How Credit Card Payment is Calculated

Contents

A credit card payment is calculated by first adding up all of the interest and fees associated with the card, and then dividing that number by the number of days in the billing cycle.

Checkout this video:

How is credit card payment calculated?

Most people don’t know how credit card companies calculate your minimum payment. Your minimum payment is usually a percentage of your balance, plus interest and fees. For example, let’s say your credit card balance is $1000 and your interest rate is 15%. Your minimum payment would be $25, which is 2.5% of your balance.

Introductory rates

Interest on credit card debt is not simple. Although you have a stated APR, your interest charge may be different from month to month, and it’s important to understand how your issuer calculates it.

Here we’ll focus on how issuers calculate interest charges during the introductory rate period. After that, we’ll look at how they calculate interest for balances subject to the regular APR.

With credit cards, you almost always have a grace period during which you can avoid paying interest on new purchases. But once the grace period ends, any balance you carry will start accruing interest at the card’s stated APR.

For example, say you have a credit card with a 20% APR and a $1,000 balance. If your issuer uses the average daily balance method (explained below), you would be charged $33 in interest for that month (($1,000 x 0.20)/12 = $33).

But if you only pay the minimum amount due each month ($25 in this example), it would take you 40 months to pay off the balance, and you would end up paying $381 in interest — more than three times the original balance! And that’s not including any additional fees or charges.

Average daily balance

Your credit card company probably uses your average daily balance to calculate your interest charges.

To get your average daily balance, the credit card issuer first adds up your ending balance for each day of the billing cycle. Then, it divides that total by the number of days in the cycle. The resulting number is your average daily balance.

Let’s say that you have a credit card with a $1,000 credit limit and a 20% annual percentage rate (APR). Assume further that you make these transactions during a period when there are 30 days in the billing cycle:

Day 1: You spend $100. Your balance is $100.

Day 2: You spend $50. Your balance is $150.

Day 3: You don’t use your card. Your balance is $150.

Balance transfer

When you make a purchase with your credit card, the issuer of your card will lend you the money for that purchase. If you don’t pay off your balance in full each month, you will be charged interest on the outstanding balance.

The interest rate that you are charged on your credit card depends on a number of factors, including the type of card that you have, the prime rate, and your creditworthiness. Most credit cards have variable interest rates, which means that the interest rate can go up or down over time.

If you have a balance on your credit card from a previous month, this is called a “carryover balance.” The interest on a carryover balance is calculated using what’s called the “average daily balance” method.

To calculate your average daily balance, the issuer of your card will take the beginning balance for each day in the billing cycle and add any new charges or payments that are made during that day. This figure is then divided by the number of days in the billing cycle to arrive at the average daily balance.

The interest on a carryover balance is then calculated by multiplying the average daily balance by the monthly interest rate (also called the “annual percentage rate,” or APR). This figure is then divided by 12 to arrive at the amount of interest charges for one month.

Cash advance

When you get a cash advance, you’re essentially borrowing money from your credit card issuer. The interest rate on a cash advance is often higher than the purchase APR, and you’ll start accruing interest on the transaction as soon as it posts to your account — there’s no grace period like there is for purchases.

How to calculate your credit card payment?

Determine your APR

The first step in understanding how your credit card company calculates your monthly payment is to understand your annual percentage rate (APR). This is the interest rate that you’re charged on your outstanding balance each year. For example, if your APR is 15%, that means you’ll be charged 15% interest on any unpaid balances carried over from month to month. To calculate your monthly interest charges, simply multiply your outstanding balance by your APR, and then divide that number by 12 (since there are 12 months in a year).

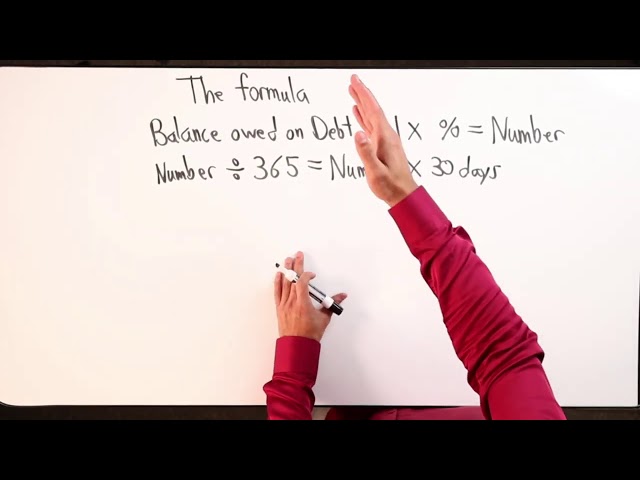

Determine your daily periodic rate

Your daily periodic rate is your APR divided by the number of days in the year. If your APR is 15% and there are 365 days in the year, your daily periodic rate would be .04109%.

To calculate your daily periodic rate, divide your APR by 365.

Determine your average daily balance

Your average daily balance is your balance at the end of each day of your billing cycle, divided by the number of days in that billing cycle. This is the balance that accrues interest charges.

For example, let’s say you have a credit card with a $1,000 credit limit and a 20% annual percentage rate (APR). During the month, you charge $500 and make a payment of $200. At the end of the month, your balance is $300. Your average daily balance for the month would be (($1000 x .2/365) + ($500 x .2/365) + ($300 x 29/365)) / 31 or $9.59.

Calculate your minimum payment

On your credit card statement, you’ll find your minimum payment due. This is usually a percentage of your balance, plus any fees and interest charges that have accrued since your last billing period.

To calculate your minimum payment, start by adding up any new charges, fees, and interest since your last statement. Then, multiply your APR by your balance to get the total amount of interest you’ll owe for the month. Finally, add up these two totals to get your minimum payment amount.

For example, let’s say you have a balance of $1,000 and an APR of 15%. Your interest for the month would be $150 (0.15 x $1,000), and your minimum payment would be $250 ($1,000 + $150).

If you have a low balance and can afford to pay more than the minimum payment each month, you should do so. This will help you pay off your debt faster and save money on interest charges.

How to make a payment?

In order to make a payment, you need to know how much you owe and what the minimum payment is. The minimum payment is usually a percentage of your balance, and it changes depending on your credit card issuer. You can find your minimum payment by looking at your most recent statement.

Online

Assuming that you are making a payment on an online store, the process is relatively simple. After you have added the items you wish to purchase to your cart and are ready to checkout, you will be prompted to enter your credit card information. This will include the 16-digit card number, as well as the expiration date and security code. Once you have entered this information, you will click the “submit” or “complete purchase” button, and the funds will be transferred from your credit card to the store’s account.

In some cases, you may also be asked to enter your billing address and zip code. This is for verification purposes, as the card issuer will want to confirm that the address on file for your account matches the one being used for the transaction. Once everything has been verified and the payment has gone through, you will receive an email confirmation from the store, as well as a receipt from your credit card issuer.

By phone

To make a payment by phone, please call the customer service number on the back of your card. You will need to provide your account number, name as it appears on the card, and billing address.

In person

When you use your credit card to make a purchase in person, the merchant will run your card through a credit card reader. The reader will capture your credit card information and send it to the credit card network. The credit card network will then route the transaction to your credit card issuer for approval. Once your issuer approves the transaction, it will be authorized and the funds will be transferred from your credit card account to the merchant’s account.

When is your payment due?

Your credit card payment is calculated based on your average daily balance. This means that your payment will fluctuate based on your spending patterns. For example, if you spend more during the month, your payment will be higher. You can view your payment due date in your online account or on your monthly statement.

Grace period

The grace period is the specified time period during which you can avoid paying finance charges on your credit card balance. If you pay your balance in full by the due date each month, you’ll usually avoid finance charges. However, if you don’t pay in full, you’ll be charged a finance charge on the unpaid balance, starting from the date of purchase. Check your credit card agreement or contact your issuer for more details about when finance charges begin to accrue.

Most credit card issuers give cardholders a grace period of 21 days to pay their balance in full before finance charges are assessed. However, some issuers have shorter grace periods of 20 days or even 15 days. Additionally, some issuers do not offer a grace period on cash advances and balances transferred from other accounts, so it’s important to check with your issuer to see what applies in your case.

Late payment

If you’re planning to pay your credit card bill late, you’ll need to know how much it will cost you. Here’s a look at how late payments are calculated.

Most credit card issuers charge a late fee if you don’t pay your bill by the due date. The fee is typically around $25 for your first offense, and it can go up to $35 or more for subsequent offenses.

Some issuers also charge a higher interest rate on your outstanding balance if you make a late payment. This penalty rate can be as high as 29.99%, so it’s important to make sure you pay your bill on time to avoid these additional costs.

What are the consequences of not paying your credit card bill?

If you don’t pay your credit card bill, you will be charged interest. This interest is calculated based on your average daily balance. The interest rate is usually a percentage of your APR, and you will be charged this rate on the outstanding balance of your credit card. Not paying your credit card bill can also result in late fees and penalty APR.

Fees

One of the consequences of not paying your credit card bill is that you will be charged fees. These fees can add up quickly, and they can be very expensive. The late payment fee is typically around $35, but it can be as high as $55 or more. If you miss a payment, you will also be charged interest on the outstanding balance. The interest rate on credit cards is typically much higher than the interest rate on a loan, so this can add up quickly. Additionally, your credit score will suffer if you miss a payment, which could make it more difficult to get approved for loans in the future.

Interest

Interest is charged on your outstanding balance from the day your statement is produced until the day you pay, and is calculated using a daily rate.

The daily rate is worked out by dividing your APR by the number of days in the year. So, if you have an APR of 18% and you owe £100, the daily rate would be 0.00049% (18 ÷ 365).

If you don’t clear your balance in full every month, interest will be charged at this rate on the portion of your balance that remains outstanding.

Credit score

Your credit score is one of the most important factors in your financial life. It can affect everything from getting a loan to renting an apartment. So it’s no surprise that one of the consequences of not paying your credit card bill is a lower credit score.

When you don’t pay your credit card bill on time, it’s reported to the credit bureaus as a late payment. This can cause your credit score to drop. The late payment will also stay on your credit report for seven years, so it can have a long-term impact on your score.

In addition to a lower credit score, you may also face other consequences if you don’t pay your credit card bill. These can include higher interest rates, late fees, and being turned over to a collection agency. If you’re struggling to make your payments, contact your credit card issuer or lender to see if they can help you make arrangements before you miss a payment.