How Often Should You Apply for New Credit Cards?

Contents

- Applying for New Credit Cards

- How Often Should You Apply for New Credit Cards?

- If you’re trying to improve your credit score, you should space out your applications

- If you’re trying to earn sign-up bonuses, you can apply for multiple cards at once

- You can also stagger your applications to keep your credit utilization low

Applying for new credit cards can be a great way to earn rewards, but you don’t want to apply for too many at once. Find out how often you should apply for new credit cards to maximize your rewards without jeopardizing your credit score.

Checkout this video:

Applying for New Credit Cards

Trying to get a new credit card? You’re not alone. Research shows that most people apply for new credit cards when they’re trying to improve their credit score or they’re trying to take advantage of a great sign-up bonus. But how often should you actually apply for new credit cards?

Applying for too many credit cards at once can lower your credit score

When you apply for a new credit card, the issuer will typically do a hard pull on your credit report. This can temporarily lower your credit score by a few points. But if you’re applying for multiple credit cards in a short period of time, that can add up to a significant drop in your score.

It’s generally best to space out your applications for new credit cards so that you’re only doing one or two every six months or so. This will help you avoid any significant drop in your credit score. And it will also give you time to build up your credit history with each new card before applying for another.

Applying for a new credit card can give you a “credit utilization” boost

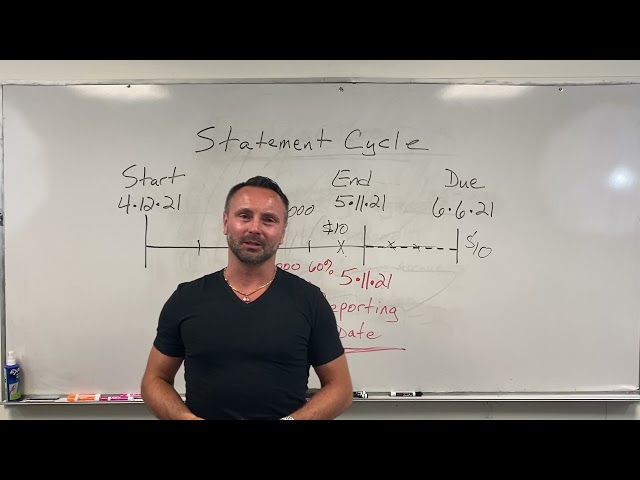

If you’re trying to improve your credit score, one strategy is to increase your “credit utilization ratio.” This is the amount of credit you’re using compared to the amount of credit you have available. So, if you have a $1,000 credit limit and a $500 balance, your credit utilization ratio would be 50%.

One way to increase your credit utilization ratio is to apply for a new credit card. This gives you a new source of available credit, which can help improve your utilization ratio. But there’s a downside: every time you apply for a new credit card, your credit score takes a small hit.

How much of a hit? It depends on your individual situation, but usually it’s no more than 5 or 10 points. That’s not enough to make a significant difference in your score. And the boost you’ll get from the increased utilization may be worth the short-term ding to your score.

There’s no hard and fast rule about how often you should apply for new credit cards. If you’re trying to improve your utilization ratio, then applying for a new card every few months may be a good strategy. But if you’re happy with your current level of available credit, there’s no need to keep applying for new cards.

Applying for a new credit card can help you earn sign-up bonuses

Applying for a new credit card can help you earn sign-up bonuses and rewards, but you should be strategic about when you apply. Applying for multiple cards in a short period of time can hurt your credit score, so it’s important to consider how often you apply for new credit cards.

If you’re looking to earn rewards, applying for a new credit card can be a great way to do it. Many cards offer sign-up bonuses, which can include thousands of points or miles that can be used for travel or other purchases. But before you apply for a new card, there are a few things you should keep in mind.

First, every time you apply for a credit card, the issuer will do a hard pull of your credit report. This can ding your score by a few points, so if you’re planning on applying for multiple cards in a short period of time, it’s important to be aware that your score could take a hit.

Second, if you’re approved for a new card with a high credit limit, your credit utilization ratio could go up. This is the amount of debt you have compared to your credit limit, and it makes up 30% of your FICO score. So if your goal is to improve your credit score, you might want to wait to apply for new cards until you’ve lowered your balances on existing cards.

Finally, when you open a new account, the average age of your accounts decreases. This isn’t necessarily a bad thing – after all, having newer accounts shows that you’re actively using credit – but it is something to keep in mind when considering how often to apply for new cards.

In general, experts recommend that people with good or excellent credit avoid opening more than one account per year. If you have fair or poor credit, it’s best to open fewer than one account every six months. And if you’re trying to improve your credit score, it might be best to wait even longer between applications.

How Often Should You Apply for New Credit Cards?

You’ve probably heard the advice to “apply for new credit cards responsibly.” But what does that actually mean? How often should you be applying for new credit cards?

If you’re trying to improve your credit score, you should space out your applications

If you’re trying to improve your credit score, you should space out your applications for new credit cards. Applying for too many cards at once can hurt your score, as it can make you look like a high-risk borrower. Try to space out your applications so that you’re only applying for one or two new cards every six months. This will give you time to build up your credit history with each card and improve your score.

If you’re trying to earn sign-up bonuses, you can apply for multiple cards at once

Earning sign-up bonuses is one of the easiest ways to rake in points and miles, and there’s no limit to how many times you can do it. In fact, some people apply for multiple cards at once in order to hit the minimum spending requirement on all of them before the deadline.

But if you’re not trying to earn sign-up bonuses, you might be wondering how often you should apply for new credit cards. The answer depends on a few factors, including your credit score and your financial goals.

If you have good or excellent credit, you can probably get approved for multiple cards within a short period of time without negatively affecting your score. That’s because applying for multiple cards in a short period of time is only counted as a single hard inquiry on your credit report.

On the other hand, if you have fair or poor credit, each new credit card application is likely to result in a hard inquiry on your report, which could ding your score. In this case, it’s better to space out your applications so that you’re not seen as a high-risk borrower.

In general, experts recommend waiting at least six months between applications for new credit cards. This gives you time to build up your credit history with each card issuer and improve your chances of getting approved.

Of course, there are exceptions to this rule. If you’re trying to earn a specific sign-up bonus before it expires, you might need to apply for multiple cards at once in order to hit the minimum spending requirement in time. Or if you’re working on improving your credit score, you might want to stagger your applications so that each one results in a small increase instead of a big drop.

In the end, there’s no hard-and-fast rule for how often you should apply for new credit cards. Just use common sense and don’t apply for more than you can handle without damaging your credit score or putting yourself into debt.

You can also stagger your applications to keep your credit utilization low

Opening multiple credit cards in a short period of time can impact your credit score, but there are ways to minimize the impact.

For example, you can stagger your applications so that you’re not opening multiple cards in a short period of time. This will keep your credit utilization low, which is good for your credit score.

You can also try to open cards with different issuers. This way, if one issuer does give you a hard pull on your credit report, the other issuers won’t be as likely to do so.

Ultimately, it’s up to you how often you apply for new credit cards. Just be sure to keep an eye on your credit score and be mindful of the potential impact on your credit history.