How to Calculate Your PPP Loan Amount

The Paycheck Protection Program (PPP) loan amount is based on 2.5 times your average monthly payroll costs. Here’s how to calculate your loan amount.

PPP Loan Amount’ style=”display:none”>Checkout this video:

What is PPP?

The Paycheck Protection Program, or PPP, is a loan program from the Small Business Administration (SBA) that helps small businesses and nonprofits keep their workers employed during the COVID-19 pandemic. The loan can be forgiven if the borrower meets certain criteria, such as using the loan for payroll and retaining employees. The maximum loan amount is the lesser of $10 million or 2.5 times the average total monthly payroll costs for the 8-week period preceding the loan.

What are the eligibility requirements for PPP?

In order to be eligible for a PPP loan, you must:

-Be a small business with 500 or fewer employees

-Be a sole proprietor, independent contractor, or self-employed individual with no more than 500 employees

-Have experienced a 25% reduction in gross receipts in the first, second, or third quarter of 2020 compared to the same quarter in 2019

-Demonstrate that you were in operation as of February 15, 2020

What are the loan terms for PPP?

The Paycheck Protection Program (PPP) is a loan designed to help small businesses keep their workers on the payroll during the COVID-19 pandemic.

The loan is 100% federally guaranteed and may be forgiven if used for eligible payroll and other expenses.

Loan terms are as follows:

– maximum loan amount is 2.5 times your average monthly payroll costs

– maximum interest rate is 4%

– maturity date is 10 years from the date of loan origination

– no collateral or personal guarantees are required

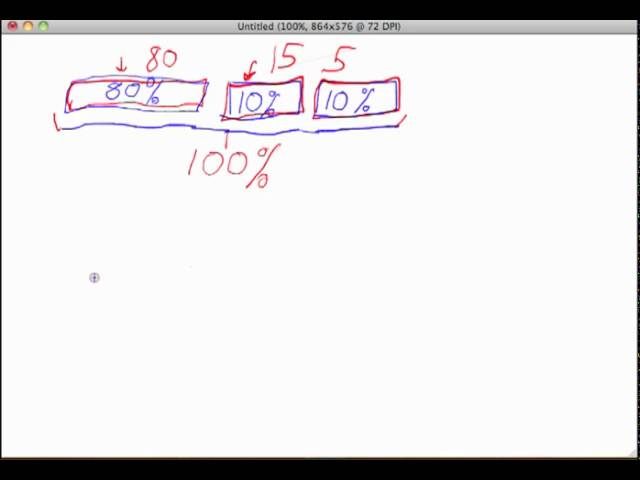

How to calculate your PPP loan amount

The PPP loan amount that you can receive is based on your average monthly payroll costs from the last 12 months. To calculate your PPP loan amount, you will need to gather your payroll documents from the last 12 months. This includes your pay stubs, W-2 forms, and any other documentation that shows your monthly payroll costs. Once you have all of your documentation, you will need to calculate your average monthly payroll costs.

What is the maximum loan amount?

The PPP loan program offers loans up to $10 million, however the loan amount you are eligible for will depend on a few different factors. To calculate your maximum loan amount, you will need to determine your average monthly payroll costs and multiply that number by 2.5.

For example, if your average monthly payroll costs are $100,000, your maximum loan amount would be $250,000 (($100,000 x 2.5) = $250,000).

If you are self-employed or have no employees, you can still qualify for a loan of up to $10 million. However, your maximum loan amount will be calculated differently. Instead of using your average monthly payroll costs, you will use your net income from the 2019 tax year. Once you have determined your net income, you will then multiply that number by 2.5 to get your maximum loan amount.

How to calculate your maximum loan amount

The maximum loan amount is determined by calculating the average monthly payroll costs for the past 12 months. Only payroll costs are included in the calculation, and they are capped at $100,000 annualized. The calculation also includes any tips or other forms of compensation paid to employees. You will need to provide documentation to your lender to verify your payroll costs.

How to calculate your PPP loan amount if you’re self-employed

If you’re self-employed, you can calculate your PPP loan amount by multiplying your average monthly self-employment income by 2.5. You can use your 2019 or 2020 IRS tax return to calculate your average monthly income, but you must use the same tax return for your entire loan application.

If you didn’t file a tax return in 2019 or 2020, you can use your 2018 tax return to calculate your loan amount. To do this, multiply your 2018 net profit by 2.5 and divide that number by 12.

How to apply for a PPP loan

The PPP loan program is a federal loan program that provides small businesses with funding to help them keep their employees on the payroll during the COVID-19 pandemic. The loan amount is based on your average monthly payroll costs, and you can apply for a loan through your local bank or credit union.

What documents do you need to apply for a PPP loan?

When you apply for a PPP loan, you will need to submit certain documentation to your lender. The SBA has compiled a list of the required documents, which includes:

-Payroll documentation

-Income tax forms

-Documentation of paid leave or other benefits paid to employees

-Articles of incorporation

-Business license

-Driver’s license or passport

How to apply for a PPP loan

If you’re a small business owner or self-employed individual, you may be wondering how to apply for a Paycheck Protection Program (PPP) loan. The PPP loan is a federal program that provides low-interest loans of up to $10 million to qualifying businesses who have been affected by the coronavirus pandemic.

To apply for a PPP loan, you will need to fill out and submit an application through the Small Business Administration (SBA). You can find the SBA’s application portal here.

Once you’ve submitted your application, you will need to provide documentation verifying your payroll expenses and other financial information. The SBA will then review your application and make a decision on whether or not you qualify for the loan.

If you are approved for the loan, you will need to sign a promissory note and return it to the lender. Once the promissory note is received, the lender will disburse the funds to you.

You can use the PPP loan for any qualifying expenses, including payroll costs, mortgage interest payments, rent payments, and utility bills. You will need to use at least 60% of the loan for payroll costs in order to have your loan forgiven.

If you have any questions about how to apply for a PPP loan or what documentation you will need to provide, please contact our office and we would be happy to help.

How to get your PPP loan forgiven

The Paycheck Protection Program (PPP) offers loans to help businesses keep their workforce employed during the Coronavirus (COVID-19) pandemic.

The PPP loan forgiveness process is as follows:

1. Download and complete the Loan Forgiveness Application.

2. Gather required documentation to support your loan forgiveness application including:

– payroll reports,

– bank statements, and

– proof of payment for eligible expenses.

3. Submit your completed application and required documentation to your lender for review.

4. Your lender will review your application and supporting documentation and make a decision on loan forgiveness.