How Does the Federal Solar Tax Credit Work?

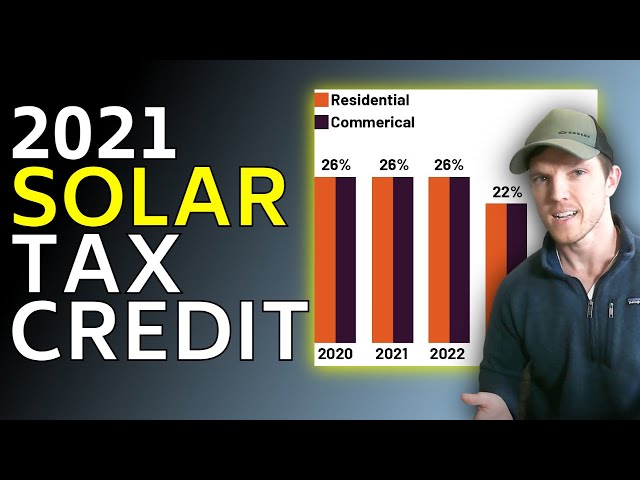

The federal solar tax credit, also known as the Investment Tax Credit (ITC), allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes. The ITC applies to both residential and commercial systems, and there is no cap on its value.

Checkout this video:

The Federal Solar Tax Credit

The federal solar tax credit is a tax credit that allows you to deduct a certain amount of money from your federal taxes for installing solar panels. The solar tax credit is available for both residential and commercial properties. The credit is available for both new and existing structures.

What is the solar tax credit?

The solar Investment Tax Credit (ITC) is a federal tax credit for solar systems for both residential and commercial properties that have been in place since 2006. The credit is worth 30% of the system’s cost, and it can be applied to both existing homes and new construction. There is no maximum value for the credit, so it can potentially cover the entire cost of a solar installation. The ITC is set to step down over the next few years, so now is a great time to take advantage of it!

How does the solar tax credit work?

The solar tax credit, also known as the investment tax credit (ITC), allows you to deduct a portion of the cost of installing a solar energy system from your federal taxes. The ITC applies to both residential and commercial systems, and there is no limit on its amount. The only requirement is that your system must be placed in service before December 31, 2023.

In order to receive the solar tax credit, you must first purchase a solar energy system outright, or enter into a lease or power purchase agreement (PPA) for one. Once your system is installed, you can then claim the ITC by filing your taxes for the year in which it was placed in service.

The amount of the solar tax credit you can claim depends on the type of solar energy system you install. For residential systems, you can claim a credit equal to 26% of the total cost of the system. For commercial systems, the credit is equal to 10% of the total cost.

If you do not have enough tax liability to claim the entire amount of the solar tax credit in one year, you can carry forward any unused portion of the credit to future years. There is no time limit on how long you can carry forward the credit

What are the requirements for the solar tax credit?

In order to receive the solar tax credit, also known as the Investment Tax Credit (ITC), the system must be placed in service after 2006. The ITC allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes. The ITC applies to both residential and commercial systems, and there is no maximum size for either type of system.

The ITC is set to decrease incrementally over time. For systems placed in service after 2019, the ITC will decrease to 22 percent. After 2021, the ITC will be 10 percent for commercial systems and zero for residential systems, unless Congress takes action to extend or modify the credit.

State Solar Tax Credits

The Federal solar tax credit, also known as the investment tax credit (ITC), allows you to deduct 26 percent of the cost of installing a solar energy system from your federal taxes. The ITC applies to both residential and commercial systems, and there is no maximum limit on its value. The credit is available for systems that are placed in service between January 1, 2020 and December 31, 2023.

What are state solar tax credits?

State solar tax credits are an important part of the financial incentives offered to home and business owners to encourage the installation of solar photovoltaic (PV) systems. In addition to the federal solar tax credit, which is available for both residential and commercial installations, many states offer their own tax credits, rebates, and other incentives. Some states have specific programs for solar PV, while others include solar in a broader renewable energy initiative.

The amount of the state solar tax credit can vary widely, from a few hundred dollars to tens of thousands of dollars, depending on the state. In some cases, the state solar tax credit may be offered as a rebate, which means that you would receive the money after you have installed your system and it has been inspected by the utility company. In other cases, the state solar tax credit may be offered as a grant, which means that you would not have to repay the money.

To find out what sort of state solar tax credits are available in your area, you can contact your state energy office or search the Database of State Incentives for Renewables & Efficiency (DSIRE).

How do state solar tax credits work?

The solar tax credit is a federal program that allows homeowners and businesses to deduct a portion of the cost of installing a solar system from their taxes. The credit is equal to 26% of the cost of the system, and it can be claimed in the year that the system is installed.

In order to claim the credit, you must have a federal tax liability that is greater than the amount of the credit. The credit can be carried forward to future years if it can’t be used in the year it was earned.

State solar tax credits work in much the same way as the federal tax credit, but each state has its own rules and regulations regarding how the credit can be used. Some states offer a rebate instead of a tax credit, and others have programs that allow homeowners to take advantage of the federal tax credit and also receive additional benefits from their state.

Before you install a solar system, be sure to check with your state’s solar office to find out what incentives are available to you.

What are the requirements for state solar tax credits?

Most states with a solar tax credit require that the solar panel system be purchased and installed after a certain date, usually January 1, 2009.

The system must also be new, meaning that it cannot have been used before or installed on another property. Additionally, the system must be intended for use on the taxpayer’s primary residence, which can be a single-family home, townhouse, condo, or apartment that you own and live in most of the year.

Systems installed on second homes or rental properties do not qualify for the credit. The credit is also available for systems installed on new construction that will serve as your primary residence, as long as you occupy the home within a year of installation.

Solar Renewable Energy Credits

The federal solar tax credit is a tax credit for individuals and businesses that install solar panels. The credit is worth 30% of the cost of the installation, and it is available for both residential and commercial installations. The credit can be applied to both new and existing homes and businesses.

What are solar renewable energy credits?

Solar renewable energy credits (SRECs) are credits that solar power producers can earn for each megawatt-hour (MWh) of electricity they generate and send to the grid. In states with SREC markets, solar power generators use their credits to offset the cost of installing solar panels.

Solar RECs are a key driver of the solar power market in the United States. More than 30 states and Washington, D.C., have SREC programs, which are designed to spur solar investment and deployment. SRECs provide an additional financial incentive for going solar on top of the many other benefits of solar power, such as lower electricity bills and environmental benefits.

How do solar renewable energy credits work?

Solar renewable energy credits (SRECs) are a key part of many state solar incentive programs. They provide an additional financial incentive for solar by allowing solar owners to sell credits they earn for each megawatt-hour (MWh) of solar electricity they generate.

The value of an SREC varies by state, but is typically in the range of $10 to $30 per megawatt-hour. SRECs can be sold separately from the electricity generated by the solar system, which provides users with a way to monetize their investment in solar.

In order to qualify for SRECs, a solar system must be connected to the grid and meet certain other requirements. Once these requirements are met, the solar owner earns one SREC for every 1,000 kilowatt-hours (kWh) of electricity generated by their system.

SRECs can be sold annually or bundled and sold as a block over a period of years. The length of time over which SRECs can be sold is typically set by the state program, and ranges from 5 to 20 years.

What are the requirements for solar renewable energy credits?

The residential renewable energy tax credit allows homeowners to claim a tax credit for 26% of the cost of installing a solar energy system. There is no maximum limit on the size of the system or the credit amount. The credit can be applied to both existing homes and new construction, and there is no limit on the number of times you can claim the credit. The credit is available for both primary and secondary residences. To claim the credit, you must install a solar system that:

-Uses solar panels or solar water-heating panels to generate heat or electricity

-Is placed in service between January 1, 2006 and December 31, 2023

-Is used for personal, not business purposes