How Does Interest on a Loan Work?

Contents

How Does Interest on a Loan Work? We take a look at the different factors that come into play when your loan’s interest is calculated.

Checkout this video:

Introduction

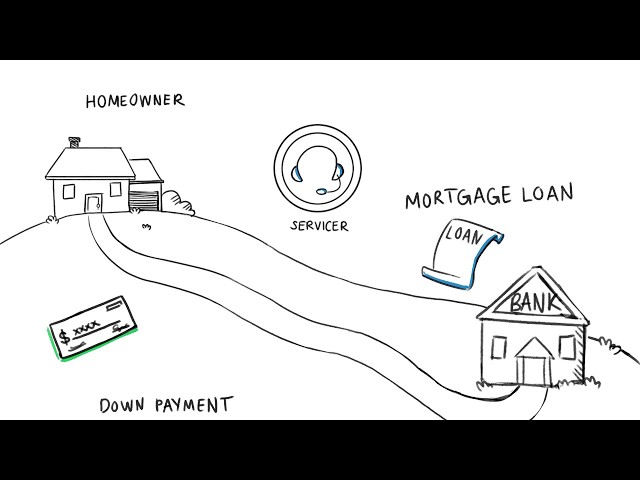

Interest is charged on a loan when you borrow money from a lender. The amount of interest you pay depends on the amount you borrow, the length of time you borrow for and the interest rate. The interest rate is usually set by the lender and can be fixed or variable.

With a fixed interest rate, the amount of interest you pay each month will stay the same for the duration of your loan. With a variable interest rate, your monthly payments may go up or down depending on changes in the market interest rates.

The length of your loan also affects how much interest you pay. The longer you borrowed money for, the more time the lender has to charge you interest. In general, loans with shorter terms have lower interest rates than loans with longer terms.

You can calculate your monthly loan payments by using a loan calculator. This will give you an estimate of what your payments will be, based on the amount you borrowed, the length of time you borrowed for and the interest rate.

What is interest?

Interest is the cost of borrowing money. When you take out a loan, you agree to pay back the amount you borrowed (the principal) plus interest. The amount of interest you pay depends on the interest rate and how often interest is compounded.

How is interest calculated?

Interest on a loan is the amount of money you pay to the lender in addition to the principal (the amount of money you borrow). The interest rate is the percentage of the loan that you pay in interest.

There are several different ways that lenders can calculate interest on a loan. The simplest way is to charge a flat rate, which is a fixed percentage of the principal. This is often used for short-term loans, such as car loans.

Another common method is to use a variable interest rate, which means that the interest rate can fluctuate over time. This type of interest rate is often used for mortgages and other long-term loans.

Lenders can also use a combination of these two methods, which is called a hybrid interest rate. For example, some lenders may charge a variable interest rate for the first few years of a loan and then switch to a flat interest rate for the remainder of the loan.

How does compounding interest work?

Compounding interest is when interest is calculated on the original loan amount, as well as on any accumulated interest. This means that the more time that passes, the more interest will accrue, and the larger the total loan amount will become.

Most loans compound interest on a monthly basis, which means that every month, the total amount of interest owed is added to the outstanding principal balance of the loan. This can cause a loan to balloon in size over time if it is not paid off quickly.

The good news is that compounding interest also works in your favor when you are saving money. Money that compounds interest will grow at a much faster rate than money that does not, which is why it’s important to start saving early and often.

How does interest affect my loan?

Interest is the cost of borrowing money, and it’s typically expressed as a percentage rate. The higher the rate, the more expensive your loan will be.

Here’s how it works: Let’s say you borrow $10,000 at a 5% interest rate. That means you’ll owe the lender $500 in interest over the life of the loan — assuming you make all your payments on time.

The amount of interest you pay will also depend on the term length of your loan — that is, how long you have to repay it. The longer the loan, the more interest you’ll pay because you’re giving the lender more time to collect interest.

You can use an online calculator to estimate your monthly payments and total interest paid for different loan terms and rates. Or, if you want to get a personalized rate quote from multiple lenders, you can check out NerdWallet’s personal loan tool.

Conclusion

In conclusion, when you take out a loan, the interest is the amount of money that you pay in addition to the principal, or the amount of money that you borrowed. The higher the interest rate, the more you will pay in interest over the life of the loan. Interest is typically expressed as a percentage of the loan amount and is often compounded, which means that you will pay interest on the interest that you have already accrued.