How Does Credit Cards Work?

Contents

A credit card is a plastic card that gives the cardholder a line of credit to use for purchases.

How does credit card work?

When you use a credit card, you are borrowing money from a lending institution, usually a bank, which you will then need to pay back with interest.

Credit Cards Work?’ style=”display:none”>Checkout this video:

What is a credit card?

A credit card is a plastic card that gives the cardholder a line of credit to use for purchases. When you make a purchase using your credit card, you are borrowing money from the credit card issuer. The issuer then pays the merchant for your purchase and you are responsible for repaying the issuer. You usually have to pay interest on your credit card outstanding balance if you don’t pay it off in full each month.

There are two main types of credit cards:

1) charge cards and

2) revolving credit cards.

With a charge card, the cardholder must pay the balance in full each month. With a revolving credit card, the cardholder has a set credit limit and can carry a balance from month to month, paying interest on the outstanding balance.

How do credit cards work?

Credit cards are a type of loan, and they work by you borrowing money from a lender and then repaying that money over time. The main benefit of using a credit card is that it can help you build your credit history and improve your credit score.

The credit card network

Most credit cards are part of a network like Visa, Mastercard, American Express, or Discover. When you use your credit card to make a purchase, the credit card network connects with the merchant’s bank to approve the transaction.

The credit card network also sets the rules that merchants must follow when they accept credit cards. For example, the network may require that merchants only charge you for items that you actually receive (and not for items that are out of stock).

The issuer

A credit card issuer is a bank or credit union that gives a consumer (the cardholder) a line of credit with which to make purchases or withdraw cash.

The issuer creates the credit card, sets the credit limit, and is responsible for sending the cardholder their monthly statement. The issuer is also the organization that the cardholder makes payments to.

The acquirer

Every credit card transaction starts with the same basic components: a cardholder, a merchant and a card issuer. But there’s another player in the mix – the acquirer.

The acquirer is the financial institution that provides the merchant with the ability to accept credit cards as payment. When a customer hands their credit card to a merchant, the merchant will run the card through an electronic point-of-sale terminal or POS. The POS connects with the acquirer, which in turn routes the transaction to the appropriate credit card network. The credit card network will then route the transaction to the card issuer for approval.

How to use a credit card?

A credit card is a plastic card that gives the cardholder a line of credit to use when making purchases. The cardholder can make purchases up to the credit limit and has to pay back the borrowed amount plus interest and fees. Credit cards are a convenient way to make purchases and can help you build your credit history. Let’s get into how to use a credit card.

Choose the right credit card

Not all credit cards are created equal. When you’re looking for a credit card, it’s important to find one that fits your lifestyle and spending habits.

Here are a few things to consider:

-Do you carry a balance on your credit card from month to month? If so, you’ll want to look for a card with a low interest rate.

-Do you travel frequently? If so, you may want a card that offers travel rewards.

-Do you have good credit? If so, you may be able to qualify for a card with perks like cash back or a low introductory interest rate.

-Do you have bad credit? If so, you may want to look for a secured credit card that requires a deposit.

Once you’ve considered your spending habits, it’s time to compare features and benefits of different cards. Here are a few things to look for:

-Annual fee: Some cards come with an annual fee, while others do not. Be sure to compare the annual fee of different cards before you decide which one is right for you.

-Interest rate: This is the rate you’ll be charged on any balances you carry from month to month. Be sure to compare the interest rates of different cards before you decide which one is right for you.

– Rewards program: Some cards offer rewards like cash back or points that can be redeemed for travel or merchandise. If this is important to you, be sure to find a card that offers the type of rewards program that fits your needs.

Know your credit limit

Your credit limit is the maximum amount of money you’re allowed to spend in a day, month, or year. It’s important to know your credit limit so you don’t accidentally go over it and end up with late fees or penalties. You can usually find your credit limit on your monthly statement or by logging into your account online.

Use your credit card wisely

Credit cards are a great way to build your credit, but only if you use them wisely. Here are some tips to help you use your credit card responsibly:

• Use your credit card for purchases you can afford to pay off in full each month. This will help you avoid interest charges and keep your debt-to-credit ratio low, which is good for your credit score.

• Pay your bill on time every month. Late payments can damage your credit score, so it’s important to set up automatic payments or reminders so you never miss a due date.

• Keep an eye on your credit card balance. Maxing out your credit card can hurt your credit score, so try to keep your balance below 30% of your credit limit.

• Check your statement regularly and report any unauthorized charges immediately. By law, you are only responsible for up to $50 of fraudulent charges on your account.

• Don’t open too many new accounts at once. Applying for multiplecredit cards in a short period of time can be a red flag for lenders and can negatively impact your credit score.

The benefits of using a credit card

Credit cards are a great way to build your credit, make purchases, and earn rewards. When used responsibly, credit cards can help you manage your finances and improve your credit score. Let’s take a look at the benefits of using a credit card.

Build your credit history

When you use a credit card and make your payments on time, you’re building a good credit history. That history will be useful when you need to borrow money in the future, whether it’s for a car loan, a mortgage, or something else. A good credit history can also help you get utility services and rent an apartment.

Earn rewards

When you use a credit card, you have the potential to earn rewards like cash back, points or miles. These rewards can be earned on every purchase you make, and they can be redeemed for things like travel, merchandise or gift cards. Some credit cards even offer bonus rewards when you spend in certain categories, such as restaurants or gas stations. If you’re a savvy shopper, you can use your rewards to save money on everyday purchases or to finance a special purchase.

Get protection from fraud

When you use a credit card, you’re protected from fraud in a way that you’re not when you use cash or a debit card. That’s because if someone fraudulently uses your credit card, you can dispute the charges and get your money back. You may have to pay a small fee for this service, but it’s worth it for the protection you get.

The disadvantages of using a credit card

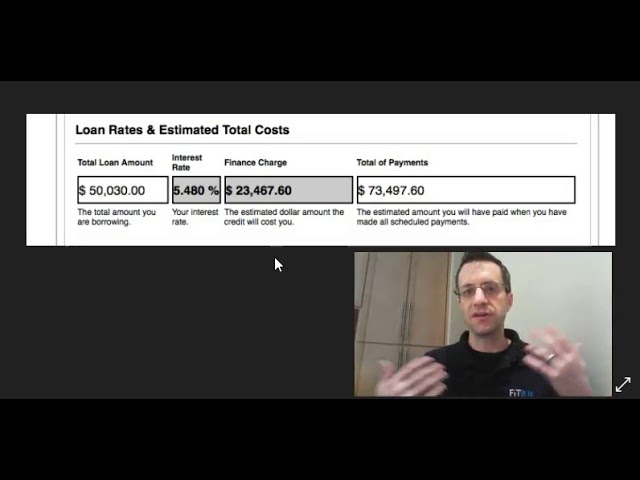

Although credit cards offer many advantages, such as the ability to purchase items without having to carry cash , they also have disadvantages. One of the biggest disadvantages is the potential to accumulate debt. When not used carefully, credit cards can lead to financial ruin. Another disadvantage is the high interest rates that are typically associated with credit cards. If you carry a balance on your credit card from month to month, you will end up paying a lot of money in interest.

High interest rates

High interest rates are the biggest disadvantage of using a credit card. If you carry a balance on your card from month to month, you’ll accrue interest at the card’s annual percentage rate (APR). For example, if your APR is 18% and you have a $1,000 balance, you’ll owe $900 in principal and $180 in interest for a total of $1,080 at the end of the year.

If you’re only making minimum monthly payments, it will take you longer to pay off your balance and you’ll pay more in interest. As an example, say you have a credit card with a $3,000 balance and an APR of 18%. Your minimum monthly payment is 2% of the balance plus any interest accrued for that month, which comes to $60 per month. At that rate, it will take you 25 years to pay off the debt, and you’ll end up paying more than $7,000 in interest.

Annual fees

Using a credit card can come with a number of fees, including annual fees, late payment fees, and interest charges. Some cards also have Balance Transfer Fees or Cash Advance Fees. Before you decide to use a credit card, be sure to compare the fees associated with different cards so that you can choose the card that will cost you the least amount of money.

Late fees

If you don’t pay your credit card bill in full each month, you will be charged interest on the unpaid balance. Interest is usually charged daily, so if you make a payment even one day late, you will be charged interest going back to the date of your last statement. In addition, most credit card companies charge a late fee if your payment arrives after a certain date, usually around the 20th of the month. The late fee is often $25 for the first offense and $35 for subsequent offenses.