How Much Auto Loan Can I Afford?

Contents

How much auto loan can you afford? This is a common question among car buyers. Here are some tips on how to determine how much you can afford.

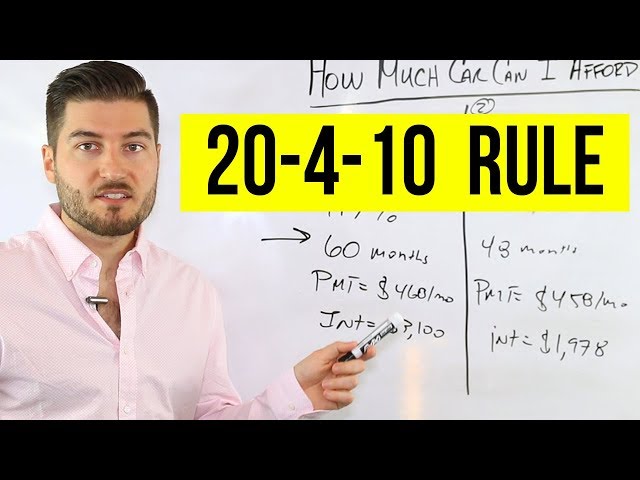

Checkout this video:

Introduction

Auto loans are a big financial responsibility, so it’s important to know how much you can afford before you start shopping for a car. Generally, experts recommend that you spend no more than 10% of your take-home pay on your car payment each month. So, if your monthly after-tax income is $3,000, you should look for an auto loan that will keep your monthly payment around $300.

Of course, this is just a general rule of thumb, and there are other factors to consider when trying to determine how much auto loan you can afford. For example, if you have a lot of other debts (e.g., credit card bills, student loans), you may want to keep your car payment lower so that you don’t get overwhelmed. Alternatively, if you have a lot of cash saved up and don’t have any other major purchases planned, you may be able to afford a higher car payment.

To get a more precise estimate of how much auto loan you can afford, consider using an online calculator or speaking with a financial advisor. Once you have a good idea of how much you can afford to spend on a car, you can start looking for the perfect vehicle!

How much can you afford?

You can use an auto loan calculator to estimate your monthly payments, but ultimately, it’s up to the lender to decide how much you can afford. Factors like your credit score, employment history, and income will all be taken into account when you apply for an auto loan. Keep in mind that the amount you can afford will also depend on the type of vehicle you’re looking to purchase.

Monthly car payments

Your monthly car payment is one of the most important factors in how much car you can afford. In order to get an idea of what your monthly payments might be, you can use a loan calculator.

If you’re not sure how much you can afford to spend on a car, you can start by looking at your monthly budget and seeing how much you can comfortably set aside for a car payment. Once you have an idea of what you can afford, you can start looking at cars that fit within your budget.

If you’re looking to finance your purchase, be sure to check with your lender to see what their requirements are for monthly payments. You’ll also want to factor in the interest rate when considering your monthly payment. The higher the interest rate, the higher your monthly payments will be.

Once you have an idea of what you can afford, start shopping around for cars that fit within your budget. Be sure to test drive each vehicle to find one that best suits your needs.

Insurance

Before you start shopping for a car, you need to have a firm understanding of your budget. This includes knowing how much you can afford to spend on a vehicle as well as how much you can afford to spend each month on a car loan.

The first step is to figure out your monthly budget. To do this, you need to take into account all of your fixed expenses, such as your mortgage or rent payment, car insurance, and any other debts you may have. Once you have your fixed expenses accounted for, you need to determine how much money you have left over each month. This is the amount of money you can afford to put towards a car loan each month.

The next step is to determine how much money you can afford to put down on a car. Generally, it is advisable to put down at least 20% of the purchase price of the vehicle. However, if you cannot afford this amount, there are still options available to you. For example, many lenders will offer financing for very little money down if you agree to pay a higher interest rate on the loan.

Once you know how much money you can afford each month and how much money you can put down on a car, you need to calculate the maximum loan amount that you can qualify for. The best way to do this is by using an online auto loan calculator. An auto loan calculator will take into account your monthly budget and the amount of money that you can put down on a car and will give you an estimate of the maximum loan amount that you will qualify for.

Now that you know the maximum loan amount that you can qualify for, it is time to start shopping for a car!

Maintenance and repairs

We all know that owning a car isn’t cheap. In addition to your monthly loan or lease payments, you have to budget for gas, insurance, and upkeep. But how much should you expect to spend on maintenance and repairs?

Unfortunately, there’s no easy answer to that question. The amount you spend will depend on a number of factors, including the make and model of your vehicle, how often you drive it, and where you take it for service.

That said, there are some general guidelines you can follow to get an idea of what you’ll be spending. According to AAA, the average driver spends about $1,000 per year on auto repairs and maintenance. This figure includes routine services like oil changes and tire rotations as well as more unexpected expenses like engine repairs and transmission work.

Of course, this is just an average, and your actual costs may be higher or lower depending on the factors mentioned above. If you drive an older car or one that isn’t well-maintained, you can expect to spend more than $1,000 per year. On the other hand, if you have a newer car with a good warranty, your repair costs may be much lower.

No matter what kind of car you have, it’s important to budget for maintenance and repairs. By setting aside money each month, you can avoid the financial stress that comes with unexpected auto expenses.

Fuel

If you’re looking to save money on fuel, you may want to consider a smaller, more fuel-efficient car. The cost of gas can add up quickly, so it’s important to factor in your estimated monthly fuel expenses when determining how much car you can afford.

Assuming you drive an average of 15,000 miles per year and gas prices are $3.00 per gallon, you would spend approximately $225 per month on gas. This is just an estimate, and your actual monthly fuel expenses may be higher or lower depending on your driving habits and the price of gas in your area.

Total cost of ownership

ownership expenses, including depreciation, interest on your loan, taxes and fees, insurance premiums, fuel, maintenance and repairs.

When you’re thinking about how much car you can afford, it’s important to look at the total cost of ownership. This is the full price of the car when you factor in all the expenses associated with ownership, including depreciation, interest on your loan, taxes and fees, insurance premiums, fuel, maintenance and repairs.

Expect to pay about 15 percent of the purchase price of your car each year in ownership costs. So if you’re buying a $20,000 car, you can expect to pay around $3,000 a year in ownership costs.

How to save money on your auto loan

When you’re looking to buy a car, one of the first things you’ll need to consider is how much you can afford to spend. This will determine the price range of the cars you can look at, as well as the type of financing you’ll need to get. There are a few different ways to save money on your auto loan, and we’ll go over some of them here.

Shop around for the best interest rate

You can often save money on your auto loan by shopping around for the best interest rate. Many lenders offer special rates for online applications, so it’s worth checking rates from a few different lenders before you apply.

It’s also important to compare loans from different lenders to make sure you’re getting the best deal. Some lenders may offer low interest rates but charge high fees, so it’s important to compare all the costs of each loan before you make a decision.

Get pre-approved for a loan

You can shop around for the best loan terms by getting pre-approved with multiple lending institutions. Each one will do a hard pull of your credit, which can temporarily lower your score, but you can offset this byComparison shopping within a 14- to 45-day period

When you find a lender with rates and terms you like, you can start the process of getting pre-qualified. After verifying your identity, employment and income, the lender will give you a letter that states how much they’re willing to lend you. The amount will be based on their assessment of your ability to repay the loan, as well as the value of the vehicle you plan to purchase.

With a pre-approval in hand, you’ll have a better idea of how much car you can afford and be in a stronger negotiating position when it comes time to seal the deal on your new ride.

Make a large down payment

One of the quickest ways to lower your monthly car payment is to increase the size of your down payment. A larger down payment has two major benefits:

1. You’ll owe less money overall.

2. You’ll likely qualify for a lower interest rate, which can save you money in the long run.

If you don’t have much saved for a down payment, there are a few things you can do to try to increase the amount. If possible, wait a few months to purchase your car so that you have time to save up more money. You could also look into Trade-In programs offered by dealerships or explore other financing options, such as a personal loan.

Conclusion

After figuring out how much you can afford to spend on a car, the next step is to figure out how much you can afford to finance. This will give you your maximum loan amount. To do this, simply add up your income (after taxes) and subtract your other monthly payments (for things like rent, student loans, etc.). The resulting number is the maximum amount you can afford to spend on a car loan.