How Much Down Payment Do You Need for a Land Loan?

Contents

How Much Down Payment Do You Need for a Land Loan?

When you purchase land, the down payment is usually 20% of the total loan amount.

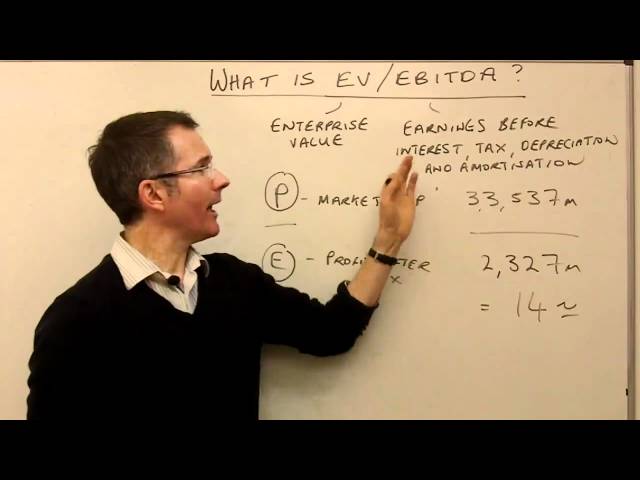

Checkout this video:

The Importance of a Down Payment

When you purchase land, you may be required to make a down payment. The down payment is the amount of cash that you put towards the purchase of the property. The remaining balance will be due in the form of a loan. The amount of the down payment can vary based on the sale price, but it is typically 10 to 20 percent of the purchase price.

The down payment serves several purposes. First, it shows that you are committed to the purchase. Second, it shows that you have the financial resources to make the purchase. And third, it gives you equity in the property. Equity is the portion of the property that you own outright.

If you are unable to make a down payment, there are other options available, such as lease-to-own or owner financing. However, these options should be considered carefully before entering into any agreement.

How Much Down Payment Do You Need?

The minimum down payment for a land loan is usually between 20 and 30 percent of the purchase price. However, depending on the size and location of the property, the lender may require a higher down payment, sometimes as much as 50 percent.

In addition to the down payment, you will also need to pay closing costs, which can range from 2 to 5 percent of the loan amount.

For example, if you are buying a $100,000 piece of land, your total loan amount would be $130,000 ($100,000 purchase price + $30,000 down payment + $2,000 in closing costs).

Saving for a Down Payment

Saving for a down payment on a land loan is different than saving for a mortgage down payment. Usually, you will need a much larger down payment — often 20 percent or more of the total cost of the land. That can be tens of thousands of dollars, so you’ll need to plan ahead and start saving as soon as possible.

If you’re buying vacant land, you may be able to get away with a smaller down payment — sometimes as little as 10 percent — because the risks are lower. Lenders will also look at your credit history, employment and income when considering a land loan. The process is similar to getting a mortgage, so you’ll want to shop around and compare rates and terms from several lenders before committing to a loan.

Types of Loans That Require a Down Payment

There are a few types of loans that will require a down payment, most notably Conventional and FHA loans. A Conventional loan is any loan that is not backed by the government. So, if you’re looking for a loan to purchase land and build a home on, you’ll likely need at least a 5% down payment. FHA loans are government-backed loans that tend to be more accessible for first-time homebuyers. They typically require a 3.5% down payment but there are programs available that can help you with that amount.

How to Get a Loan for a Down Payment

There are a few ways to get a loan for a down payment on land. One way is to get a personal loan from a lender like a bank or credit union. This can be a good option if you have good credit and can afford the interest payments. Another way to get a loan for a down payment is to finance the purchase with a land contract. This means you make monthly payments to the seller until the purchase price is paid off, at which point you own the land outright. You may also be able to get government financing for your down payment through programs like the USDA Rural Development program.

Down Payment Assistance Programs

These are programs that offer financial assistance to help with a down payment and/or closing costs for a land purchase. Some programs may require that you meet certain income and credit score requirements, and you may need to be a first-time homebuyer. There may also be geographical restrictions. To see if there are any programs available in your area, you can check with your county or state housing office, or search for down payment assistance programs online.