How Much Construction Loan Can I Afford?

Contents

How much construction loan can I afford? This is a question we get a lot here at A&M Mortgage. And the answer is, it depends on a number of factors.

Checkout this video:

How the Loan Process Works

Construction loans are short-term loans that are used to finance the construction of a new home. The loan amount is based on the value of the land and the projected cost of the home. You will only make interest payments on the loan during the construction period. Once the construction is complete, the loan will be converted to a permanent mortgage.

Applying for the Loan

The loan process begins with the completion of a loan application. Once the application is submitted, the lender will order a property appraisal to determine the value of the collateral. If the property is deemed to be worth less than the amount of money requested, the loan may be denied.

After the appraisal is completed, the lender will review the loan application and supporting documentation to determine if the borrower meets their lending criteria. If approved, the borrower will be required to sign a loan agreement which outlines the terms and conditions of the loan.

Qualifying for the Loan

To qualify for a construction loan, you’ll need to prove that you can afford the monthly payments and that you have the resources to cover the down payment and any additional costs associated with the loan.

The construction loan process begins with applying for and being approved for a loan. The lender will then disburse the funds in accordance with the loan agreement.

During construction, the lender will typically make progress payments to the borrower as work on the project progresses. Once construction is complete, the borrower will then need to pay off the remaining balance of the loan.

The Loan Application Process

The loan application process starts with a loan pre-qualification, which is simply a statement from the lender that states the maximum amount you can borrow based on your income and debts. You’ll need to provide some basic financial information to the lender, including your income, debts, and any assets you have.

The next step is the loan application, which is a more detailed look at your finances. The lender will pull your credit report and evaluate your income, debts, and assets. They’ll also look at your employment history and any other factors that may impact your ability to repay the loan.

Once you’ve submitted your loan application, the lender will review it and decide whether or not to approve you for a loan. If you’re approved, you’ll be given a loan estimate that outlines the terms of the loan, including the interest rate, monthly payments, and closing costs. The lender will also require that you undergo a home appraisal to ensure that the property is worth what you’re borrowing.

Once you’ve agreed to the terms of the loan, the lender will send out a loan commitment letter outlining all of the final terms and conditions. At this point, you’ll need to complete a few more steps before funding can be released. These steps may include ordering a title search or obtaining homeowners insurance. Once everything is in order, the lender will provide you with the funds for your construction project.

How Much Can You Afford?

You can use a construction loan calculator to find out how much you can afford to spend on your new home. This will help you know what you can realistically afford before you start shopping for a home. It is important to know your budget so that you can avoid overspending and getting in over your head financially.

Determining How Much You Can Afford

When it comes to taking out a construction loan, the amount of money you can afford to borrow will largely depend on your income, your current debt obligations, and the value of the land or property you want to build on.

In order to determine how much you can afford to borrow, most lenders will look at your debt-to-income ratio (DTI). This is a calculation that compare your monthly debts (including your construction loan payments) to your monthly income. For most lenders, a DTI ratio of no more than 43% is ideal.

In addition to looking at your DTI ratio, lenders will also consider the value of the land or property you want to build on. In order to get an accurate estimate of this value, they will often order a property appraisal. The appraised value will be used as collateral for your construction loan, so it’s important that it is as accurate as possible.

Once all of these factors have been taken into consideration, the lender will be able to give you a better idea of how much money you can afford to borrow for your construction project.

Qualifying for the Loan

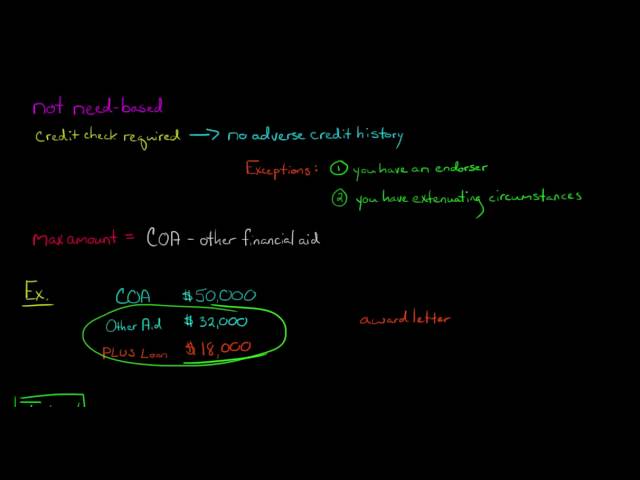

In order to qualify for a construction loan, you will need to prove that you have the financial ability to pay back the loan. Lenders will consider many factors when determining whether or not you are qualified for a loan, but some of the most important factors include your credit score, your income and your employment history.

A good credit score is essential for qualifying for a construction loan. Lenders use your credit score to determine how likely you are to repay the loan on time. The higher your credit score, the more likely you are to qualify for a loan and the better interest rate you will receive.

Income is another important factor that lenders consider when determining whether or not you qualify for a loan. Your income will be used to determine how much money you can afford to put towards repaying the loan each month. Lenders will also consider your employment history when determining whether or not you qualify for a loan. A history of steady employment is often seen as a good sign that you will be able to repay the loan on time.

The Loan Application Process

A construction loan is a short-term loan used to finance the building or renovation of a home or other real estate project. Construction loans are typically short term with a maximum of one year and have variable rates that move up and down with the prime rate. The rates on this type of loan are higher than rates on permanent mortgage loans. To gain approval for a construction loan, you’ll need to provide detailed estimates of the cost of your project.

You’ll also need to create a detailed budget and submit it to the lender for approval. After your loan is approved, you’ll typically have up to 12 months to complete your project. Once your project is finished, you’ll need to find a permanent loan to pay off the construction loan.Construction loans can be tricky to navigate because they’re not as widely available as other types of loans, and the application process can be confusing. Here’s what you need to know about how construction loans work and how to get one for your next project.

The first step in getting a construction loan is finding a lender that offers this type of financing. Construction loans are not offered by every lender, so you’ll need to shop around for one that does offer them. Once you’ve found a few options, compare their interest rates and terms before choosing one that’s right for you.

Once you’ve found a lender, you’ll need to complete an application and provide detailed information about your project, including its cost and schedule. Your lender will also require information about your financial history, including tax returns and credit reports. Be prepared to answer questions about your income, debts, and assets.

After your application is approved, the lender will issue a construction loan in phases (typically three), based on inspections of the completed work. For each phase, you’ll only be responsible for paying interest on the amount of money that has been disbursed so far. Once all phases are completed and the final inspection is approved, the entire balance of the loan will come due. At that point, you’ll either need to pay it off with another loan or by selling the property.