How Long Do Student Loans Stay on Your Credit?

Contents

If you’re wondering how long student loans stay on your credit report, the answer is usually around seven years. However, there are a few things that can impact this, so it’s important to know the details.

Checkout this video:

The basics of student loans and credit

Student loans can help you pay for college, but they can also have a lasting impact on your finances and credit. It’s important to understand how student loans work and how they can affect your credit. In this article, we’ll discuss the basics of student loans and credit.

How student loans can impact your credit

Student loans can have a positive or negative impact on your credit, depending on how you manage them. If you make your payments on time and in full, your student loans can help build your credit history and improve your credit score. However, if you miss payments or default on your loan, it can damage your credit.

According to the Consumer Financial Protection Bureau, about 40 million Americans have student loan debt, totaling more than $1.5 trillion. And while most borrowers are repaying their loans responsibly, more than 8 million are delinquent or in default.

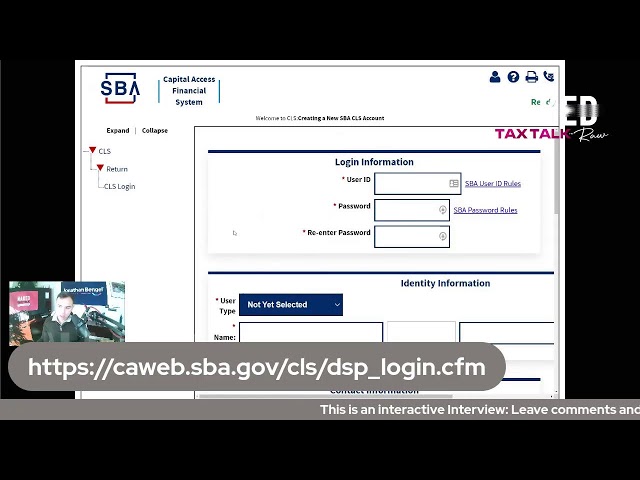

If you’re struggling to make your student loan payments, there are options available to help you get back on track. You can contact your lender to discuss alternatives, such as deferment or forbearance. You can also consider consolidating or refinancing your loans to get a lower interest rate or longer repayment term.

If you’re struggling with debt, it’s important to seek help from a reputable source. You can find free counseling and assistance from nonprofit organizations like the National Foundation for Credit Counseling or the Money Management International Financial Education Foundation.

The different types of student loans

There are two main types of student loans: federal student loans and private student loans.

Federal student loans are issued and backed by the U.S. Department of Education. You can get these loans through the federal government’s Direct Loan program.

Private student loans are issued by banks, credit unions, and other financial institutions. They’re not backed by the federal government.

The type of loan you have will affect how long it stays on your credit report. Federal student loans generally stay on your report for seven years after you graduate or leave school, while private student loans usually stay on your report for 10 years after you graduate or leave school.

How long do student loans stay on your credit report?

Federal student loans

Federal student loans will stay on your credit report for up to seven years after you either drop out of school or finish repaying the loan. This is true even if you never miss a payment and pay the loan off early.

Private student loans

Private student loans will stay on your credit report for seven years from the date of the first missed payment. If you make all of your payments on time, they will come off your report early.

How to manage your student loans and credit

Tips for paying off your student loans

-Start by evaluating your budget to see how much you can realistically afford to put towards your student loans each month.

-Try to make payments that are at least the size of your monthly interest charges, even if you can’t afford the full amount of your loan payments.

-If you have multiple student loans, consider consolidating them into a single loan with a lower interest rate.

-If you’re having trouble making your loan payments, contact your lender or servicer to discuss your options. You may be able to temporarily postpone or lower your payments.

Tips for improving your credit score

Your credit score is a number that reflects the information in your credit report. This number is used by lenders to decide whether or not to give you a loan, and if so, how much interest to charge you. A higher credit score means you’re a lower-risk borrower and are more likely to get approved for a loan at a lower interest rate.

There are several things you can do to improve your credit score:

1) Make sure your credit report is accurate. Check it periodically for errors and dispute any that you find.

2) Pay your bills on time, every time. This includes not just your credit card bills, but also things like rent, utilities, and cell phone service.

3) Use a mix of different types of loans, such as auto loans, student loans, and credit cards. Having different types of loans shows lenders that you can handle different types of debt responsibly.

4) Keep your debt-to-income ratio low. This ratio is calculated by dividing your monthly debt payments by your monthly income. Lenders want to see that you’re not overextending yourself financially and that you’ll be able to make your loan payments on time each month.

5) Keep older accounts open even if you don’t use them anymore. Length of credit history is one of the factors that makes up your credit score, so it’s important to keep old accounts open even if you don’t use them anymore.