How Fast Will a Car Loan Raise My Credit Score?

Contents

Find out how quickly a car loan can raise your credit score. We’ll give you some tips on how to improve your credit score.

Checkout this video:

The car loan process

Before you can understand how a car loan will affect your credit score, you need to know how the process works. It all starts with a loan application. The lender will then order a credit report and score from one or more of the credit reporting bureaus. After that, the lender will look at your employment history, income, and debts to determine if you qualify for the loan. If you do, the lender will send you a loan offer.

Applying for a car loan

When you apply for a car loan, the lender will run a hard inquiry on your credit report, which can temporarily lower your credit score by a few points. But if you make all your payments on time and in full, the positive impact of the loan on your credit score will eventually outweigh the temporary dip. The key is to keep your balances low and make all your payments on time and in full.

Getting approved for a car loan

There are a few things you can do to give yourself the best chance of getting approved for a car loan. Firstly, make sure you have all the necessary documents handy – things like your driver’s license, proof of income, and so on. Secondly, it’s always a good idea to shop around and compare interest rates from different lenders before you apply for a loan. And finally, try to get pre-approved for a loan before you start shopping for a car – this will give you an idea of how much you can afford to spend.

How a car loan affects your credit score

A car loan can help improve your credit score if it’s managed responsibly. Payment history is the biggest factor in credit scores, and a car loan gives you the opportunity to make on-time payments and improve your payment history. Additionally, the revolving credit associated with a car loan can help improve your credit mix, which is another factor that contributes to your credit score.

The impact of a car loan on your credit score

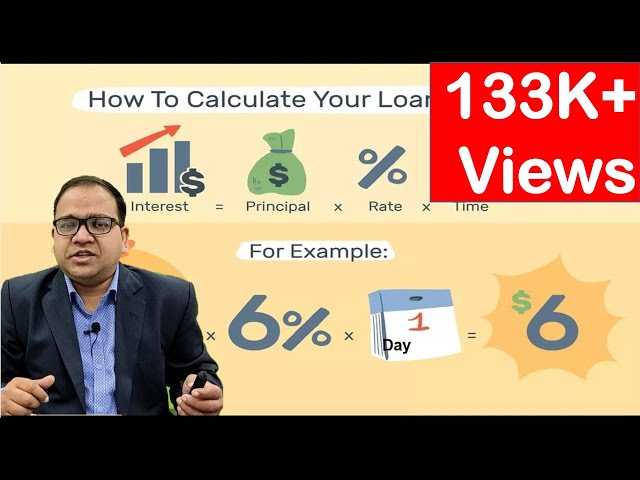

A car loan is a type of installment loan, which means it’s a set loan that you pay off in equal monthly payments. Installment loans are different from revolving debt, such as credit cards, which have no set repayment schedule.

Because installment loans have a set repayment schedule, they can be helpful in building your credit score. That’s because one of the factors that goes into your credit score is your “credit mix,” or the different types of credit you have. So having both revolving debt (like credit cards) and installment debt (like a car loan) can help boost your score.

How much your car loan affects your credit score depends on a few factors:

-Your payment history: One of the most important factors in your credit score is your payment history, or whether you pay your bills on time. So if you make all your car loan payments on time and in full, that will help boost your score.

-Your credit utilization: This is the ratio of the amount of credit you’re using to the amount of credit you have available. You want to keep your utilization rate low — ideally below 30% — because using too much of your available credit can hurt your score. So if you have a $20,000 car loan and a $30,000 credit limit, your utilization rate would be 66%. That’s pretty high, so you might want to try to pay down your debt to get it below 30%.

-The age of your accounts: The length of your credit history makes up 15% of your FICO® Score☉ , so having a longer history can help boost your score. So if you take out a five-year car loan, that will help lengthen your average account age and could give you a small bump in points.

-Your other debts: If you have other debts — like student loans or medical debt — that might also impact how much paying off a car loan helps improve your score

How long it takes for a car loan to impact your credit score

When you take out a car loan, the loan will appear on your credit report as new debt. This can have a negative impact on your credit score, although the exact effect will depend on your individual financial situation.

Typically, it takes about 30 days for a new car loan to appear on your credit report. Once it does, your score may drop by a few points. However, if you have a good history of making timely payments on other debts, this drop may be offset by the positive impact of having another active loan on your credit report.

Over time, as you make timely payments on your car loan, your credit score will gradually improve. Eventually, the negative impact of the loan will diminish and your score will return to its pre-loan level (or even higher).

So, while a car loan can temporarily lower your credit score, it can also help to improve your score in the long run – as long as you make all of your payments on time.

Tips for raising your credit score with a car loan

If you’re looking to raise your credit score, one option is to take out a car loan. A car loan can help improve your credit score by showing that you’re able to make regular, on-time payments. Additionally, the loan will add to your credit history, which can also help improve your credit score. Here are a few tips to keep in mind when taking out a car loan to help raise your credit score.

Make on-time payments

One of the most important things you can do to raise your credit score is to make your payments on time. That includes any kind of loan, including a car loan. late payments can stay on your credit report for up to seven years, so it’s important to stay on top of your payments. If you know you’re going to have trouble making a payment, talk to your lender ahead of time to see if you can work out a payment plan.

Keep your credit utilization low

Your credit utilization is the ratio of your outstanding balances to your credit limits. It’s one of the most important factors in your credit score, and you should aim to keep it below 30% (ideally, below 10%). That means if you have a $5,000 credit limit, you shouldn’t carry a balance of more than $1,500.

Pay off your loan as soon as possible

If you want to raise your credit score quickly with a car loan, one of the best things you can do is pay off the loan as soon as possible. The longer you have the loan, the more it will help your credit score. But, if you pay it off sooner, you’ll get the benefit of the boost to your credit score faster. Plus, you’ll save money on interest payments. So, if you can swing it, pay off your car loan as fast as you can.