What is a Recourse Loan?

Contents

You may have heard the term “recourse loan” but what does it mean? In this blog post, we’ll explain what a recourse loan is and how it works.

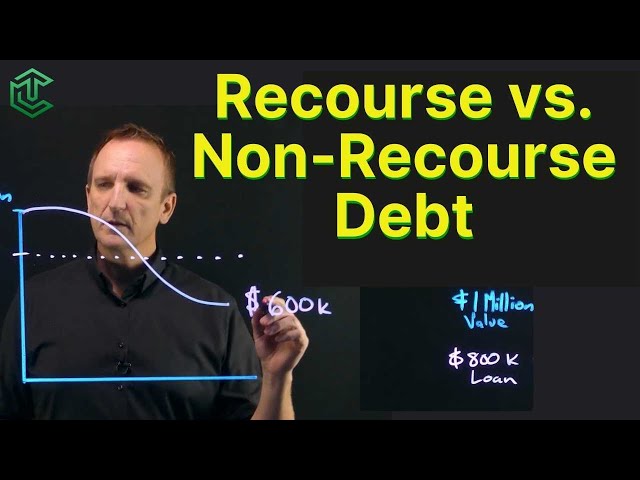

Checkout this video:

Introduction

A recourse loan is a type of loan in which the borrower agrees to give the lender the right to take legal action against him or her if the loan is not repaid. The most common type of recourse loan is a mortgage, in which the house being purchased serves as collateral for the loan. If the borrower defaults on the loan, the lender can foreclose on the property and sell it in order to recoup his or her losses.

Other types of recourse loans include auto loans and personal loans. In most cases, if the borrower defaults on a recourse loan, the lender can sue him or her for payment. If the borrower does not have enough money to repay the debt, the lender may be able to garnish his or her wages or seize other assets.

A non-recourse loan is a type of loan in which the borrower does not give the lender any legal rights to take action against him or her if the loan is not repaid. In most cases, non-recourse loans are securitized, which means that they are backed by collateral (such as a mortgage). If the borrower defaults on a non-recourse loan, the lender can only seize and sell the collateral; he or she cannot sue for payment or Garnish wages.

What is a Recourse Loan?

A recourse loan is a type of loan that allows the lender to take legal action against the borrower if the borrower does not repay the loan. This type of loan is typically used for large loans , such as mortgages and business loans.

What is a recourse loan?

A recourse loan is a type of loan that allows the lender to seek compensation from the borrower beyond the collateral pledged for the loan. In other words, if the borrower defaults on the loan, the lender can go after the borrower’s other assets to collect on the debt.

Recourse loans are often used in situations where the collateral is not enough to cover the entire loan amount. For example, if a borrower takes out a $100,000 loan to buy a house and pledges the house as collateral, but then defaults on the loan and owes $110,000, the lender can seek to collect the additional $10,000 from the borrower.

Recourse loans are different from non-recourse loans, which do not allow lenders to go after a borrower’s other assets in case of default. Non-recourse loans are often used in situations where the collateral is worth more than the loan amount (so even if the borrower defaults, the lender will still be able recover its losses).

What are the benefits of a recourse loan?

A recourse loan is a type of loan that allows the lender to seek reimbursement from the borrower if the borrower defaults on the loan. In other words, if you take out a recourse loan and you default on the payments, the lender can come after you for the outstanding balance of the loan.

Recourse loans are typically used for high-value items, such as real estate or vehicles. They’re also common in business loans. The main benefit of a recourse loan is that it allows the lender to recoup some of their losses if the borrower defaults.

There are some downsides to recourse loans, however. First, they often come with higher interest rates than non-recourse loans. Second, if you default on a recourse loan, the lender can pursue legal action against you and try to collect the outstanding balance of the loan from your assets. This can damage your credit score and make it difficult to get future loans.

If you’re considering taking out a recourse loan, be sure to weigh the pros and cons carefully. Make sure you understand all of the terms of the loan before you sign anything. And be sure to shop around and compare interest rates to get the best deal possible.

What are the risks of a recourse loan?

If you default on a recourse loan, the lender may come after your personal assets in order to recoup their loss. This is in contrast to a non-recourse loan, where the lender’s only remedy is to foreclose on the property itself. Because of this added risk, recourse loans generally have higher interest rates than non-recourse loans.

How to Get a Recourse Loan

A recourse loan is a type of loan that allows the lender to demand repayment from the borrower’s other assets if the borrower defaults on the loan. This type of loan can be useful for borrowers who have a difficult time qualifying for a loan from a traditional lender. However, it is important to understand the terms of a recourse loan before signing any paperwork.

How to get a recourse loan

If you’re thinking of taking out a loan, you may be wondering what a recourse loan is and how to get one. A recourse loan is a type of loan that gives the lender the right to seize your assets if you default on the loan. This means that if you can’t repay the loan, the lender can take your property or other assets to recoup their losses.

While this may sound like a scary proposition, recourse loans can actually be a good option for borrowers who may not have the best credit. That’s because lenders are more likely to approved borrowers for a recourse loan if they have collateral to back up the loan. This means that if you do default on the loan, the lender has something to fall back on.

If you’re thinking of taking out a recourse loan, there are a few things you should keep in mind. First, make sure you understand the terms of the loan and what your obligations are. Second, make sure you have some form of collateral to back up the loan. And finally, make sure you shop around and compare interest rates and terms from different lenders before choosing one.

How to qualify for a recourse loan

A recourse loan is a type of loan that allows the lender to collect not only from the borrower, but also from any guarantors of the loan. In order to qualify for a recourse loan, you will need to have good credit and collateral. The interest rates on recourse loans are usually higher than non-recourse loans.

How to compare different recourse loans

When you’re trying to find the best recourse loan for your needs, it’s important to compare different offers from a variety of lenders. There are a few key things to look for when you’re comparing loans, including:

-The interest rate: This is the amount of money you’ll be paying back in addition to the amount you borrow, so it’s important to get a loan with a low interest rate.

-The term: The term is the length of time you have to repay the loan, so you’ll want to choose a loan with a term that fits your needs.

-The fees: Some loans come with origination fees or other charges, so be sure to compare the total cost of the loan before you make a decision.

Once you’ve found a few different loans that meet your needs, it’s time to start comparing them side by side. You can use an online calculator to help you compare the total cost of each loan, including the interest rate, fees, and term. Be sure to compare apples to apples when you’re using a calculator—for example, don’t compare a 30-year mortgage with a 15-year mortgage.

Once you’ve found the loan that offers the best terms for your needs, it’s time to apply. You can do this online or in person at a bank or credit union. Be sure to have all of your financial documents ready when you apply, including your tax returns, pay stubs, and bank statements.

Conclusion

A recourse loan is a type of loan that allows the lender to seek repayment from the borrower if the loan is not repaid. This type of loan is often used for high-risk borrowers, such as those with bad credit or a history of defaulting on loans. Recourse loans can be either secured or unsecured, and they typically have higher interest rates than other types of loans.