How Long Does an SBA Loan Take to Be Approved?

How long does it take to get approved for an SBA loan? The answer may surprise you – it can be as little as 30 days! Here’s what you need to know about the SBA loan approval process.

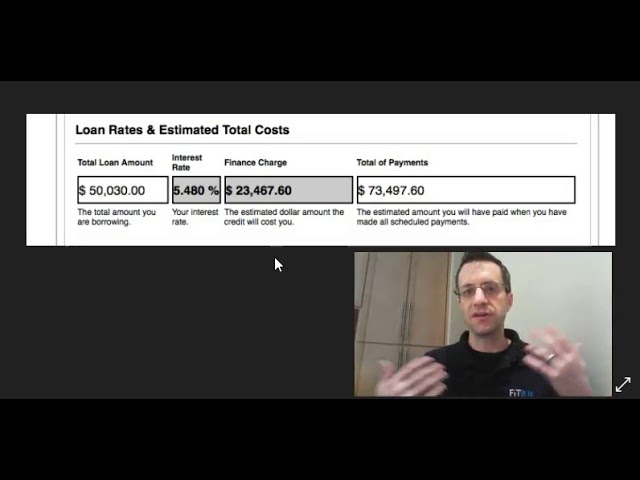

Checkout this video:

SBA Loan Basics

The Small Business Administration (SBA) is a federal agency that provides financial assistance to small businesses. One of the ways they do this is through SBA loans. SBA loans are available through participating lenders, such as banks, and they are guaranteed by the SBA. This means that if you default on your loan, the SBA will pay back the lender.

What is an SBA loan?

The Small Business Administration (SBA) is a federal agency that provides financial assistance to small businesses. One of the most popular programs is the SBA loan, which can be used for a variety of purposes, including start-up costs, working capital, and expansion.

SBA loans are made through participating lenders, such as banks, credit unions, and development companies. The SBA does not directly lend money to small businesses; instead, it guarantees a portion of the loan, which reduces the risk for the lender and makes it more likely that the loan will be approved.

SBA loans typically have lower interest rates and longer repayment terms than other types of loans, making them an attractive option for small businesses. But they can also take longer to be approved than other loans; in some cases, it can take several months for an SBA loan to go through the approval process.

How long does an SBA loan take to be approved?

The entire process—from the time you submit your loan application to the moment you receive your loan funds—usually takes about two to six weeks. The SBA approval process is generally quicker than going through a traditional bank.

The length of time it takes to get an SBA loan approved depends on a few factors, including:

-The type of loan you’re applying for

-How complete and accurate your loan application is

-How quickly you submit any requested additional documentation

-The current workload of the SBA office processing your loan

You can usually expect a decision on your loan application within 30 to 60 days, but it’s not unusual for the process to take longer.

SBA Loan Application Process

The first step in applying for an SBA loan is to fill out the loan application form. Once you have submitted the form, the SBA will review your application and determine whether or not you are eligible for the loan. If you are approved for the loan, the next step is to submit your financial information.

How to apply for an SBA loan

The first step in applying for an SBA loan is to get in touch with your local SBA district office. You can also apply online, but it’s often helpful to speak with someone in person first.

Once you’ve made contact, you’ll need to fill out some paperwork and provide some basic information about your business. The SBA will then send you a list of approved lenders in your area.

You’ll need to choose one of these lenders and complete the loan application process with them. This usually involves completing a detailed business plan and providing financial statements.

Once your application is complete, the lender will submit it to the SBA for approval. The SBA typically takes 2-3 weeks to approve or deny a loan application. If your application is approved, the lender will work with you to finalize the loan agreement and get the money you need.

What is the SBA loan application process?

The SBA loan application process can take some time, but it’s worth it if you want to get the best possible loan for your business. Here’s a step-by-step guide to the process:

1. Research the different types of SBA loans and decide which one is right for your business.

2. Gather the required documents, such as financial statements, tax returns, and business plans.

3. Fill out the online application or download and print a paper application.

4. Submit your completed application to the SBA lender of your choice.

5. The SBA will review your application and make a decision on your loan.

SBA Loan Approval Timeline

The Small Business Administration (SBA) loan program is a government-backed loan program that provides financing to small businesses. The SBA does not directly lend money to small businesses. Rather, it provides guarantees to lenders, which reduces the risk for the lender and makes it more likely that the lender will approve the loan.

How long does it take for an SBA loan to be approved?

The SBA Loan approval timeline can vary depending on the type of loan you are applying for and the lender you are working with. In general, the process can take anywhere from a few weeks to a few months.

The first step in the process is to fill out and submit an application. Once your application is received, a lender will review it and determine if you meet the eligibility requirements. If you do, they will send you a loan package to complete.

This loan package will include all of the necessary paperwork that needs to be completed and returned to the lender. Once the lender has received all of the required paperwork, they will begin processing your loan.

The processing time can vary depending on the type of loan and the number of applications they are currently working on. In general, it takes approximately 30 days for a loan to be approved or denied.

If your loan is approved, you will then need to sign all of the necessary documents and agree to the terms and conditions of the loan. Once this is done, the funds will be disbursed to you and you can begin using them for your business needs.

What factors influence the SBA loan approval timeline?

The SBA loan approval timeline can vary depending on a number of factors, including the type of loan you apply for, the amount of money you borrow, and the Lender you work with.

For example, an SBA 7(a) Loan for working capital can take anywhere from 2-3 weeks to be approved, while an SBA 504 Loan for commercial real estate can take up to 90 days.

Some of the other factors that can influence the timeline for your loan include:

-The strength of your business plan

-Your personal credit history

-The amount of collateral you have to offer

-Whether you have all the required documentation

-How busy your Lender is

SBA Loan Tips

The SBA loan process can seem complex and time-consuming, but we’re here to help make it as smooth as possible. In this article, we’ll break down the SBA loan process step-by-step so you know what to expect. We’ll also provide some tips to help you get approved for an SBA loan.

How to increase your chances of SBA loan approval

Here are a few things you can do to increase your chances of SBA loan approval:

1. Get your financial documents in order

2. Have a well-thought-out business plan

3. Choose the right lender

4. Be prepared to explain why you need the loan

What to do if your SBA loan is not approved

If you’ve applied for an SBA loan and been denied, you’re not alone. In FY2019, the SBA approved $28.9 billion in 7(a) loans, but rejected nearly 60,000 loan applications totaling $11.4 billion.

The good news is that you have options if your application is denied. Here are four steps you can take:

1. Review the SBA’s reason for denial. The SBA will send you a notice that explains why your loan was not approved. Be sure to review this notice carefully so you can address the issues raised by the SBA.

2. Appeal the decision. If you believe the SBA made a mistake in its decision, you can file an appeal within 30 days of receiving the notice of denial.

3. Work with a nonprofit lender. There are many nonprofit lenders that work with small businesses, including those that have been denied for an SBA loan. These lenders may be able to offer you more favorable terms than a traditional bank.

4. Seek other financing options. If you’re unable to get an SBA loan or another traditional bank loan, there are other financing options available, such as alternative lenders or business credit cards.