How Long After Bankruptcy Can I Get a FHA Loan?

It’s a common question we get asked and it’s one we’re happy to answer. You can get an FHA loan just 24 months after a bankruptcy.

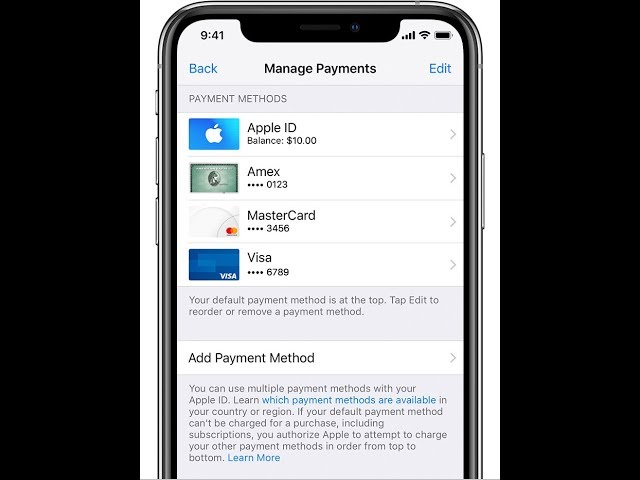

Checkout this video:

Bankruptcy Basics

Bankruptcy is a legal process that allows you to discharge or restructure your debts. Depending on the type of bankruptcy you file, you may be able to get rid of some or all of your debts. Filing for bankruptcy can give you a fresh start and help you get back on your feet. However, it is important to understand that bankruptcy is not a quick fix. There are a few things you should know before you file for bankruptcy.

What is bankruptcy?

Bankruptcy is a legal process that allows individuals or businesses to eliminate or repay their debts under the protection of the bankruptcy court. There are different types of bankruptcies, but the two most common are Chapter 7 and Chapter 13.

In a Chapter 7 bankruptcy, also known as a liquidation bankruptcy, the debtor’s assets are sold in order to repay creditors. In a Chapter 13 bankruptcy, also known as a reorganization bankruptcy, the debtor reorganizes their finances and enters into a repayment plan with creditors.

Both types of bankruptcies have pros and cons, and it is important to speak with an attorney to determine which type of bankruptcy is right for you.

What are the different types of bankruptcy?

There are different types of bankruptcy that can be filed depending on the circumstances. The three most common types are:

-Chapter 7 bankruptcy: Also known as a “liquidation” or “straight bankruptcy,” this is the most common type of bankruptcy. It allows you to discharge most debts, although some, such as alimony, child support and student loans, cannot be discharged.

-Chapter 11 bankruptcy: This type of bankruptcy is usually filed by businesses, but individuals can also file. It reorganizes your debts and allows you to keep your property.

-Chapter 13 bankruptcy: Also known as a “wage earner’s plan,” this type of bankruptcy allows you to repay your debts over a three- to five-year period.

What are the consequences of bankruptcy?

There are a number of consequences associated with bankruptcy. These can include:

-The loss of certain assets, including your home or car

-The impact on your credit rating, which can make it difficult to get a loan or credit card in the future

-The effects on your employment, as some employers may be reluctant to hire someone who has declared bankruptcy

-The impact on your ability to get insurance, as some insurers may view you as a higher risk

Bankruptcy can also be a costly process, both in terms of the fees you will have to pay to your lawyer and the court, and in terms of the time and effort it will take to go through the process.

FHA Loan Basics

A Federal Housing Administration loan is a great financing option if you have a small down payment and less-than-perfect credit. The FHA insures these loans, and if you default on your loan, the FHA will pay the lender.

What is an FHA loan?

FHA loans are government-backed mortgages insured by the Federal Housing Administration. These loans are available to homeowners who may not qualify for conventional loans and have lower credit scores. FHA loans allow borrowers to finance up to 96.5% of their home’s purchase price, meaning they can purchase a home with a down payment as low as 3.5%.

How do FHA loans work?

An FHA loan is a government-backed mortgage insured by the Federal Housing Administration, or FHA. Popular with first-time homebuyers, FHA home loans require lower minimum credit scores and down payments than many conventional loans. You can qualify for an FHA loan with a credit score as low as 500 with 10 percent down. To get the maximum financing, you need a credit score of 580 or higher and 3.5 percent down.

If you have a bankruptcy in your past, you may still be eligible for an FHA loan. After Chapter 7 bankruptcy, you must wait two years to get an FHA loan. For Chapter 13 bankruptcy, you must wait until you have made 12 months of payments and received court approval.

What are the benefits of an FHA loan?

FHA loans are government-backed mortgages that provide borrowers with a more accessible and affordable home financing option. Although FHA loans are not restricted to first-time home buyers, they are generally more attainable than conventional loans because they have lower credit score and down payment requirements. In addition, FHA loans come with several other benefits that can make the home buying process easier and more affordable, such as:

– lenient credit requirements

– low down payment options

– higher debt-to-income ratios

– more flexible employment history guidelines

– assumable mortgage feature

How Long After Bankruptcy Can I Get an FHA Loan?

It’s possible to get an FHA loan after a bankruptcy filing, but you’ll have to wait at least two years and you’ll need to prove that you’ve re-established good credit. If you wait longer than two years, you’ll need to pay a special kind of premium mortgage insurance.

Chapter 7 bankruptcy

FHA loan rules for borrowers after Filing Bankruptcy. May 20, 2019 – In a tough economy borrowers worry about bankruptcy, foreclosure, and the effects such issues can have on the ability to borrow.

One big topic these days concerning FHA home loans involves the required waiting period for new FHA home loans after filing bankruptcy or foreclosure.

Chapter 13 bankruptcy

If you have filed for Chapter 13 bankruptcy, you may be eligible for an FHA loan after making regular payments for at least one year. If you have made all of your payments on time and can show that the bankruptcy has had no effect on your current ability to pay your mortgage, you may be eligible for an FHA loan.

Other types of bankruptcy

There are two other types of bankruptcy that can be filed in the United States, but they are much less common than Chapter 7 and Chapter 13. Chapter 11 bankruptcy is typically used by businesses that need to reorganize their debts, and it can be used by individuals as well. In a Chapter 11 bankruptcy, the debtor remains in control of their assets and is given a certain amount of time to come up with a repayment plan. If the debtor is unable to come up with a plan or make the required payments, then the case may be converted to a Chapter 7 bankruptcy.

Chapter 12 bankruptcy is designed specifically for farmers and fishermen. It works similarly to a Chapter 13 bankruptcy, but the repayment period is usually shorter (three to five years) and the debt limits are higher.

If you have filed for any type of bankruptcy, you will need to wait a certain amount of time before you will be eligible for an FHA loan. The waiting periods vary depending on the type of bankruptcy that was filed, as well as the circumstances surrounding the bankruptcy.