How Does a Commercial Loan Work?

Contents

A commercial loan is a debt-based funding arrangement between a business and a financial institution such as a bank.

Checkout this video:

What is a Commercial Loan?

A commercial loan is a debt-based funding arrangement between a business and a financial institution such as a bank. It is typically used to finance major capital expenditures and/or cover operational costs that the business may otherwise be unable to afford.

The terms of a commercial loan can vary widely depending on the borrower, lender, and the type of business being financed. However, all commercial loans will have certain common features:

-They are typically larger than personal loans or lines of credit, with typical loan amounts ranging from $50,000 to $5 million or more.

-They often have shorter repayment terms than personal loans, ranging from 1 year to 10 years or more.

-They usually have fixed interest rates, which means that the interest rate will remain constant throughout the life of the loan.

-They may require collateral, such as real estate or equipment, in order to secure the loan.

If you are thinking about taking out a commercial loan for your business, it is important to understand how they work and what their key features are. This will help you choose the right loan for your needs and ensure that you are able to repay it in a timely manner.

How Does a Commercial Loan Work?

A commercial loan is a debt-based funding arrangement that a business can set up with a financial institution, as opposed to an individual. They are most often used for short-term funding needs.

Commercial loans are similar to other types of loans, but there are some key differences. The main difference is that they are not backed by collateral like a home or car. This means that if you default on the loan, the lender can come after your business assets to recoup their losses.

Another key difference is that commercial loans are typically much larger than other types of loans. This is because they are designed to fund business expansions, new equipment purchases, and other large investments.

Commercial loans typically have shorter repayment terms than other types of loans, such as mortgages. This is because businesses typically generate revenue more quickly than individuals do.

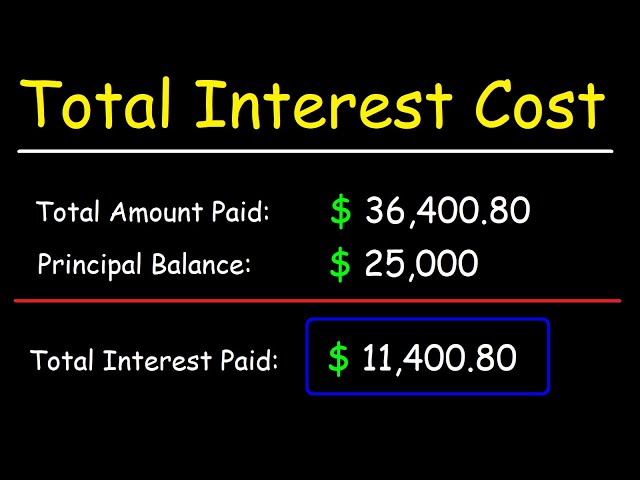

The interest rate on a commercial loan is usually higher than the interest rate on a personal loan. This is because businesses are considered to be a higher risk than individuals when it comes to lending money.

Banks and other financial institutions will often require businesses to have good credit before they will approve a commercial loan. They will also want to see proof of income and cash flow to ensure that the business can repay the loan.

Types of Commercial Loans

Commercial loans are a type of loan that is given to business owners in order to help them finance their business. The loan can be used for a variety of purposes, such as buying inventory, hiring new employees, or expanding the business. There are two main types of commercial loans: term loans and line of credit loans. Term loans are loans that are given for a specific period of time, usually one to five years. Line of credit loans are loans that can be used as needed up to a certain limit.

SBA Loans

The U.S. Small Business Administration (SBA) offers several types of financing programs to help small businesses get the funding they need to start or expand their operations. SBA loans are partially guaranteed by the government, which means that if you default on the loan, the SBA will repay a portion of the outstanding balance to the lender.

There are several types of SBA loans, each with its own eligibility requirements and terms. The most common type of SBA loan is the 7(a) loan, which can be used for a wide variety of purposes, including working capital, equipment purchases, real estate acquisitions, and business expansions. Other types of SBA loans include 504 loans, which are typically used for real estate or equipment purchases, and 7(b) loans, which can be used for short-term working capital needs.

To qualify for an SBA loan, you must first meet the eligibility requirements set forth by the SBA. In general, you must be a small business as defined by the SBA (generally speaking, this means businesses with less than 500 employees) and you must be able to demonstrate a need for financing in order to grow or expand your business. You will also need to have good personal credit and a strong business plan in order to qualify for an SBA loan.

Bridge Loans

Bridge loans are interim financing for an individual or business until permanent or longer-term financing can be obtained. Creditworthy borrowers can utilize bridge loans to finance the purchase of new property before selling their existing property. Q: How do bridge loans work?

A: Commercial bridge loans (also called commercial mortgage bridge loans) are short-term real estate financing used to purchase owner-occupied commercial property before refinancing to a long-term mortgage at a later date. The loan is secured by the equity in the property being financed.

Hard Money Loans

Hard money loans are a type of financing provided by private investors or companies. Hard money loans are typically used for short-term financing, often for the purchase of property or equipment. Hard money loans have higher interest rates than traditional bank loans, but they can be a valuable tool for companies or individuals who cannot qualify for traditional financing.

A hard money loan is secured by the value of the property or equipment being purchased. The loan is not based on the borrower’s credit history or ability to repay the loan. Hard money loans are typically used for short-term financing, such as the purchase of real estate or equipment.

Hard money loans are expensive and should only be used as a last resort. Borrowers should carefully consider all their options before taking out a hard money loan.

How to Qualify for a Commercial Loan

Commercial loans are a necessary part of the business world, allowing companies to finance large projects, expand operations, and make other important investments. But how do commercial loans work? In this post, we’ll take a high-level look at how commercial loans work and some of the things you need to know if you’re thinking of taking one out.

To qualify for a commercial loan, businesses will typically need to have been in operation for at least two years and have strong financials. Lenders will also look at the company’s credit score and history as well as the owner’s personal credit score. The amount that can be borrowed will depend on these factors as well as the type of loan being sought.

There are a number of different types of commercial loans, each with its own terms and conditions. The most common type of loan is a term loan, which is repaid in installments over a set period of time. These loans can be used for a variety of purposes, including expanding your business, purchasing equipment or real estate, or consolidating debt.

Other types of commercial loans include lines of credit, which can provide working capital or be used to finance short-term expenses; SBA loans, which are government-backed loans that typically have low interest rates and flexible repayment terms; and Equipment Financing Loans, which are used to purchase new or used equipment.

If you’re considering taking out a commercial loan, it’s important to do your research and compare lenders to find the best deal. Be sure to focus on factors like interest rates, fees, and repayment terms when comparing lenders. And remember, it’s always a good idea to consult with a financial advisor or accountant before taking out any loan.

How to Get the Best Rate on a Commercial Loan

There are a number of factors that will affect the interest rate you are offered on a commercial loan. The most important factor is your credit score. The higher your credit score, the lower the interest rate you will be offered. Other factors that will affect your interest rate include the amount of the loan, the term of the loan, and the type of collateral you are using to secure the loan.

Pros and Cons of Commercial Loans

There are a few key advantages of taking out a commercial loan:

-You can use the money for any business purpose, including buying property, setting up operations, or expanding your business.

-Interest rates on commercial loans are usually lower than on personal loans or credit cards.

-Commercial loans can be tailored to fit your specific business needs.

However, there are also some potential disadvantages to taking out a commercial loan:

-You may be required to provide collateral, such as property or equipment, to secure the loan.

-If you default on the loan, you could lose your collateral.

-Commercial loans typically have shorter terms than personal loans, which means you’ll have to repay the loan more quickly.