wells Fargo offers a wide range of credit cards, from cards for those with excellent credit to cards for those with fair or limited credit. If you have excellent credit, you may be eligible for a Wells Fargo Platinum Card or Wells Fargo Rewards Card. These cards offer low interest rates and great rewards programs. If you have good or fair credit, you may be eligible for a Wells Fargo Cash Back Card or Wells Fargo Secured Credit Card. These cards have higher interest rates than the Platinum and Rewards cards, but they can still help you build or improve your credit.

No matter what type of card you are considering, it is important to compare the different offers and make sure you understand the terms and conditions before you apply. You can compare Wells Fargocredit cards online at their website.

Consider your spending habits

When you’re trying to decide which Wells Fargo credit card is best for you, the first step is to consider your spending habits. Do you typically carry a balance on your credit card from month to month? Or do you pay off your entire balance each month?

If you carry a balance, you’ll want to find a card with a low interest rate. The Wells Fargo Platinum Visa® Card and the Wells Fargo Cash Back College℠ Visa® Card both have an introductory APR of 0% for 18 months (after that, the APR will be 13.40%-23.40% Variable).

If you pay off your balance each month, you may be more interested in a card that offers rewards, like cash back or points. The Wells Fargo Propel American Express® Card offers 3x points on select categories, 2x points at gasoline stations and 1x points on all other purchases.

Gather the required documents

Before you begin the application process, you’ll need to gather the following documents: your most recent Social Security statement, a government-issued photo ID, and your most recent Wells Fargo statements (if you’re a current customer). If you’re not a current Wells Fargo customer, you’ll also need to provide proof of income and two years of employment history.

Social Security number

A Social Security number (SSN) is a nine-digit number that the Social Security Administration (SSA) assigns to you. Wells Fargo uses your SSN to check your credit report and verify your identity. You will need to provide your SSN when you apply for a credit card.

Driver’s license or state-issued ID

When you apply for a credit card, you’ll need to provide some basic information about yourself. This includes your name, address, date of birth, and Social Security number. You’ll also need to show a government-issued ID, such as a driver’s license or passport.

Annual income

Your annual income is the total amount of money you earn in one year. This may include money from a job, alimony, child support, disability payments, Social Security, and more. When you apply for a credit card, the issuer will want to know your annual income to get an idea of whether you can afford to make the monthly payments.

Complete the online application

To start your Wells Fargo credit card application, you’ll need to gather some information. You’ll need your name, address, Social Security number, and date of birth handy, as well as information about your current employment situation and annual income. You’ll also need to decide which credit card you want to apply for. Once you have all of this information, you’re ready to begin the online application.

Enter your personal information

To begin, you’ll need to provide some personal information, including your name, address, and Social Security number. You’ll also need to enter your date of birth and email address. Once you’ve entered all of the required information, click “Continue.”

Enter your financial information

You’ll need to provide some financial information, including your annual income and the estimated balance of any other credit cards you have. This helps us determine whether you qualify for the card and what credit limit might be appropriate.

Enter your employment information

To begin, you’ll need to enter your employment information. To do this, you’ll need to provide your employer’s name and address, your job title, your total annual income, and the date you started your current job. You’ll also need to indicate whether you’d like to have your payments deducted from your Wells Fargo checking or savings account.

Wait for a decision

If you’re approved, you’ll receive your credit card in the mail

If you’re approved for a Wells Fargo credit card, you’ll receive your credit card in the mail. You can use your credit card to make purchases anywhere that accepts Visa. You can also use your credit card to withdraw cash from an ATM, but you’ll pay a fee for this service.

If you’re not approved, you can try again in 60 days

If you’re not approved for a Wells Fargo credit card, you can try again in 60 days. If you’re not approved for a Wells Fargo credit card, you can try again in 60 days. This is because credit cards are a revolving line of credit, which means that if you’re not approved for a Wells Fargo credit card, you can try again in 60 days.